BlackRock Cuts Shareholding in BHP Billiton

September 23 2015 - 7:20PM

Dow Jones News

By Rhiannon Hoyle

SYDNEY--BlackRock Inc., the world's largest asset manager, has

cut its shareholding in resources giant BHP Billiton Ltd. (BHP.AU),

offloading stock as a global commodities slump pushes its share

price to the lowest level since 2008.

BlackRock ceased to be a substantial shareholder in BHP, the

world's biggest miner by market value, on Sept. 22, according to a

regulatory filing to the Australian Securities Exchange.

BlackRock has in recent times been the top holder of BHP shares,

with a roughly 5% stake.

Shares in BHP have fallen sharply over the past year, as prices

for the main commodities it produces, including iron ore, coal and

crude oil, fall sharply. The stock fell as low as 22.41 Australian

dollars (US$15.69) last month, its weakest value since November

2008.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 23, 2015 19:05 ET (23:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

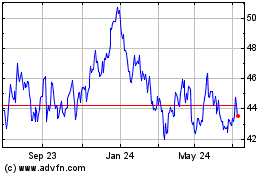

BHP (ASX:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

BHP (ASX:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024