Bayer, Versant Mount New Stem-Cell Venture -- WSJ

December 10 2016 - 3:02AM

Dow Jones News

By Christopher Alessi

FRANKFURT -- German pharmaceuticals giant Bayer AG and U.S.

health care investor Versant Ventures plan to establish a stem-cell

research company, marking the latest effort by a big pharmaceutical

company to develop new and innovative drugs by joining with venture

capital and biotechnology firms.

Executives at Bayer and Versant said in an interview that they

would launch the startup, to be called BlueRock Therapeutics, with

initial joint funding of $225 million. BlueRock plans to focus on

developing stem-cell therapies to regenerate heart muscles

following a heart attack and treatments for Parkinson's

disease.

The companies plan to formally announce the deal on Monday.

The agreement follows a wave of similar deals in the Big Pharma

sector. Companies including Sanofi SA, Johnson & Johnson and

GlaxoSmithKline PLC have been increasingly partnering with external

investors and then jointly outsourcing the research and development

of new technologies to smaller biotech outfits and academic

institutions.

But the Bayer and Versant agreement represents one of the

largest ever initial venture capital financing deals for a biotech

startup, according to Nooman Haque, the director of healthcare and

life sciences at Silicon Valley Bank's UK branch. "It's a monster,"

he said, noting that most original funding for biotech firms is an

average range of $10 million to $20 million.

The trend has accelerated in recent years as patents for many of

the industry's blockbuster drugs have begun expiring, putting new

pressure on companies to discover differentiating drugs, experts

say.

About 70% of the pharmaceutical industry's new sales come from

drugs that were originally developed in small companies, up from

30% in 1990, according to the Boston Consulting Group.

"We at Bayer were not so familiar with these new technologies

and needed a different spirit to really drive them to maturity,"

said Axel Bouchon, the head of Bayer's Life Science Center. Bayer

launched the center recently to develop innovative R&D

partnerships.

Mr. Bouchon said that the more dynamic environment of a biotech

firm would give the stem-cell experts the space to "solely focus on

the science."

The high risk of investing in newer technologies has made it

more necessary for pharmaceutical companies to form new

partnerships to share the burden of development, said Jerel Davis,

a managing director at Versant.

Mr. Davis said the broad range of experts and stakeholders

connected to the new firm would give it the "ability to pursue

multiple programs and bring some [new drugs] into clinic by

2018."

Versant is not new to collaborating with Big Pharma.

"More and more pharmaceutical companies have been approaching us

to do these kind of projects," said Bradley Bolzon, a managing

director at Versant. He said Versant had already partnered with

three other pharmaceutical companies on projects around the

"frontier" technologies of cell therapy and gene therapy.

Bayer was unique in establishing a brand new company to tackle

stem-cell technology, rather than joining forces with an existing

biotech firm or going it alone, Mr. Bolzon said.

BlueRock has licensed foundational stem cell intellectual

property from a Nobel Prize winning scientist at Kyoto University

and has begun to assemble a team of researchers through

partnerships with the Toronto-based McEwen Center for Regenerative

Medicine and Memorial Sloan Kettering in New York. The startup,

which will be based out of Toronto, New York and Boston, expects to

hire more than fifty employees within the next year and a half,

executives said.

Bayer's Mr. Bouchon and Versant's Messrs. Davis and Bolzon will

all initially serve on the BlueRock's board of directors.

The stem-cell biotech group is the second investment by the

Bayer Life Science Center. The unit last year established a joint

venture with gene-editing startup Crispr Therapeutics AG, a company

co-founded by Versant. That venture aims to use gene-editing

technology known as Crspir-Cas9 to find new drugs for conditions

such as hemophilia, heart disease in infants and a form of

blindness called Stargardt.

Mr. Bouchon said that both the Crispr and Versant endeavors

aimed to harness new medical technologies to push the

pharmaceutical industry to tackle "the challenge of moving from

treatments to cures."

Write to Christopher Alessi at christopher.alessi@wsj.com

(END) Dow Jones Newswires

December 10, 2016 02:47 ET (07:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

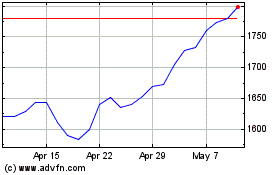

Gsk (LSE:GSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

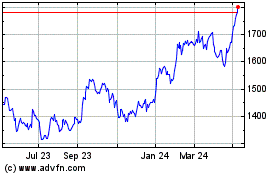

Gsk (LSE:GSK)

Historical Stock Chart

From Apr 2023 to Apr 2024