Beverage Industry Sues to Block Philadelphia's Sweetened-Drink Tax

September 14 2016 - 4:00PM

Dow Jones News

Beverage companies and retailers on Wednesday sued to try to

halt Philadelphia's special tax on sweetened drinks slated to go

into effect in January.

Philadelphia become the first large U.S. city to pass such a

measure in June, when the city council approved a levy of 1.5 cents

per ounce on non-alcoholic beverages with added sweeteners ranging

from soda to sports drinks and energy drinks.

A civil complaint filed with the Philadelphia County Court of

Common Pleas argues the tax is unlawful because such drinks already

are subject to a state sales tax and that Pennsylvania law

prohibits cities from imposing duplicate taxes.

Plaintiffs include the American Beverage Association, the

Pennsylvania Food Merchants Association, beverage distributors and

two city residents.

City officials have said they are confident they can defeat a

legal challenge in part because the levy is imposed on distributors

and isn't a sales tax. Mayor Jim Kenney championed the tax on

distributors as a way to generate $91 million in annual revenue for

prekindergarten and other city services.

The legal challenge, which had been expected, comes as other

cities weigh special taxes on sugary drinks amid rising concern

over obesity and diabetes rates. Residents in San Francisco,

Oakland, Calif., and Boulder, Colo., will vote in November ballot

initiatives.

Beverage makers like Coca-Cola Co., PepsiCo Inc. and Dr Pepper

Snapple Group Inc. say such taxes are discriminatory by unfairly

singling out products representing less than 10% of caloric intake.

A federal judge put San Francisco's planned health warnings for

sugary drinks on hold in June after the industry argued the

warnings violate its free-speech rights under the First

Amendment.

In Wednesday's 59-page lawsuit, plaintiffs estimated

Philadelphia's tax would raise prices by an average of 31%, leading

to fewer purchases and an annual revenue loss of $2.7 million to

$7.8 million for Pennsylvania because of lower sales tax

receipts.

They argued Philadelphia's special tax could set a precedent

allowing local governments to tax thousands of goods ranging from

over-the-counter drugs to cars, further undermining the state's

tax-collection rights.

Plaintiffs also argued Philadelphia's levy violates the state

constitution requiring uniformity of taxation because the levy is

calculated by volume, not value. They estimated prices on larger,

less-expensive items such as 2-liter soda bottles could more than

double, while smaller energy shots would only have a single-digit

percentage increase.

The complaint also asserts that cities or states are prohibited

from taxing items including sweetened drinks purchased with

federally funded food stamps under the Supplemental Nutrition

Assistance Program, or SNAP. Nearly half a million residents of

Philadelphia, or almost a third of the city's population of 1.6

million, receive SNAP benefits, according to plaintiffs.

Write to Mike Esterl at mike.esterl@wsj.com

(END) Dow Jones Newswires

September 14, 2016 15:45 ET (19:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

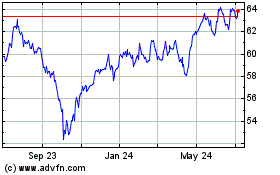

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

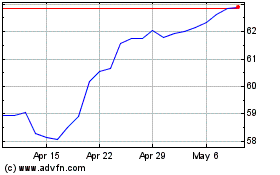

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024