Bitcoin Startup Blockstream Raises $55 Million in Funding Round

February 03 2016 - 12:27PM

Dow Jones News

By Paul Vigna

Blockstream, a bitcoin-focused startup founded by some of the

industry's most high-profile developers, raised $55 million in one

of the largest funding rounds in the history of the virtual

currency.

Investors including Horizon Ventures, Hong Kong magnate Li

Ka-shing's venture-capital firm, Tokyo-based Digital Garage and the

investment arm of insurance giant AXA Group contributed to the

funding. Horizon Ventures also took a seat on Blockstream's

board.

This is the latest in a string of deals that underscore the

resilient appetite for bitcoin investments amid the anxiety in

capital markets world-wide.

Last month, Digital Asset Holdings, a startup led by former J.P.

Morgan Chase & Co. executive Blythe Masters, raised $52

million. On Tuesday, the firm said it had added Goldman Sachs Group

Inc. and International Business Machines Inc. as investors,

bringing that funding round's total to $60 million.

Launched in 2009, bitcoin is a digital currency that operates on

a decentralized computer network without a monetary authority. In

the last year, the technology underlying the currency, called

blockchain, has garnered increasing attention from Wall Street

firms. Banks are tinkering with the technology, joining development

consortia and taking stakes in companies.

Blockstream's business is focused around an idea called "

sidechains." These are bitcoin-like ledgers that operate

independently of, but are pegged to, bitcoin. This allows users to

build a separate platform for a specific use but still have access

to the bitcoin blockchain.

Blockstream, which didn't disclose its valuation, plans to use

the money to help expand its business. "Throughout our business and

the world there is a huge opportunity right now to start changing

some of the basic plumbing of traditional finance," said Chief

Executive Austin Hill.

Blockstream raised $21 million in seed funding in 2014.

The company, based in Montreal, has released two products so

far. Elements, is an open-source platform for building and testing

applications that Mr. Hill likens to as a "Lego-constructor

kit."

Liquid, designed for bitcoin exchanges, allows for high-speed

transactions. Several exchanges, such as Kraken, BTCC, and

Bitfinex, have already signed up for Liquid, which is expected to

go live by the end of March. Exchanges under contract will pay a

monthly subscription fee for use.

Blockstream last week said it would partner up with global

accounting and consulting firm PricewaterhouseCoopers to build,

deploy and maintain blockchain-based products for PwC clients.

Another blockchain-focused startup, Eris Industries, is also member

to that partnership.

Companies focused on virtual currencies raised $490 million in

2015, according to data from CoinDesk, an industry news service.

Funding rounds so far in 2016 suggest the pace is picking up. In

addition to the fundings by Blockstream and Digital Asset, a

startup called Gem raised $7.1 million in early January, and

investment firm Blockchain Capital raised $13 million for its

second venture fund.

The $116 million raised by bitcoin startup 21 Inc. last year is

the largest bitcoin-related fundraising round to date. The second

largest is the $75 million raised by Coinbase in 2015.

Bitcoin companies have raised more than $1 billion during the

currency's seven-year history.

(END) Dow Jones Newswires

February 03, 2016 12:12 ET (17:12 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

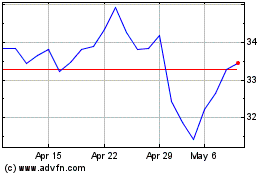

Axa (EU:CS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Axa (EU:CS)

Historical Stock Chart

From Apr 2023 to Apr 2024