Banks' Cost-Cutting Efforts Crimp New Hires

February 01 2016 - 7:23AM

Dow Jones News

By Margot Patrick and Max Colchester

LONDON--When Barclays PLC hired a new chief risk officer last

week, Chief Executive Jes Staley had to override a firm-wide ban on

adding new staff to the payroll.

Dogged by high costs and the need to cut thousands of staff to

improve returns, banks across Europe are instituting hiring freezes

in key areas or across their entire operations. Barclays froze new

hiring last fall as it and rivals, including Deutsche Bank AG and

Credit Suisse AG, restructure their businesses and try to get a

grip on costs. On Friday, HSBC Holdings PLC told its roughly

260,000 employees they wouldn't get pay rises this year and that no

new staff would be added.

The moves come as all of those banks are trying to cut thousands

of jobs in response to new regulations, tough market conditions and

a wave of fines and litigation. Other measures to save money have

included curbing the use or cutting the pay of outside contractors

and moving jobs to lower-cost countries such as Poland and

India.

Despite promising to radically cut back staff numbers, European

banks have been slow to reshape. Regulatory pressure to hire

compliance staff, negotiations with unions and the cost of firing

workers have slowed progress in chopping staff. Banks have also

been reticent to take the revenue hit which comes from exiting

certain businesses.

At HSBC, this year's hiring freeze is aimed at reversing rising

employee numbers that came even as the bank tried to cut costs. CEO

Stuart Gulliver said last year that the bank's regulatory and

compliance staff had mushroomed to keep up with global rules. Staff

numbers grew to 259,834 at the end of the third quarter, up by

2,231 from the start of 2015. A memo to staff Friday laid out the

plans.

Between 2012 and 2014, Barclays cut nearly 7,000 jobs. To

accelerate cost cuts, the bank has made it impossible for new

payroll number to be created in some functions, helping it cut

around 4,400 jobs since the freeze started, a person familiar with

the matter said.

In practice such bans are rarely watertight. For example,

Barclays will still make hires in its U.K. retail branch network, a

person familiar with the matter said. The bank is also hunting for

top executives to refresh its management team. Last week the

British bank announced it had poached C.S. Venkatakrishnan, J.P.

Morgan Chase & Co.'s operational risk head.

Some analysts have taken heart form the banks'

announcements.

HSBC's action "is the thing you want to see from a bank that is

trying to deliver on their promise of flat costs from 2014 to

2018," said James Chappell, a banking analyst at Berenberg. "The

way to go about that is to take tough decisions on pay."

Deutsche Bank has curtailed its hiring outside of areas such as

technology, compliance and certain trading desks where it wants to

grow, such as equities trading, bank officials have said. CEO John

Cryan said last week that employee morale had been hit by the

continuing cost-cutting and restructuring. The bank aims to cut a

net 9,000 full-time jobs by 2020.

Write to Margot Patrick at margot.patrick@wsj.com and Max

Colchester at max.colchester@wsj.com

(END) Dow Jones Newswires

February 01, 2016 07:08 ET (12:08 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

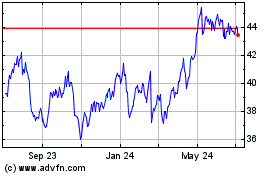

HSBC (NYSE:HSBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

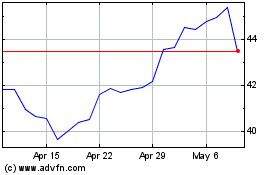

HSBC (NYSE:HSBC)

Historical Stock Chart

From Apr 2023 to Apr 2024