Black Stone Minerals, L.P. Announces Fourth Quarter Cash Distribution

February 09 2016 - 7:20PM

Business Wire

Black Stone Minerals, L.P. (NYSE:BSM) (“Black Stone Minerals”)

today announces that the Board of Directors of the general partner

has approved a cash distribution of $0.2625 per common unit and

$0.18375 per subordinated unit, attributable to the fourth quarter

of 2015. Distributions will be payable on February 26, 2016 to

unitholders of record at the close of business on February 19,

2016.

Thomas L. Carter, Jr., Black Stone Minerals’ President, Chief

Executive Officer, and Chairman commented, “The Board of Directors

is committed to maintaining the growing minimum quarterly

distribution for common units and expects to maintain the current

minimum quarterly distribution of $0.2625 per common unit and the

scheduled increase to $0.2875 per common unit set for the second

quarter of 2016. We are also reducing the distribution on

subordinated units to $0.18375 per unit for the fourth quarter of

2015, a 30% reduction from last quarter’s distribution. The

decision to reduce the subordinated distribution is not a decision

we made lightly. Indeed, management and the Board of Directors are

significant holders of subordinated units, so we clearly understand

how this affects legacy owners. However, the decision is consistent

with the two-class common and subordinated structure we implemented

in our IPO in May 2015, which gave owners of common units a clear

view to a secure and growing distribution with excellent coverage.

This decision is also consistent with our philosophy of maintaining

strength in our balance sheet. While we could have maintained the

full minimum quarterly distribution on the subordinated units in

line with distributions in prior quarters without borrowing, we

have chosen to reduce the distribution to the subordinated units in

order to preserve liquidity and keep cash in the business. We

believe this is prudent and in the best long-term interests of the

partnership, particularly given the opportunities we are seeing in

the acquisition market. The Board of Directors is prepared to

adjust future distribution amounts for subordinated units so that a

total distribution coverage in excess of 1.0x can be maintained. We

will continue to review subordinated distributions on a quarterly

basis in these times of price volatility, looking for the best

means to generate yield for our unitholders and long-term growth

opportunities for the partnership.”

About Black Stone Minerals, L.P.

Black Stone Minerals is one of the largest owners of oil and

natural gas mineral interests in the United States. The partnership

owns mineral interests and royalty interests in over 40 states and

60 onshore basins in the continental United States. The partnership

also owns and selectively participates in non-operating working

interests in established development programs, primarily on its

mineral and royalty holdings. The partnership expects that its

large, diversified asset base and long-lived, non-cost-bearing

mineral and royalty interests will result in production and reserve

growth, as well as increasing quarterly distributions to its

unitholders.

Forward-Looking Statements

This news release includes forward-looking statements. All

statements, other than statements of historical facts, included in

this news release that address activities, events or developments

that the partnership expects, believes or anticipates will or may

occur in the future are forward-looking statements. Terminology

such as “will,” “may,” “should,” “expect,” “anticipate,” “plan,”

“project,” “intend,” “estimate,” “believe,” “target,” “continue,”

“potential,” the negative of such terms or other comparable

terminology often identify forward-looking statements. Except as

required by law, Black Stone Minerals undertakes no obligation and

does not intend to update these forward-looking statements to

reflect events or circumstances occurring after this news release.

You are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date of this

news release. All forward-looking statements are qualified in their

entirety by these cautionary statements. These forward-looking

statements involve risks and uncertainties, many of which are

beyond the control of Black Stone Minerals, which may cause the

partnership’s actual results to differ materially from those

implied or expressed by the forward-looking statements. Important

factors that could cause actual results to differ materially from

those in the forward-looking statements include, but are not

limited to, those summarized below:

- the partnership’s ability to execute

its business strategies;

- the volatility of realized oil and

natural gas prices;

- the level of production on the

partnership’s properties;

- regional supply and demand factors,

delays, or interruptions of production;

- the partnership’s ability to replace

its oil and natural gas reserves; and

- the partnership’s ability to identify,

complete, and integrate acquisitions.

Information for Non-U.S. Investors

This press release is intended to be a qualified notice under

Treasury Regulation Section 1.1446-4(b). Although a portion of

Black Stone Minerals’ income may not be effectively connected

income and may be subject to alternative withholding procedures,

brokers and nominees should treat 100% of Black Stone Minerals’

distributions to non-U.S. investors as being attributable to income

that is effectively connected with a United States trade or

business. Accordingly, Black Stone Minerals’ distributions to

non-U.S. investors are subject to federal income tax withholding at

the highest marginal rate, currently 39.6% for individuals.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160209006889/en/

Black Stone Minerals, L.P.Brent Collins, 713-445-3200Vice

President, Investor

Relationsinvestorrelations@blackstoneminerals.com

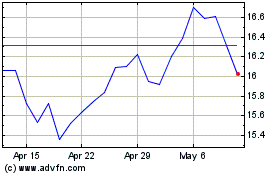

Black Stone Minerals (NYSE:BSM)

Historical Stock Chart

From Mar 2024 to Apr 2024

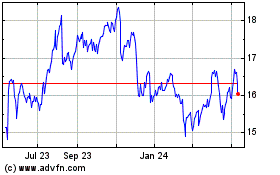

Black Stone Minerals (NYSE:BSM)

Historical Stock Chart

From Apr 2023 to Apr 2024