Bear of the Day: Fresh Del Monte Produce (FDP) - Bear of the Day

December 09 2013 - 4:37AM

Zacks

While many stocks have soared so far in 2013, those in the

commodity production space have had a much rougher time. Investors

have shunned commodity producers by and large, as the focus has

been on growth stocks, or companies in more cyclical sectors

instead.

Although much of the focus has been on the metal mining space,

those in the agricultural operations segment have also faced severe

weakness as of late too. In particular, one company that has been

weak and may continue to face resistance in this space is

Fresh Del Monte Produce (FDP).

FDP in Focus

FDP produces tropical fruit such as bananas, pineapples, but also

melons and ‘deciduous’ fruit as well. This includes grapes, apples,

peaches, etc. giving the firm a wide variety of production across a

number of popular fruits.

While this might sound like a decent business to be in, FDP has

definitely struggled as of late. This has largely been due to

rising costs, and with a lack of any real competitive advantages,

the pain may continue for Fresh Del Monte Produce for quite some

time.

Estimates

This poor trend for FDP is best exemplified by the recent earnings

history of the company. Over the past four quarters, there has only

been one beat, and there have been two misses of at least 75%. This

latest miss was especially ill-received by the market, as the stock

plunged by nearly 10% following the news.

If this wasn’t enough, estimates have also been falling for FDP

across the board. Two months ago, the consensus for the current

quarter was for a loss of three cents a share, but this has now

fallen to a loss of 22 cents a share. Furthermore, the current year

estimates have slumped from $2.11/share two months ago, to

$1.63/share today, suggesting that the outlook for FDP is not

looking very good.

So with these plunging estimates Fresh Del Monte Produce is now

expected to have an earnings contraction of 36% (yoy) for the

current year. While the following year estimates are once again

showing growth, we are very bearish on FDP, assigning this company

a Zacks Rank #5 (Strong Sell).

Better Choices

Given the broad trends in the commodity world, it is tough to find

good picks in the agricultural operations space. In fact, the

current industry rank for the segment is in the bottom 10%,

suggesting that there are plenty of better choices out there

instead.

However, if you are dead-set on getting into this space, it may be

a good idea to look to the Agriculture/products segment instead.

This corner of the commodity world is doing much better from

a rank perspective—top 30%-- and it even has a number 1

Ranked stock,

The Andersons (ANDE).

This company focuses on the grain market, as opposed to FDP’s fruit

focus, and it has seen a solid history at earnings season. In fact,

ANDE delivered a huge beat of nearly 50% in the latest report, and

it has been seeing solid levels of estimate revisions lately too,

suggesting this might be a better approach to agricultural

investing, especially when compared to the struggling Fresh Del

Monte Produce.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days.

Click to get this free report

>>

ANDERSONS INC (ANDE): Free Stock Analysis Report

FRESH DEL MONTE (FDP): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

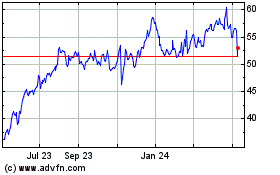

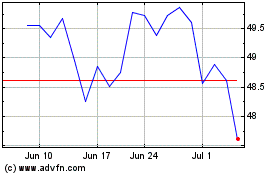

Andersons (NASDAQ:ANDE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Andersons (NASDAQ:ANDE)

Historical Stock Chart

From Apr 2023 to Apr 2024