Brent Crude Rises Above $50 a Barrel

May 25 2016 - 11:40PM

Dow Jones News

HONG KONG— Brent crude prices rose above $50 a barrel in early

Asia trade Thursday, as a recent decline in U.S. crude stocks

raised expectations for a tightening in the market.

July Brent crude on London's ICE Futures exchange rose $0.29 to

$50.03 a barrel, its highest point since November.

On the New York Mercantile Exchange, light, sweet crude futures

for delivery in July recently traded at $49.78 a barrel, up $0.22

in the Globex electronic session.

Oil prices have been in the doldrums for nearly two years, but

recent supply disruptions and growing demand from China and India

have injected fresh optimism into the market. Prices are now nearly

80% higher than where they were in February when they hit a 12-year

low.

The latest bright spot of news was the larger-than-expected

reduction in U.S. crude stocks last week. On Wednesday, the U.S.

Energy Information Administration said U.S. crude stockpiles fell

4.2 million barrels last week; Analysts polled by The Wall Street

Journal had expected a decrease of 2.5 million barrels.

"The fundamentals of the U.S. are changing, and the declining

production rate in the U.S. is a welcoming sign that adds to the

belief the glut is dwindling," said Vyanne Lai, energy analyst at

National Australia Bank.

Even Goldman Sachs, which called for oil to dip to $20 a barrel

before a recovery, said the market has flipped into a deficit this

month.

The price collapse has prompted energy companies to scale back

their drilling activities to protect cash flow. The International

Energy Agency expects a "dramatic reduction" in supply in the

second half of the year amid higher demand.

However, some analysts say the rally is likely to be short-lived

because there is still isn't enough demand to soak up excess supply

as producers inside the Organization of the Petroleum Exporting

Countries are set to increase output.

Earlier this week, Iran said again it has no plan to freeze

output.

"Under the present circumstances, the government and the Oil

Ministry have not issued any policy or plan to the National Iranian

Oil Company towards halting the increase in the production and

exports of oil," said Deputy Oil Minister Rokneddin Javadi,

according to a statement on the NIOC's official website.

Currently, Iran's oil exports have reached 2 million barrels a

day and they are expected to rise to 2.2 million barrels a day by

the middle of the summer, the NIOC said.

Meanwhile, some supply outages are coming to an end. In Canada,

where production has declined by at least 1 million barrels a day

due to a wildfire, some oil facilities have been cleared to resume

operation.

"Newsflow on the gradual return of oil sands production may

offset the bullish price impact of lower U.S. crude imports from

Canada—and further Canadian stockdraws may prevent the latter from

happening anyway," Socié té Gé né rale said in a note.

Nymex reformulated gasoline blendstock for June—the benchmark

gasoline contract—rose 79 points to $1.6495 a gallon, while June

diesel traded at $1.5160, 33 points higher.

ICE gasoil for June changed hands at $452.75 a metric ton, up

$5.25 from Wednesday's settlement.

Nicole Friedman contributed to this article.

Write to Jenny W. Hsu at jenny.hsu@wsj.com

(END) Dow Jones Newswires

May 25, 2016 23:25 ET (03:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

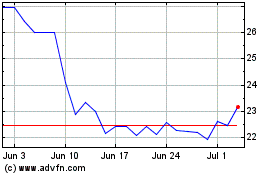

Societe Generale (EU:GLE)

Historical Stock Chart

From Mar 2024 to Apr 2024

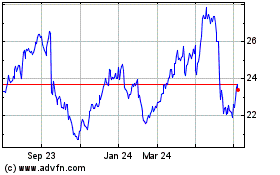

Societe Generale (EU:GLE)

Historical Stock Chart

From Apr 2023 to Apr 2024