Beijing Infrastructure Investment Selling U.S. Dollar Bonds Through Offshore Unit -- Term Sheet

November 13 2014 - 12:24AM

Dow Jones News

By Carol Chan

HONG KONG--State-owned rail investor Beijing Infrastructure

Investment Co. is planning to sell U.S. dollar bonds through its

offshore unit to help fund the development of Beijing's urban

railway transit system, according to a term sheet seen Thursday by

The Wall Street Journal.

The company is selling the benchmark-sized U.S. dollar bonds via

two tranches. It has set price guidance to yield about 190 basis

points above comparable U.S. Treasurys for the three-year tranche

and has set price guidance to yield about 195 basis points above

comparable U.S. Treasurys for the five-year tranche, according to

the term sheet.

The company has hired the Royal Bank of Scotland PLC and HSBC

Holdings PLC as joint global coordinators for the bond issue, the

term sheet said.

Write to Carol Chan at carol.chan@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

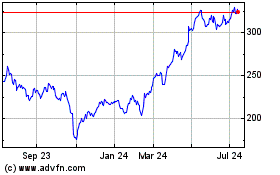

Natwest (LSE:NWG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Natwest (LSE:NWG)

Historical Stock Chart

From Apr 2023 to Apr 2024