Banks, Insurance Stocks Lead Markets Higher, Bond Yields Rise

November 18 2016 - 4:20AM

Dow Jones News

Banks and insurance companies led markets higher on Friday while

bond yields climbed as investors stepped up bets on U.S. interest

rate rises.

The Stoxx Europe 600 rose 0.3% in the early minutes of trading,

led by shares of HSBC Holdings, Prudential and Allianz, following

gains in Asian markets and on Wall Street.

U.S. stocks had risen and the 10-year Treasury yield hit its

highest level of the year on Thursday after economic data and

comments from Federal Reserve Chairwoman Janet Yellen reinforced

expectations for higher U.S. interest rates this year and in

2017.

The yield on the 10-year U.S. Treasury note climbed to 2.339%

early Friday, while the 10-year German government bond yield rose

to 0.333%. The yield premium that investors demanded to own

Treasury notes relative to bunds had climbed to its highest since

1989 on Thursday.

In currencies, the WSJ Dollar Index rose 0.3% on Friday after

advancing for nine consecutive trading days in its longest winning

streak since 2009. It was last up 0.1% against the euro and up 0.5%

against the yen, after rising above ¥ 110 for the first time in

five months.

The moves in the Japanese currency supported stock markets in

Japan, which touched a 10-month high on Friday, but weighed on

dollar-denominated commodities.

Brent crude oil was down 0.7% at $46.18 a barrel while gold fell

1% to $1,204 an ounce, around a six-month low.

Write to Riva Gold at riva.gold@wsj.com

(END) Dow Jones Newswires

November 18, 2016 04:05 ET (09:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

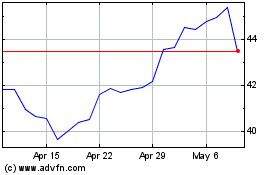

HSBC (NYSE:HSBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

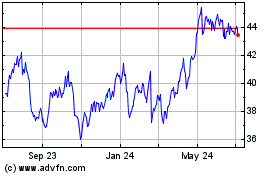

HSBC (NYSE:HSBC)

Historical Stock Chart

From Apr 2023 to Apr 2024