Bill Gross's Bond Fund at Janus Lost 2.9% Monday

August 25 2015 - 9:30AM

Dow Jones News

Bill Gross's bond mutual fund at Janus Capital Group Inc.

suffered a 2.87% decline in its net asset value Monday, according

to fund-research firm Morningstar Inc.

The drop is unusually large for a bond fund, according to people

familiar with the industry. Mr. Gross's $1.5 billion Janus Global

Unconstrained Bond fund follows a strategy that allows it to invest

in a variety of securities, unlike a typical bond fund.

"I have spent 25 years investing with managers across every

asset class, and I don't think I have ever seen a bond fund drop

almost three percent in one day," says Bradley Alford, chief

investment officer at Alpha Capital Management in Atlanta, which

manages mutual funds.

By comparison, rival BlackRock's $31.1 billion Strategic Income

Opportunities fund, which follows a similar strategy, fell 0.2%

Monday, according to Morningstar.

A spokeswoman for Janus Capital declined to comment.

Mr. Gross has been managing the Janus Global Unconstrained Bond

fund since late September of last year, following his abrupt

departure from Pacific Investment Management Co.

Write to Kirsten Grind at kirsten.grind@wsj.com and Gregory

Zuckerman at gregory.zuckerman@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 25, 2015 09:15 ET (13:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

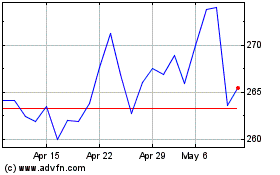

Allianz (TG:ALV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Allianz (TG:ALV)

Historical Stock Chart

From Apr 2023 to Apr 2024