Brexit Fears and Weak Pound Weigh on Corporate Europe

July 20 2016 - 9:36AM

Dow Jones News

By Robert Wall

LONDON--The fallout from last month's Brexit vote is starting to

pile up for Europe Inc.

On Wednesday, European budget carrier Wizz Air Holdings PLC said

it would cut the number of seats it planned to add to routes to and

from the U.K. because of the lower pound. Appliance maker

Electrolux AB and Groupe Eurotunnel SA both said the weaker pound

would hit earnings.

Uncertainty over how Britain will disentangle itself from the

European Union is clouding corporate forecasts. But the sharp drop

in the pound after last month's Brexit vote is already having

short-term effects across the continent.

Many companies stand to gain from the falling pound. Investors

have bid up shares of several big, British-listed firms that earn

most of their revenue outside the U.K., like drinks maker Diageo

PLC and pharmaceuticals giant GlaxoSmithKline PLC.

But for many European firms dependent on the U.K. for revenue,

the falling pound is turning into a headache. The British currency

fell to a 31-year-low against the dollar after the June 23

referendum. On Wednesday, sterling was still more than 8% lower

against the euro and down more than 11% against the dollar.

Wizz Air, based in Budapest, Hungary, said it would cut

capacity-growth plans on U.K. routes because of the currency rout.

The fast-growing carrier, one of Europe's lowest-priced airlines,

said it would add just 15% more seats for the U.K. market during

the winter season, instead of the planned 30% increase. Chief

Executive József Váradi said the decision was currency related, and

wasn't based on worry that passengers would stop traveling to and

from Britain.

The airline takes in a chunk of revenue for U.K. inbound and

outbound flights in pounds. It said it would shift plans to add

seats on routes previously earmarked to serve the U.K. to other

locations.

Jonas Samuelson, chief executive of Swedish household-appliance

maker Electrolux AB, told analysts the British construction

industry was more cautious after Brexit and that is expected to

affect demand for Electrolux products.

"Our biggest job is to compensate for the currency impact," he

said after the company reported earnings for the second quarter

ended June 30. Electrolux said it is bracing for a tougher third

quarter, when the effect of the weaker pound will stretch out over

three months and as currency hedges it has in place unwind.

Groupe Eurotunnel SA, operator of the Channel Tunnel that links

Britain with France, said that weakness in the pound knocked

earnings before interest, tax, depreciation and amortization, by 2%

in the first half. Stripping out the impact of foreign exchange,

earnings would have risen 4%, the company said.

Matthias Verbergt

in Stockholm; William Horobin and

Thomas Varela

in Paris contributed to this article.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

July 20, 2016 09:21 ET (13:21 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

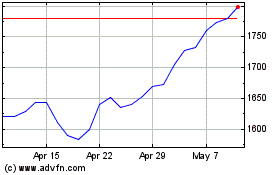

Gsk (LSE:GSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

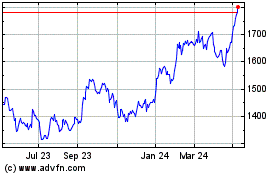

Gsk (LSE:GSK)

Historical Stock Chart

From Apr 2023 to Apr 2024