Investing in the shares, which are up 8% since the election, is

seen as a bet on U.S. growth

By Nicole Friedman

Warren Buffett was one of Donald Trump's biggest critics during

the final months of the presidential campaign. Now he is one of the

biggest beneficiaries of a Trump-influenced market rally boosting

the value of everything from banks to railroads.

Mr. Buffett's Berkshire Hathaway Inc. posted its best month in

six years in November, and its shares are trading at all-time highs

at $240,000. The conglomerate's market capitalization, which stood

at roughly $20 million when Mr. Buffett acquired the former textile

maker in 1965, is hovering just below $400 billion.

Berkshire, which owns traditional businesses such as insurers,

railroads, utilities and manufacturers, stands in the echelon of

tech giants. It is the fourth-biggest U.S. company by market

capitalization, according to FactSet, below Apple Inc., Alphabet

Inc. and Microsoft Corp. Mr. Buffett, Berkshire's chairman and

biggest shareholder, is the world's third-richest man, according to

Forbes.

U.S. stocks have risen since the presidential election on the

expectation that Mr. Trump's administration and Republican

leadership in Congress will roll back taxes and regulations. The

S&P 500 has gained 3% to 2204.71 from Nov. 8 through

Monday.

In that period, Berkshire Class A and Class B shares have both

risen about 8%. Both classes of shares rose Monday, with A shares

up 0.4% to $240,000 and Class B up 0.5% to $160.21.

Mr. Buffett, a Democrat, campaigned for Hillary Clinton and

criticized Mr. Trump during the campaign. After Mr. Trump alleged

at a presidential debate that Mr. Buffett had taken a "massive"

deduction on his taxes, Mr. Buffett publicly released his personal

tax information and challenged the Republican candidate to do the

same.

Mr. Buffett didn't respond to a request for comment. In April,

he told shareholders that Berkshire would "continue to do fine" no

matter which candidate was elected president. Following the

election, Mr. Buffett told CNN that his investing decisions had

been unaffected by the election and that Mr. Trump "deserves

everybody's respect."

"The stock market will be higher 10, 20, 30 years from now," Mr.

Buffett said in a CNN interview aired Nov. 11. "It would have been

with Hillary, and it will be with Trump."

Helping drive Berkshire's stock higher is a broad exposure to

the financial industry through its ownership of insurance companies

and banks. Notably, J.P. Morgan Chase & Co. and Goldman Sachs

Group Inc. are two of the best performers in the Dow Jones

Industrial Average since the election.

Berkshire's investment portfolio owns large stakes in financial

companies including Wells Fargo & Co. and American Express Co.,

and the company recently bought shares in four major U.S. airlines.

Wells Fargo stock slid this fall due to its sales-practices scandal

but has risen alongside other banks since the election.

Financial firms across the market have benefited from a belief

that a Trump administration will help fuel a shift to higher

interest rates, as well as push for less onerous regulation of the

industry, according to analysts.

An investment in Berkshire is also a bet on U.S. growth, given

the firm's broad diversification. Berkshire sells electricity,

furniture, cars, newspapers and other goods through its subsidiary

companies. Its BNSF Railway Co. is one of the biggest in the

U.S.

"There is this sense that after this surprise election, under

President Trump there will be more rapid growth than there would

have been otherwise," said Meyer Shields, managing director at

Keefe, Bruyette & Woods. "Berkshire is represented in all

elements of the economy."

Mr. Buffett built Berkshire Hathaway, originally a New England

textiles company, into a powerhouse over five decades through

long-term stock investments and dozens of acquisitions. One of the

company's enduring advantages has been its ability to profitably

invest "float," the cash given to the company as insurance premiums

that doesn't have to be paid out until years later. Berkshire's

insurance float stood at $91 billion at the end of the third

quarter, according to the company.

Since Mr. Buffett acquired Berkshire in 1965, its per-share

market value has posted a compounded annual gain of 21% through

2015. Class A shares are up more than 21% this year.

Some investors may be buying Berkshire shares postelection as a

defensive bet because Mr. Buffett's value-oriented investment

strategy can outperform during market routs, said Paul Lountzis,

president of Lountzis Asset Management LLC, which owns Berkshire

shares.

"It's a safe place to put your money. [Berkshire has] a broad

diverse set of revenues," Mr. Lountzis said. "If we would go into a

very difficult time on the equities side, Berkshire has proven

repeatedly that they are a Fort Knox."

Write to Nicole Friedman at nicole.friedman@wsj.com

(END) Dow Jones Newswires

December 06, 2016 02:48 ET (07:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

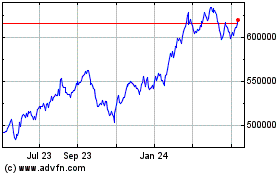

Berkshire Hathaway (NYSE:BRK.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

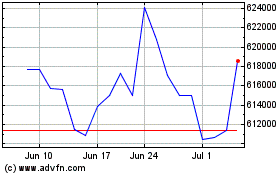

Berkshire Hathaway (NYSE:BRK.A)

Historical Stock Chart

From Apr 2023 to Apr 2024