Pair of large asset managers won't let investors withdraw as the

pound sinks

By Darren Lazarus, Jason Douglas and Jenny Strasburg

LONDON -- Two big British asset managers blocked worried

investors from pulling money out of real-estate funds, and the

pound sank to a new 31-year low Tuesday, twin signs that the U.K.'s

vote to leave the EU was injecting new turbulence into financial

markets after days of relative calm.

At the same time, the Bank of England eased regulatory

restraints on British banks, a bid to allow them to lend more and

keep the economy flush with credit.

Britain is laboring through the second week after its Brexit

vote with little clear direction. David Cameron has announced his

resignation as prime minister, his Conservative Party is picking a

successor in a sharply contested ballot and the opposition Labour

Party is in disarray.

Much of the postvote economic response has been left to the

central bank and its governor, Mark Carney. A news conference

Tuesday was Mr. Carney's third public appearance in the 12 days

since the vote.

The fund freeze is among the most tangible economic consequence

to sprout up. Investors, concerned that Britain's huge and frothy

real-estate market might come undone, scrambled to dump their

holdings. Fund managers, unable or unwilling to sell the shopping

malls and office buildings in their portfolios, closed the

door.

M&G Investments and Aviva Investors both said Tuesday they

had barred investors from pulling out of property funds, following

a similar announcement by Standard Life on Monday afternoon.

The real-estate fears and the pound's decline are intertwined:

Foreign investors have been huge buyers of U.K. property, and they

have started to cash out. The Bank of England said Tuesday in its

financial-stability report that foreign flows into U.K. commercial

real-estate sank nearly 50% in the first quarter. Late Tuesday in

London, the pound traded near $1.30, down 2%.

The central bank also pointed to signs in the stock market --

the midcap FTSE 250 index fell 2.4% Tuesday -- that foreign

investors were pulling out of the U.K. The economy faces a

"material slowing" in growth in the months ahead, officials warned

in the report.

Stocks fell broadly in Europe Tuesday. The only index that ended

the day in positive territory was Britain's FTSE 100, which is

packed with companies with foreign earnings and is boosted by the

weak pound.

Investors fled to government bonds: Yields on the 10-year U.S.

Treasury bond and the 10-year U.K. gilt touched record lows. Yields

fall as prices rise.

Souring views on the global economy, and views that low

inflation will persist, have helped pull down long-term bond yields

across the developed world. Short-term bond yields have also

declined, reflecting a belief that central banks will keep rates at

ultralow levels, or possibly even cut them further. But the slump

in long-term yields is especially dramatic. In the U.K., the

10-year bond now yields around two-thirds of a percentage point

more than the two-year bond, roughly half the spread that existed

at the beginning of the year.

The BOE's move Tuesday to reduce the so-called countercyclical

capital buffer from 0.5% to zero is one of the first instances of a

major central bank relaxing bank-capital requirements to mitigate a

gathering economic slowdown.

The change means banks don't need to hold as much capital

against their assets. The BOE said they aren't supposed to use the

breathing room to increase dividends or other payouts.

It is an especially important test case because traditional

central-bank tools are stretched. The BOE's benchmark interest rate

is 0.5%, meaning Mr. Carney doesn't have much room to cut rates

further. The bank may be led to cut nonetheless and to revive its

bond-buying program.

Real estate is an especially vulnerable asset to mass flight

because it is difficult to sell quickly, while "open-ended" funds

typically allow their investors to cash out any day they like.

"Systemic risk would arise from the funds needing to sell

illiquid assets in a hurry," said Michael Snapes, a

financial-services risk and regulation director with

PricewaterhouseCoopers in London. That would depress prices

further, spurring more redemption requests and a downward

spiral.

M&G said it put up the gate on a GBP4.4 billion U.K.

property fund -- the biggest of its kind -- after redemption

requests rose on the back of "high levels of uncertainty."

Aviva said in a note to investors that dealing in the GBP1.8

billion Aviva Investors Property Trust was "temporarily suspended"

at midday on July 4 because of "higher than usual volumes of

requests to sell units." Standard Life locked investors into its

GBP2.9 billion UK Real Estate Fund.

"It would not surprise me if similar firms take similar actions

in the coming weeks," said Laith Khalaf, senior analyst at

Hargreaves Lansdown.

The U.K. commercial real-estate market holds in aggregate about

GBP800 billion worth of assets, according to Mike Prew, an analyst

at Jefferies Group LLC. Residential real-estate assets amount to a

total of GBP5 trillion.

Memories of the global financial crisis of 2008, when problems

in the housing sector quickly spread to banks, loom large for

investors.

Analysts said the U.K. banking system is now more insulated

against a commercial-property crash than it was then. Regulators

forced banks to raise capital and go through a series of stress

tests to check whether they can weather a severe downturn.

British banks have since cut their stock of commercial

real-estate lending in half, according to the Bank of England. Much

of that slack was taken up by the nonbanking sector: Pension funds

and insurers, looking for steady returns in a low-interest-rate

environment, piled in.

But while major banks like Lloyds Banking Group PLC and Royal

Bank of Scotland Group PLC cut their lending, smaller British banks

have jumped in. These newer lenders have taken on proportionately

more high-risk loans in the commercial sector.

Investors are already taking flight from smaller banks that have

been gaining share in the buy-to-let market, in which banks lend to

landlords. Some analysts expect rental-property lending to be stung

by Brexit if house prices fall, especially in London.

For instance, Aldermore Group PLC, a small lender which focuses

on small businesses, saw its share price drop 9% on Tuesday. It is

down 64% over the past 12 months.

A relatively small increase in write-offs of U.K. real-estate

exposures would be painful for Aldermore and a handful of other

small lenders with more-concentrated investment in the sector,

Deutsche Bank U.K. banking analyst David Lock wrote in a research

note last week.

Meanwhile, shares of Virgin Money Holdings PLC, another rapidly

growing bank, tanked 11% on Tuesday's news. In the first three

months of the year Virgin Money increased buy-to-let lending by 17%

compared with the year before.

--Max Colchester, Elizabeth Pfeuti, Andy Pearce and Mike Bird

contributed to this article.

Write to Jason Douglas at jason.douglas@wsj.com and Jenny

Strasburg at jenny.strasburg@wsj.com

(END) Dow Jones Newswires

July 06, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

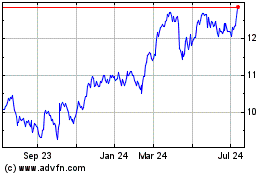

Aviva (PK) (USOTC:AVVIY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aviva (PK) (USOTC:AVVIY)

Historical Stock Chart

From Apr 2023 to Apr 2024