Barclays Sells Italian Loan Portfolio to IBL Banca

October 12 2016 - 7:21AM

Dow Jones News

By Razak Musah Baba

LONDON--Barclays PLC (BARC.LN) has agreed to sell a portfolio of

salary secured loans in Italy to IBL Banca SpA as part of the

bank's plan to exit non-strategic assets and businesses.

The lender said the portfolio forms part of Barclays Non-Core

and comprises about 260 million pounds ($319 million) of gross

receivables.

The sale will reduce non-core risk weighted assets by a further

GBP170 million and will be broadly neutral to Barclays' CET1 ratio

on completion, it said.

Last week, the British bank announced a deal to sell its

Egyptian retail and corporate bank to Morocco's Attijariwafa Bank

SA.

In May, Barclays raised GBP603 million by selling a 12.2% stake

in its Barclays Africa business. The bank is currently trying to

shed another tranche of its stake in Barclays Africa.

"Today's announcement further highlights the momentum we have in

Barclays Non-Core and the progress we're making," said Harry

Harrison, head of Barclays Non-Core.

The sale is subject to regulatory approvals and is expected to

be completed in the first quarter of 2017.

Barclays completed the sale of its Italian retail banking

network in August, and continues to operate investment banking and

corporate banking in Italy.

Barclays said its residual mortgage portfolio and other non-core

retail, wealth and corporate loans in Italy will remain part of

Barclays Non-Core, with the intention to exit or rundown over

time.

Max Colchester contributed to this article.

Write to Razak Musah Baba at razak.baba@wsj.com; Twitter:

@Raztweet

(END) Dow Jones Newswires

October 12, 2016 07:06 ET (11:06 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

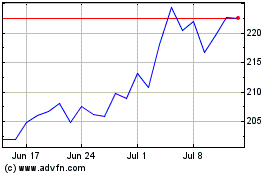

Barclays (LSE:BARC)

Historical Stock Chart

From Mar 2024 to Apr 2024

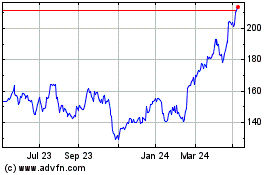

Barclays (LSE:BARC)

Historical Stock Chart

From Apr 2023 to Apr 2024