Berkshire Cuts Wesco Offer - Analyst Blog

June 24 2011 - 8:00AM

Zacks

Yesterday, Warren Buffett, the chairman and chief executive

officer of conglomerate Berkshire Hathaway Inc.

(BRK.A) (BRK.B) renegotiated the offering price to Wesco

Financial Corp. (WSC) at $385.00 per share in cash. This

is the third time that the price has been adjusted.

In February 2011, Buffet had formally entered into a binding

agreement to acquire19.9% of Wesco. In September last year, Buffet

had announced the intention to acquire Wesco, of which

Berkshirealready owns 80.1%.

At the time of entering into the formal agreement in February,

Buffet pegged the exchange rate at $386.55, based on Wesco’s

estimated book value per share at the end of January 31, 2011.

Thereafter in March it increased the offer price to $392.91, but

scaled back the price to $389.01 in April again. These changes came

on the back of fluctuation in the value of Wesco’s stock

holdings.

However, the newly set offer price of $385.00 per share

incorporates Wesco’s net worth per share of $386.55 as on January

31, 2011 along with $4.74 per share of earnings for the period

between February 1st and June 24th and deducting $6.29

per share for decline in value of Wesco’s investments ($5.49),

dividends already paid to Wesco’s shareholders’ ($0.42) and

approximate expenses and fees relating to the merger ($0.38).

On the basis of newly quoted offer price of $385.00 the deal

valuation comes at $539 million, which will see 1.4 million shares

exchanging hands.

Wesco shareholders will vote on the deal today. Based in

California, Pasadena, Wesco has been 80.1% owned by Blue Chip

Stamps (“Blue Chip”), a wholly-owned subsidiary of Berkshire since

1983. Thus, Wesco and its subsidiaries are controlled by Blue Chip

and Berkshire. All of these companies may also be deemed to be

under the control of Buffett, who owns 24.3% of Wesco’s stock.

Wesco is run and controlled by Charles T. Munger, who is also

the vice chairman of Berkshire Hathaway. Munger consults with

Buffet on Wesco’s investment decisions, major capital allocations

and the selection of chief executives to head each of its operating

businesses.

Though varying in sizes, both the companies – Berkshire and

Wesco – are similar in terms of business operations. Like the

former, Wesco is also a conglomerate, which houses businesses like

insurance, furniture rental and industrial products. Its insurance

segment consists of the operations of Wesco-Financial Insurance Co.

and Kansas Bankers Surety Co. The furniture rental segment consists

of the operations of CORT Business Services Corp. The company’s

industrial segment comprises Precision Steel’s service center and

industrial supply operations. Wesco also holds shares in some of

the same companies as Berkshire, like Coca-Cola, Kraft, Procter

& Gamble, and Wells Fargo.

Wesco continues to have a strong consolidated balance sheet,

with high liquidity and relatively little debt. Furthermore, its

equity investments are in strong, well-known companies.

Buffett intends to convert Wesco into a wholly-owned subsidiary

of Berkshire, by deploying enormous cash of approximately $28

billion at Berkshire and also to simplify operations at Wesco.

Besides Munger is already 86 and would not carry on with the role

of its chairman for long. Moreover, with 80.1% of interest and a

lot of involvement with Wesco it Berkshire just makes good business

sense to own it completely.

BERKSHIRE HTH-A (BRK.A): Free Stock Analysis Report

BERKSHIRE HTH-B (BRK.B): Free Stock Analysis Report

Zacks Investment Research

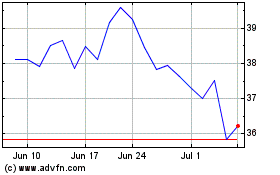

WillScot Mobile Mini (NASDAQ:WSC)

Historical Stock Chart

From Mar 2024 to Apr 2024

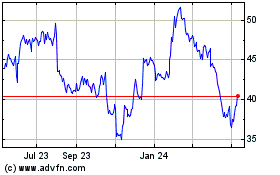

WillScot Mobile Mini (NASDAQ:WSC)

Historical Stock Chart

From Apr 2023 to Apr 2024