Boeing Nears Plane-Parts Deal With Supplier Spirit AeroSystems

August 02 2017 - 2:01PM

Dow Jones News

By Robert Wall and Doug Cameron

Boeing Co. is close to settling one of its thorniest supplier

issues by provisionally agreeing on a discount-promising, long-term

deal for plane parts with Spirit AeroSystems Holdings Inc.

Negotiations between Boeing, the world's No. 1 plane maker by

deliveries, and Spirit, its biggest supplier, have run for years

and been contentious at times as the two sides sparred over parts

pricing. Spirit in April said there was a "significant" gap on

terms.

On Wednesday, Boeing said the breakthrough was an "important

step forward" in its so-called Partnering for Success program in

which the plane maker has asked suppliers for concessions in return

for work. Boeing in recent weeks struck similar agreements with

suppliers Kawasaki Heavy Industries and Triumph Group Inc.

The effort is aimed at helping the Chicago-based plane maker

compete against European rival Airbus SE and to meet a commitment

to boost earnings margins to the midteens from around 10% now.

Spirit Chief Executive Officer Tom Gentile said the memorandum

of agreement "reduces much uncertainty that has long existed with

our largest customer." Talks since April "ebbed and flowed," he

said, and gained traction in recent weeks. Final details should be

ironed out by October and provide for a "healthier relationship"

going forward, Mr. Gentile said.

Shares in Spirit, which was spun off from Boeing's Wichita,

Kan., and Tulsa, Okla., units in 2005, surged 16% in recent trading

as investors breathed a sigh of relief that a nagging concern over

future profit and cash flow was nearing an end. Boeing shares were

about flat.

The deal covers production through 2022 of major structures on

Boeing airliners including the ubiquitous 737 single-aisle plane

and the 787 Dreamliner long-range jet, Spirit said.

The supplier agreed to price concessions at predetermined points

on two larger Dreamliner versions, the 787-9 and 787-10. Those

models of the composite plane weren't covered under an earlier

accord. In return, the deal will cover production of more of the

planes. Boeing and Spirit had a deal covering production of 1,003

Dreamliners. That would be expanded to 1,300 Dreamliners with

provisions for up to 1,405 planes.

Cutting costs to build Dreamliners is critical to Boeing and its

future earnings as it tries to shed more than $26 billion in

deferred production costs on the program.

The accord comes as Boeing considers developing a brand new

airliner. The plane maker has signaled it may not work with

suppliers that don't accommodate its needs for greater efficiency.

Mr. Gentile said Spirit has no guarantees it would be on the new

plane if it gets built, but "what this agreement does is it enables

us to compete."

The contract terms forced Spirit to recognize a $353 million

forward loss through 2022 on the 787 program. Even so, the company

boosted guidance for 2017 free cash flow by $50 million to a range

of $500 million to $550 million. It also raised its full-year

profit outlook for up to $5.25 adjusted earnings per share.

Boeing has billed its Partnering for Success program as more

than just a cost-cutting exercise and said it would work with

partners to boost efficiency. Spirit said it had agreed with Boeing

to jointly study advanced plane parts and manufacturing processes.

The agreement also provides for joint 787 cost-reduction

initiatives with financial incentives and productivity discounts on

the 737, where Spirit builds the fuselage, contingent on volume

commitments.

Write to Robert Wall at robert.wall@wsj.com and Doug Cameron at

doug.cameron@wsj.com

(END) Dow Jones Newswires

August 02, 2017 13:46 ET (17:46 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

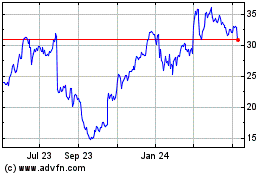

Spirit Aerosystems (NYSE:SPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

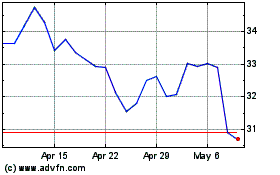

Spirit Aerosystems (NYSE:SPR)

Historical Stock Chart

From Apr 2023 to Apr 2024