Brexit Trigger News Sends British Pound Lower

October 03 2016 - 12:00AM

Dow Jones News

HONG KONG—The British pound fell in Asia Monday after Prime

Minister Theresa May said the U.K. would kick off the process of

separating from the European Union by the end of March.

In Asian trading, the pound fell 0.3% to $1.2935. The daily drop

wasn't spectacular—the pound posted five larger daily declines last

month—but it followed another rough quarter for the currency. The

pound lost 2.5% against the U.S. dollar in the third quarter,

recording its fifth consecutive quarterly loss. The British

currency fell 1.2% against the dollar in September, marking its

largest monthly percentage decline since June.

A slowdown in trade could spur the Bank of England to further

cut interest rates. In August, the central bank cut its benchmark

interest rate to a record low and reduced its 2017 growth outlook.

Expectations for lower interest rates tend to drag on values of

currencies.

Voters in the U.K. elected to leave the EU in June. Mrs. May

must formally notify the EU of Britain's plan to leave under

Article 50, which triggers a two-year period of negotiations over

the terms of the split.

Up for debate is whether British companies will be able to

access Europe's free-trade zone. That access is contingent on

countries agreeing to let European Union citizens live and work

anywhere in the bloc. Mrs. May suggested she wants British

companies to operate in the single European market, but not if that

meant giving up the right to restrict immigration to the U.K.

The EU is the U.K.'s biggest trading partner.

"If U.K. exporters will lose access to [the free-trade zone],

the question is how quickly can they negotiate bilateral

agreements," said Khoon Goh, head of Asia research at Australia

& New Zealand Banking Group in Singapore. "That could be quite

difficult," he added.

Australia is holding preliminary trade talks with the U.K.,

though a deal can't be signed until Britain formally exits.

Sentiment appears to be souring among fast-money investors.

Leveraged funds, a group that includes some hedge funds, added to

their bets that the pound would decline in the week ended Sept. 27,

according to the latest data from the U.S. Commodity Futures

Trading Commission. Those bets, based on futures and options,

nearly doubled to $5 billion from $2.7 billion in the week before,

Mr. Goh said.

Jenny Gross and Nicholas Winning contributed to this

article.

Write to Saumya Vaishampayan at saumya.vaishampayan@wsj.com

(END) Dow Jones Newswires

October 02, 2016 23:45 ET (03:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

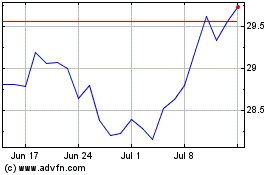

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Apr 2023 to Apr 2024