Brazilian Telecom Company Oi Wins U.S. Court Protection

July 26 2016 - 5:00PM

Dow Jones News

A U.S. bankruptcy judge agreed to help Brazil's Oi SA fend off

creditors while the telecommunications giant, whose failure spawned

the largest bankruptcy in the country's history, works to

restructure at home.

Judge Sean Lane of the U.S. Bankruptcy Court in New York signed

off on the company's request for chapter 15 protection, which

allows judges to grant the protections of U.S. bankruptcy law to

foreign companies.

Oi says it need those protections, which include the so-called

automatic stay that halts lawsuits and otherwise prevents

interference from creditors, to help it keep its restructuring

efforts focused in Brazil.

Oi says chapter 15 protection will help protect it from

litigation launched by affiliates of hedge fund Aurelius Capital

Management LP and other creditors that may be looking to gain

leverage in its bankruptcy. Oi has been fighting New-York based

Aurelius, which owns bonds issued by Oi subsidiaries, in a legal

battle in the Netherlands over billions of dollars in intercompany

loans that could affect how much the hedge fund recovers on its

investment.

A spokesman for Aurelius declined to comment on Tuesday.

Oi filed for the equivalent of chapter 11 in Brazil in June

after an out-of-court restructuring proposal collapsed. A day

later, the company and several affiliates sought chapter 15

protection in New York, listing about $19 billion in

liabilities.

Oi is Brazil's fourth-largest telecom company, with more than 74

million customers. The company's debt load largely stems from two

mergers, first with Brasil Telecom in 2010 and later with

Portuguese company Portugal Telecom, which ultimately failed to

generate enough business to fund its investment needs.

Bayard Gontijo, Oi's chief executive, resigned June 10 under

pressure from shareholders shaken by a debt-for-equity swap

proposed by the company's creditors. The deal would have

significantly diluted the company's shares, giving a 95% stake of

the restructured business to its bondholders.

Earlier this month, a Brazilian court named audit company

PricewaterhouseCoopers Assessoria Empresarial and law firm

Escritorio de Advocacia Arnoldo Wald as the judicial administrators

to oversee the company during its recovery process.

"The judicial administrators will be responsible for supervising

and assisting in the judicial recovery process of Oi, presenting

individual reports on the development of the company's activities,"

the local court said.

In court papers, Oi has blamed its financial woes on a "perfect

storm of economic strain at the corporate, sector-wide, and

national level." A deep recession in Brazil coupled with corruption

scandals has hurt foreign investment and "generally crippled the

Brazilian capital markets," according to Ojas N. Shah, whom Oi

appointed as its foreign representative in its U.S. bankruptcy

proceedings.

Oi says it was caught off-guard by a rapid shift in demand away

from fixed-line telephone service to the more-profitable mobile

services. Regulations forced it to continue expanding its services

into rural areas even as its revenue fell, court papers show.

Rogerio Jelmayer contributed to this article

Write to Tom Corrigan at tom.corrigan@wsj.com

(END) Dow Jones Newswires

July 26, 2016 16:45 ET (20:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

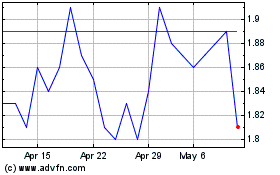

OI PN (BOV:OIBR4)

Historical Stock Chart

From Mar 2024 to Apr 2024

OI PN (BOV:OIBR4)

Historical Stock Chart

From Apr 2023 to Apr 2024