By Theo Francis

After a tough end to 2015, big companies are starting the new

year with a tight rein on capital spending, and in some cases

layoffs, as they seek to cope with sluggish industrial demand and

uncertainties about the continued resilience of the American

consumer.

A half-dozen large companies from medical-products giant Johnson

& Johnson and tobacco maker Altria Group Inc. to Internet

portal Yahoo Inc. have announced plans to cut about 14,000 jobs in

recent weeks. Others, including railroad Norfolk Southern Corp. and

oil producer Chevron Corp., are pulling back on their spending

plans.

"We know this is a tough environment in which to talk about

growth," Norfolk Southern CEO James Squires recently told

investors. "That's why we are so focused on cost reductions."

The cautious approach suggests that executives remain wary as

the strong dollar and weak growth in developing markets hurts their

foreign sales, and the stock market's slide and fears of a downbeat

economy unsettle investors and consumers at home, despite

improvements in housing and employment.

American consumers--the bulwark of the economy--are sending

mixed signals: December brought disappointing government figures on

consumer spending and retail sales, but companies like Starbucks

Corp., Ford Motor Co. and Nike Inc. continue to log strong domestic

sales.

"The U.S. is basically relying on one sector to generate most of

the growth, which is consumer," said Joseph LaVorgna, chief U.S.

economist for Deutsche Bank Research. "When you don't have breadth,

you're vulnerable to a shock."

Overall, companies in the S&P 500 index are on track to

report adjusted fourth-quarter profits down 4.1% from a year

earlier, and sales down 3.5%, according to Thomson Reuters. That

would mark two consecutive quarters of shrinking earnings for the

first time since 2009, and four straight quarters of falling

sales.

Much of the overall decline reflects a battered energy sector,

which is expected to report a 75% drop in fourth-quarter earnings

and a 35% decline in sales, Thomson Reuters projects. Chevron, BP

PLC and ConocoPhillips all reported deep fourth-quarter losses.

Excluding energy companies, adjusted earnings for S&P 500

companies are expected to rise 2.1% on sales growth of just 0.9%.

Adjusted earnings, widely used by investment analysts, exclude

costs and gains considered unusual or ancillary to the company's

core operations.

Concerns about a slowdown in manufacturing aren't new. But

economic growth outside the manufacturing sector, as measured by

the Institute for Supply Management, slowed in January, settling to

the slowest pace in nearly two years, according to Oxford

Economics. And several sectors are expected to post lower profits,

including consumer staples and utilities, according to Thomson

Reuters. Earnings growth is expected to grind to a halt in the

technology sector.

For the most part, consumers have provided reliable support as

energy prices have slumped and growth has faltered in emerging

markets. In addition to companies like Starbucks and Nike, Royal

Caribbean Cruises Ltd. reported growing demand, after a brief

period of weakness following terrorist attacks in Paris last fall.

"We are seeing particular strength from the North American

consumer," Chief Financial Officer Jason Liberty said on an

earnings call last Tuesday.

And consumer-products companies cited signs that Americans are

more willing to pay a little more for new, brand-name or

higher-quality products. Procter & Gamble Co., which reported a

2% increase in organic sales, which exclude acquisitions, improved

from a 1% decline the previous quarter. It said competitors were

concentrating efforts on new, costlier products, rather than on

cutting prices to win business.

Few executives predict significant growth in the coming year,

and are responding by pulling back on business investment.

With nearly a third of S&P 500 companies reporting detailed

year-end financial results through early last week, capital

expenditures were up 6.2% from a year earlier, said Howard

Silverblatt, senior index analyst at S&P Dow Jones Indices.

That is less than half the 13.9% increase reported in the last

quarter of 2014, though much of the slowdown comes from energy

companies, Mr. Silverblatt said.

Industrial and manufacturing companies were most emphatic about

reining in spending, or at least holding the line. Norfolk Southern

reported lower coal shipments amid low energy prices, and said

retail inventories remained high, reducing shipping demand further.

Executives said the company reduced capital spending by $100

million last year "to adapt to the shifting economic environment,"

and executives said they are poised to reduce it further if

necessary.

Oshkosh Corp., a maker of heavy vehicles and equipment, said the

rental firms among its customers are taking a

more-cautious-than-expected approach to their own purchases of

construction vehicles and equipment in 2016, though sales of

emergency-services vehicles remain brisk.

"Many want to confirm that the construction market in the U.S.

gets off to a good start before fully committing to their desired

equipment-purchasing plans," Oshkosh CEO Wilson Jones said on a

Jan. 28 call with investors.

U.S. Steel Corp., meantime, said it would emphasize multiple

smaller projects. "They're projects that have much less risk to

implement and return benefits much faster," said Dan Lesnak, a U.S.

Steel investor-relations executive, on a Jan. 27 earnings call.

"This is not the environment to kick off big, big massive

projects."

Still, some companies are taking the opportunity to invest in

their businesses. Harley-Davidson Inc. plans to boost capital

spending by as much as about 6% over last year, in part by

increasing spending on new products by 35%. "The overall growth in

the company is going to be driven by new products," as well as

additional marketing and international expansion, the company's

finance chief, John Olin, said on a recent earnings call.

Employment, ultimately, could hold the key to corporate profits

in coming quarters. Again, many of the signs remain solid. The

economy added 262,000 jobs in December, more than economists

expected, but growth for the full year fell short of 2014's 15-year

record, and jobs increased by a less-than-expected 151,000 in

January.

January jobs reports can be skewed by weather and the timing of

holidays, said Mr. LaVorgna, the Deutsche Bank economist. Still,

given corporate caution and existing trends in both the

manufacturing and nonmanufacturing sectors, Mr. LaVorgna said,

"there's some real concern that we're actually going to slow

further."

(END) Dow Jones Newswires

February 07, 2016 19:43 ET (00:43 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

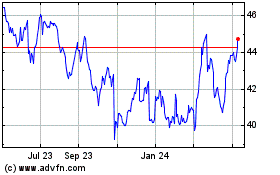

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

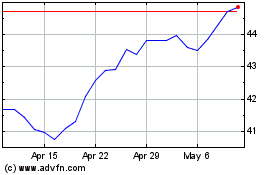

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024