Brazil's Oi Seeks Bankruptcy Protection in the U.S.

June 22 2016 - 5:30PM

Dow Jones News

Brazil's Oi SA, a telecommunications company that recently filed

the largest bankruptcy in the country's history, is seeking court

protection in the U.S. to shield its assets from an affiliate of

hedge fund Aurelius Capital Management LP, one of its holdout

bondholders.

Oi and several affiliates sought chapter 15 protection—the

section of the bankruptcy code that deals with international

insolvencies—at the U.S. Bankruptcy Court in Manhattan on Tuesday,

with a debt load of $19 billion. A day earlier, the troubled

telecom firm filed for the equivalent of chapter 11 in Brazil after

an out-of-court restructuring proposal collapsed.

If a judge approves Oi's chapter 15 request, the company would

receive the benefits of U.S. bankruptcy law, which halt lawsuits

and block creditors from seizing assets while it focuses on

restructuring at home. Oi has dollar-denominated bonds and says

many of its contracts and licenses, including those concerning

undersea cables and satellite services, are governed by U.S.

law.

Oi has been battling Capricorn Capital Ltd., the Aurelius

affiliate, which has targeted the telecom giant in lawsuit in the

Netherlands over €2.8 billion ($3.16 billion) in intercompany

loans. Oi says chapter 15 protection will help it fend off any

additional litigation from New York-based Aurelius and who may be

looking to interfere in its restructuring efforts.

A spokesman for Aurelius declined to comment Wednesday.

"The threat of additional adverse actions by creditors and the

need for a centralized forum to facilitate its reorganization

compelled the company to begin preparations for a formal judicial

restructuring," said Ojas N. Shah, whom Oi appointed as its foreign

representative in its U.S. bankruptcy proceedings.

In court papers filed Tuesday, Oi blamed its financial woes on a

"perfect storm of economic strain at the corporate, sector-wide,

and national level." A deep recession in Brazil coupled with

corruption scandals has hurt foreign investment and "generally

crippled the Brazilian capital markets," according to Mr. Shah.

The company says it was caught off-guard by a rapid shift in

demand away from so-called fixed-line telephone service to mobile,

the more profitable segment of the telecommunications sector in

Brazil. And regulations forced it to continue expanding its

services into rural areas even as its revenue fell.

A planned merger with competitor TIM Participaç õ es SA, an arm

of Telecom Italia, also fell apart.

Oi is Brazil's fourth-largest telecom company, with more than 74

million customers and 142,000 employees. The company's debt load

largely stems from two mergers, first with Brasil Telecom in 2010

and later with Portuguese company Portugal Telecom, which

ultimately failed to generate enough business to fund the company's

investment needs.

Bayard Gontijo, Oi's chief executive, resigned June 10 under

pressure from shareholders shaken by a debt-for-equity swap

proposed by the company's creditors. The deal would have

significantly diluted the company's shares, giving a 95% stake of

the restructured business to its bondholders.

The negotiations involved Oi's main shareholder, Bratel BV,

which controls a 22.24% stake in the company. Bratel is an

investment vehicle formed by former shareholders of Portugal

Telecom, using the official name Pharol SGPS. On the other side of

the table, investment bank Moelis & Co. is advising creditors

with around 40% of outstanding bonds, including big international

players such as Pacific Investment Management Co., Citadel LLC and

Wellington Management Co.

Rogerio Jelmayer and Luciana Magalhaes contributed to this

article.

Write to Tom Corrigan at tom.corrigan@wsj.com

(END) Dow Jones Newswires

June 22, 2016 17:15 ET (21:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

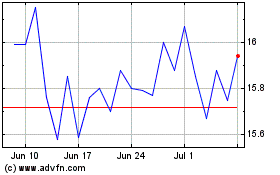

TIM ON (BOV:TIMS3)

Historical Stock Chart

From Mar 2024 to Apr 2024

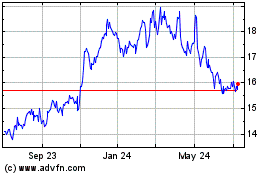

TIM ON (BOV:TIMS3)

Historical Stock Chart

From Apr 2023 to Apr 2024