Bombardier Delivers First CSeries Jet as It Takes on Boeing, Airbus

June 29 2016 - 6:20PM

Dow Jones News

Bombardier Inc. on Wednesday delivered its first CSeries jet to

launch operator Swiss International Air Lines, marking the

company's emergence as a direct competitor to the big U.S. and

European plane makers.

The first 125-seat CS100 was handed over to the unit of Deutsche

Lufthansa AG, and is due to depart for Zurich from the plane

maker's Mirabel, Quebec, facility early Thursday.

The handover opens a new chapter for Bombardier and its

bet-the-company effort to challenge Airbus Group SE and Boeing Co.

in the single-aisle passenger jet market.

The plane's development ran 2½ years late and blew billions past

its initial $3.4 billion budget, weighing on Bombardier's stock

price and triggering the replacement of most of its executive

team.

The CSeries program has gained traction with crucial orders this

year but left Bombardier a transformed company from when it

launched the program and booked its first deals in 2008.

The new leadership has boosted the order book to 370 from 233 a

year ago. On Tuesday, Air Canada completed a deal for up to 75

jets, including 45 firm orders, with deliveries beginning in 2019.

Delta Air Lines Inc. made the largest single commitment to the

program in April, ordering up to 125 planes. Bombardier discounted

heavily to win the deals, analysts say.

Bombardier was also forced to seek new liquidity. The Quebec

government and pension fund Caisse de dé pô t et placement du Qué

bec infused a total of $2.5 billion into the company, providing the

government with a 49.5% stake in the jet program and the fund a 30%

stake in its train unit.

Recently, the company's stock performance has rebounded,

climbing more than 45% from the beginning of the year, but remains

more than 75% below its July 2008 level when the CSeries was

launched.

"We knew that we would need to be competitive to get some

marquee airlines," said Chief Executive Alain Bellemare in April.

"So we've done just that."

Bombardier said it is meeting performance targets for the jet,

but has said it must quickly bring down the cost to build each jet

if it hopes to meet its cash break-even target by 2020.

"Now they have to deliver the plane and produce them at a cost

that justifies the new prices," said Adam Pilarski, senior vice

president at aviation consultancy Avitas.

Moody's, in a June 23 report, said Bombardier had good liquidity

through 2018, but it expects the company to consume $1.8 billion in

free cash as the CSeries program ramps up production through 2018.

Earnings at the company in the coming years will come entirely from

its train and business aircraft segments, not its larger jets,

Moody's said.

The Quebec government will deliver the first half of its $1

billion investment to Bombardier on Friday and the second half on

Sept. 1. Bombardier is also in negotiations with the Canadian

federal government regarding its own possible investment.

Write to Jon Ostrower at jon.ostrower@wsj.com

(END) Dow Jones Newswires

June 29, 2016 18:05 ET (22:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

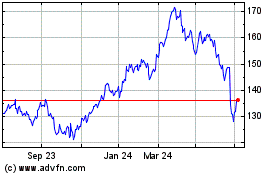

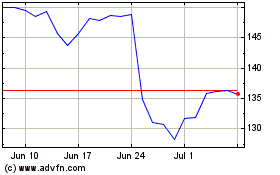

Airbus (EU:AIR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Airbus (EU:AIR)

Historical Stock Chart

From Apr 2023 to Apr 2024