BoJ's Kuroda Sees No Limit For Monetary Easing Measures

February 02 2016 - 7:59PM

RTTF2

Bank of Japan Governor Haruhiko Kuroda said there is no limit to

measures for monetary policy easing and it is open to expand asset

purchases further, if necessary.

"If we judge that existing measures in the toolkit are not

enough to achieve the goal, what we have to do is to devise new

tools, rather than give up the goal," Kuroda said in a speech in

Tokyo.

In January, the bank surprised the markets by introducing

negative interest rate.

Kuroda said the "zero lower bound" of interest rate was believed

to be impossible to conquer, but it has been almost overcome by the

wisdom and practices of central banks.

If judged necessary, there is ample room for the BoJ to further

expand the size of asset purchases, the banker said.

At the December meeting, the policy board debated over the

supplementary measures for quantitative and qualitative easing.

Some members said the bank should facilitate smoother asset

purchases and dispel concerns about the sustainability of the

programme by taking appropriate measures, the minutes of the

monetary policy meeting held on December 17 and 18 showed

today.

A few members said the extension of maturity period of Japanese

government bonds would ensure flexible and smooth conduct of JGB

purchases into the future.

But few other members noted that such an extension could

decrease the stability of the JGB purchase and prolong the period

required for normalization of monetary policy.

The remaining maturity of JGB purchases was extended by a 6-3

majority vote.

The board had decided by a vote of 6-3 majority to introduce a

new program for purchases of exchange-traded funds at an annual

pace of about JPY 300 billion.

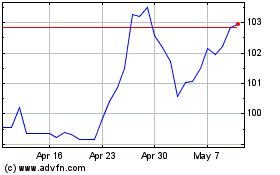

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Mar 2024 to Apr 2024

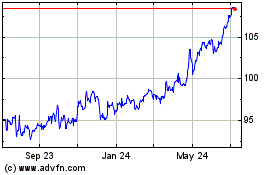

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Apr 2023 to Apr 2024