Brexit Makes London-Based Exchange Eye Eurozone

June 30 2016 - 12:00PM

Dow Jones News

LONDON—The chief executive of Europe's largest stock exchange

said it is "highly likely" to establish a presence in the eurozone

as a result of the U.K.'s vote to split from the European

Union.

The comments from Mark Hemsley, CEO of London-based Bats Europe,

came as his counterpart at Euronext NV, an operator of exchanges in

France, the Netherlands, Belgium and Portugal, warned the U.K.'s

exit from the EU would put London's position in euro-denominated

trading at risk. Bats Europe is the region's biggest stock exchange

by value of shares traded.

"Unless we get an early and clear view on the U.K.'s

negotiations with the EU, which I don't think is likely, we are

highly likely to set up a eurozone legal entity [in addition to the

London headquarters] just because it provides us with some

certainty," Mr. Hemsley said.

Bats accounts for about a quarter of all European equities

trading. In May, the exchange handled a daily average of €9.4

billion ($10.4 billion) of trades.

Mr. Hemsley said the move might not require a lot of staff to

relocate—the majority could probably remain in London—but the

amount of business put into the entity "could be increased or

decreased depending on what our customers are doing in terms of

their own Brexit planning."

Mr. Hemsley said the referendum result had the potential to put

restrictions on EU customers wanting to trade in London, but could

also restrict the exchange's ability to gain access to clearing

facilities in Europe.

Meanwhile, Sté phane Boujnah, CEO of European exchange operator

Euronext, reiterated his belief that the 30% to 45% of trading in

euro-denominated assets done in London would only be acceptable

while the U.K. was part of the single market.

Boujnah said: "What was normal when you share a common destiny,

a common single market, a consistent regulation becomes an anomaly

once London leaves the EU."

However, many lawyers and market practitioners believe there are

no legal grounds on which the trading of euro-denominated

transactions can be forced away from London. Lawyers say such a

move would be highly complex and would have ramifications for the

clearing of sterling products in the eurozone and euro products

cleared in the U.S. and elsewhere.

Still, the comments reflect a fear that London's financial

services industry could suffer once the U.K. leaves the EU, with

several banks, including J.P. Morgan Chase & Co. and Morgan

Stanley, already warning they would consider shifting some jobs to

the continent.

Some U.K.-based proprietary trading firms, which are among

Bats's largest customers, could move into the eurozone to provide

certainty over access to markets such as the Euronext exchanges,

Deutsche Bö rse and the large German futures market, Eurex.

The head of one large U.K.-based proprietary trading firm said

it was "seriously considering" the implications of setting up a

regulated entity in Amsterdam. Such a move is relatively easy for

the firms given they have typically young workforces and little

infrastructure on the ground.

The U.K.'s decision to split from the EU could also prove an

obstacle to a planned £ 21 billion tie-up between the London Stock

Exchange Group PLC and Germany's Deutsche Bö rse AG. BaFin, the

German regulator, said that following Brexit the headquarters of

the combined group would need to be located inside the European

Union.

LSE investors are due to vote on the deal on July 4, while the

tender offer for Deutsche Bö rse's shareholders will end on July

12. The two bourses have said that they remain fully committed to

the terms of the deal, and the merger wasn't conditional on the

result of the referendum.

Write to Nick Kostov at Nick.Kostov@wsj.com

(END) Dow Jones Newswires

June 30, 2016 11:45 ET (15:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

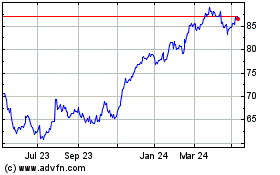

Euronext NV (EU:ENX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Euronext NV (EU:ENX)

Historical Stock Chart

From Apr 2023 to Apr 2024