Barclays Overhaul Nears End -- WSJ

February 24 2017 - 3:03AM

Dow Jones News

Bank swings to profit, but shares decline; next step is to focus

on technology, costs

By Max Colchester

LONDON -- Barclays PLC Chief Executive Jes Staley on Thursday

said a deep restructuring at the bank would soon finish, as the

British lender swung to a GBP1.6 billion ($1.99 billion) annual net

profit.

Last year, Mr. Staley launched a sweeping overhaul aimed at

refocusing the bank on its U.K. and U.S. businesses. Barclays will

shut the unit that holds its unwanted assets by June, ahead of

schedule, and will also end a hiring freeze.

"We will have completed the restructuring of Barclays at that

point," Mr. Staley said. The British bank will now focus on

revamping its technology operations to reduce costs and improve

customer service. Shares fell 4% in afternoon trading, as the bank

missed analysts' cost targets and investors fretted about future

profitability.

The U.S.-born executive, who spent three decades at J.P. Morgan

& Chase Co., advocates a strategy that was drummed into him at

his alma mater: being a bank with activities stretching from

mortgages to merger advice pays dividends.

The decision to maintain Barclays's investment bank, at the

expense of activities in Africa and Asia, helped push the lender to

a profit last year, compared with a GBP394 million loss in 2015.

Barclays said revenue was down 3% over the year to GBP21.5 billion,

as the bank continued to exit businesses. A fall in fines over its

conduct was partially offset by higher costs as the bank

accelerated a payout of deferred bonuses.

Investment banks across the U.S. have benefited from market

volatility caused by the election of U.S. President Donald Trump,

the U.K.'s vote to the leave the European Union and the prospect of

rising interest rates. Barclays benefited from this lift, with

corporate and investment bank revenue up 6% to GBP10.5 billion,

driven by bond trading and favorable exchange rates. "I would

challenge the notion that only U.S. banks gained share in 2016,"

said Mr. Staley.

Mr. Staley added that the bank didn't have any plans to refocus

more of the business on the U.S. to benefit from any potential

loosening of financial regulations by the Trump administration. "We

are managing the business under the assumption that Dodd Frank will

stay," Mr. Staley said. "So we are not changing our strategy as we

look forward."

Barclays said it was on track to deconsolidate its African

business from its accounts. It has agreed on a GBP765 million

separation agreement with its African business, which must now be

approved by South African regulators. Once the "noncore" unit is

closed, the amount of unwanted assets folded back into the bank

will be GBP25 billion, slightly larger than what analysts had

expected.

However, while the bank has made progress, analysts said not all

hurdles had been cleared. The bank posted a return on equity -- a

key measure of profitability -- at 3.6%, well below its targeted

returns.

Dividend increases remain over the horizon after shareholder

payouts were slashed to fund the accelerated turnaround at the

bank. A series of litigation issues are also hanging over the bank.

Barclays is being sued in the U.S. by the Justice Department for

its alleged role in the sales of toxic mortgage-backed securities.

It is also being probed by U.S. and U.K. authorities over how it

wooed Middle Eastern investors to pump cash into the bank at the

height of the financial crisis.

To try to reshape the bank's technology systems Mr. Staley has

replaced a number of key executives. Barclays has brought in new

technology, data and risk officers. He also poached Paul Compton

from J.P. Morgan to act as Barclays's chief operating officer.

Write to Max Colchester at max.colchester@wsj.com

(END) Dow Jones Newswires

February 24, 2017 02:48 ET (07:48 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

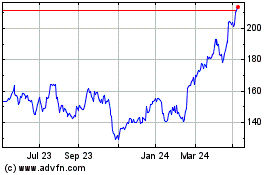

Barclays (LSE:BARC)

Historical Stock Chart

From Mar 2024 to Apr 2024

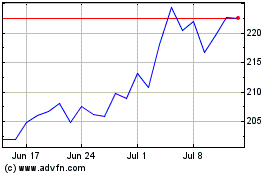

Barclays (LSE:BARC)

Historical Stock Chart

From Apr 2023 to Apr 2024