Brazil's Petrobras Expects $1.6 Billion From Total Deal in Next Two Months -- Update

December 21 2016 - 7:25PM

Dow Jones News

By Benjamin Parkin and Jeffrey T. Lewis

RIO DE JANEIRO -- Brazilian state-run oil company Petróleo

Brasileiro SA said Wednesday its strategic alliance with France's

Total SA would bring $1.6 billion in cash in the next two months, a

much-needed boost as it struggles to unload assets and reduce its

debt burden.

Petrobras said it would sell stakes in two of Brazil's deep

water "pre-salt" oil concessions to Total and that the companies

would go into partnership on a pair of power plants and

re-gasification terminal

The deal with Total is estimated to generate about $2.2 billion

for Petrobras, the companies said. Petrobras said it expects to

receive an immediate $1.6 billion in cash when the agreement is

completed in the next 60 days.

"This alliance will offer a bright future for both companies,"

Total Chief Executive Patrick Pouyanné said at a press conference

in Rio, citing Petrobras's experience in deep water projects.

The most highly leveraged oil major in the world with $123

billion in gross debt, Petrobras has so far faltered in its goal to

sell $15.1 billion of assets by the end of the year. It was dealt a

setback this month when Brazil's federal auditing court, known as

the TCU, suspended all but five of its pending sales.

Even after accounting for the partnership, Petrobras would fall

short of that goal by around $2 billion. CEO Pedro Parente said the

difference could be added to Petrobras' $19.5 billion asset-sale

goal for 2017 and 2018, and expressed confidence that the company

would reach its target.

"We're absolutely certain that our goals have not been

compromised," he said. "We will be ready the moment the TCU is

ready."

Total will assume an operating stake one of Petrobras's pre-salt

oil blocks and take a minority stake in another.

Petrobras will also have the option of buying 20% of a block in

the Mexican portion of the Perdido Foldbelt area of the Gulf of

Mexico, which Total acquired in partnership with Exxon earlier this

year.

Brazil's Congress approved a bill in October easing restrictions

on private investment in the fields by removing a requirement that

Petrobras be the lead operator on any pre-salt concessions. The

firms announced the alliance shortly after.

Write to Jeffrey T. Lewis at jeffrey.lewis@wsj.com

(END) Dow Jones Newswires

December 21, 2016 19:10 ET (00:10 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

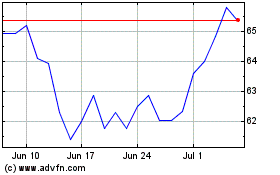

TotalEnergies (EU:TTE)

Historical Stock Chart

From Mar 2024 to Apr 2024

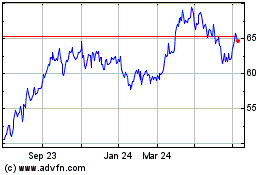

TotalEnergies (EU:TTE)

Historical Stock Chart

From Apr 2023 to Apr 2024