Baxter International Close to Hiring Outsider José Almeida as CEO

October 28 2015 - 4:10PM

Dow Jones News

Baxter International Inc. is close to hiring José Almeida as its

new chief executive, according to people familiar with the matter,

tapping an energetic deal maker to run the maker of dialysis

machines and medical products.

Mr. Almeida, who is 53 years old, was the chief executive of

Covidien PLC until January when he completed the sale of the

medical-supplies company. He is expected to be appointed Baxter's

chief as soon as this week, two of these people said. Mr. Almeida

didn't immediately respond to requests for comment.

The hiring of Mr. Almeida would culminate a monthslong search

for a successor to Robert Parkinson, Jr., who has headed Baxter

since 2004. Mr. Almeida's selection has been nudged along by

several of Baxter's biggest shareholders, some of the people

said.

The leadership change is a win for activist hedge fund Third

Point LLC, which owns nearly 10% of Baxter. When the fund disclosed

its stake in August, it said it was supportive of the CEO

transition. Munib Islam, a Third Point partner, who was named last

month to Baxter's board, is on the board committee overseeing the

search.

Baxter is poised to choose an outsider as its next leader

because there weren't any obvious internal prospects to succeed Mr.

Parkinson, one person familiar with the company said.

Mr. Almeida, who goes by the nickname "Joe," would take the helm

of Baxter in the wake of a major shift. The Deerfield, Ill.-based

company spun off its biopharmaceuticals business in July, a move

that leaves it focused on medical devices and technology.

Baxter, which has a market value of about $20 billion, sells

kidney-dialysis machines, drug-delivery systems and operating-room

drugs such as anesthesia. It still owns 19.5% of the new company,

Baxalta Inc., which is facing an unwanted takeover bid from Shire

PLC.

Mr. Almeida is no stranger to corporate slimdowns and

reshufflings. A mechanical engineer by training, the Brazil native

joined Covidien's predecessor, Tyco Healthcare, in 1995 as its

director of manufacturing and corporate engineering. He stayed with

Covidien when it was carved out of Tyco International Ltd. in 2007

via a three-way split, and later ran its medical-devices business

unit before becoming CEO in 2011.

In four years at the helm, he separated Covidien's generic-drug

unit and focused the company on medical devices and surgical tools.

Covidien was acquired this January by Medtronic Inc. for nearly $50

billion in cash and stock, a deal that earned Mr. Almeida a payout

of $54 million, according to a regulatory filing.

Mike Frazette, a former colleague of Mr. Almeida's at Tyco

Health, described him as a "very results oriented and a high energy

kind of guy."

Mr. Almeida wants to be a CEO again, because he relishes "the

chance to really build something and to compete on a large scale,"

said Bill Hawkins, a longtime acquaintance who led Medtronic until

2011. "He has had the taste of success and wants to do it

again."

While running Covidien, Mr. Almeida tapped into international

expertise for research and development by building an R&D

center in China, Mr. Hawkins recalled. "One of his hallmarks was

the way he approached building a global enterprise and the

willingness to take risks," Mr. Hawkins said.

Following Covidien's sale, Mr. Almeida was hired by Carlyle

Group this May as an operating executive in the global health care

group at the private-equity firm. He is currently a director at EMC

Corp., Analog Devices Inc. and State Street Corp.

Write to Liz Hoffman at liz.hoffman@wsj.com and Joann S. Lublin

at joann.lublin@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 28, 2015 15:55 ET (19:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

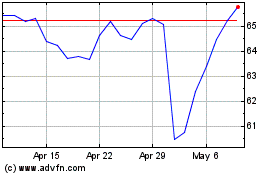

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

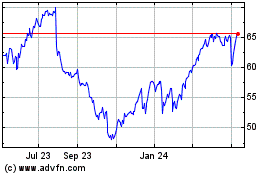

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Apr 2023 to Apr 2024