Banks Have Had Enough of Oil's Wild Ride

August 25 2016 - 2:50PM

Dow Jones News

By Rachel Louise Ensign

When oil fell below $30 a barrel earlier this year, banks turned

away from lending to energy companies. The price of crude has

bounced back nearly 80% from its February low, but banks are still

wary.

Big banks cut loans to the energy sector by about 3% in the

second quarter over all and some individual lenders pulled back

much more, according to an analysis of July and August securities

filings by Barclays analysts.

Oil's continued volatility isn't helping. Oil prices rose by

around 26% in the second quarter, only to fall nearly 14% in July.

This month, prices have so far bounced back by more than 12%.

Moreover, there is increased regulatory scrutiny of energy-sector

lending and exposures at banks.

Houston-based Green Bancorp, with about $4 billion of assets, is

among those that has pulled back. Chief Executive Geoff Greenwade

said this month that energy lending is "7% of our loan portfolio,"

but that, "It takes about 80% of our time." The bank earlier this

year decided it didn't want this headache and said it would divest

its current energy portfolio and halt future lending.

Despite oil prices being on firmer ground of late, energy loans

remain the most troubled part of banks' portfolios. And lenders

have socked away billions to cover potential losses.

At large U.S. banks including J.P. Morgan Chase & Co., Wells

Fargo & Co. and Bank of America Corp., a median 42% of energy

loans were considered criticized in the second quarter, Barclays

said. This means they are at higher risk of default. While few

energy loans are actually going bad -- a median 1.5% were charged

off in the second quarter -- large banks have collectively set

aside $6.4 billion in reserves for energy loan losses.

Lenders are getting rid of energy borrowers in a variety of

ways. Some are cutting the amount of credit they are willing to

extend. Others, like CIT Group Inc. and Green Bancorp, are also

selling some loans off entirely.

Banks with particularly big declines in energy loans included

U.S. Bancorp and Comerica Inc.; each trimmed energy exposure by

around 11% in the second quarter.

Murphy Oil Corp. is one example of how this has been playing

out. When the company in August renewed its $2 billion credit line,

eight of the 18 banks who took part in the current revolver --

including U.S. Bank and Comerica -- didn't sign on for a new loan

that extends through 2019, according to recent securities

filings.

In the end, the Arkansas exploration-and-production company got

$1.2 billion under the new line of credit, while the other banks

remained lenders under the older loan that expires next June. The

banks that continued lending to the company -- including J.P.

Morgan, Bank of America and Wells Fargo -- lent Murphy less than

they had under the previous credit agreement.

A Murphy spokeswoman declined to comment on whether the company

would have taken out a larger revolver if those lenders had signed

on.

Bankers and their advisers say a tougher regulatory stance is

playing a role: The Office of the Comptroller of the Currency in

March published an updated manual for energy lending. While the OCC

said in a statement that the "handbook imposes no new restrictions

on oil an gas lending," banks say this has effectively established

stricter guidelines for such loans.

Banks have said the new manual has led them to classify more

exploration-and-production borrowers as higher risk, or criticized.

Using one key measure in the handbook, 91% of a sample of

independent exploration and production companies would merit a

criticized rating in 2016, according to an analysis of such

companies' financials by law-firm Haynes and Boone LLP.

Over all, large banks cut loans to exploration and production

companies about 8% in the second quarter, Barclays said.

Not all firms are retreating. Some banks are boosting energy

lending as others hang back. J.P. Morgan Chase & Co, for

instance, increased energy loans by 3% in the second quarter. The

bank's trading desk has also bought some revolver debt of

distressed energy borrowers from smaller banks for between 85 and

90 cents on the dollar since the second quarter, a person familiar

with the matter said.

Emily Glazer contributed to this article.

Write to Rachel Louise Ensign at rachel.ensign@wsj.com

(END) Dow Jones Newswires

August 25, 2016 14:35 ET (18:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

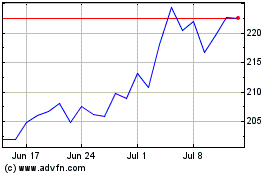

Barclays (LSE:BARC)

Historical Stock Chart

From Mar 2024 to Apr 2024

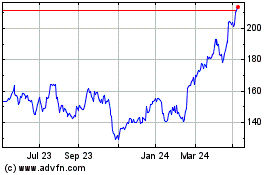

Barclays (LSE:BARC)

Historical Stock Chart

From Apr 2023 to Apr 2024