By Timothy Puko and John W. Miller

Their owners may be bankrupt, but the sprawling mines of

Wyoming's Powder River Basin are still churning out coal. It is the

same story in oil fields along the Gulf Coast and with shale-gas

wells in the Rocky Mountains.

Energy investors have long hoped that falling prices would solve

themselves by driving producers into bankruptcy and stanching the

flood of excess supply. It turns out that while bankruptcy filings

are up, they have barely impacted fossil-fuel markets.

About 70 U.S. oil and gas companies filed for bankruptcy in 2015

and 2016. They now produce the equivalent of about 1 million

barrels a day, about the same as before they declared bankruptcy,

according to Wood Mackenzie. That represents about 5% of U.S.

oil-and-gas output.

That resilience has kept energy inventories flush and prices

capped. Oil shot to $50 a barrel this summer, but has had trouble

making much progress beyond that mark. On Friday, oil futures in

New York rose 0.4% to $50.85 a barrel.

The theory that bankruptcies would help balance the market "was

misguided to begin with," says Roy Martin, a research analyst at

energy consultancy Wood Mackenzie. "And people are starting to come

around to that now."

This is exactly the way chapter 11 was meant to work. The

process is designed to save companies that can be saved, and many

energy companies are using it to lighten their heavy debt loads,

adapt to lean times and keep producing.

Peabody Energy Corp., Arch Coal Inc. and Alpha Natural Resources

Inc. -- three of the five largest U.S. coal miners -- all filed for

bankruptcy in the past 18 months. They accounted for about 36% of

U.S. coal supply in the first half of 2015. This year, production

declined only in line with the rest of the sector, and their share

for the first six months was nearly unchanged at about 33%,

according to IHS Global Energy. Arch Coal and Alpha Natural

Resources recently emerged from bankruptcy.

"It is frustrating," said Adam Wise, managing director at John

Hancock Financial Services who helps oversee about $7 billion in

energy-related debt and private-equity investments. "A lot of those

companies just operate similarly to how they were prior to entering

bankruptcy. It definitely doesn't help."

Oil hit historic lows this year and, while it has rebounded

somewhat, at $50 a barrel it is just half of what it was three

years ago. Oversupply continues to hamper the market and has forced

analysts to retreat from earlier calls that oil would be at $60 or

$70 by now.

Even accounting for recent drawdowns, oil producers and

importers have added 18 million barrels to U.S. stockpiles this

year, bringing the total to a near-record 469 million. There was

enough coal on hand in the U.S. in July to fuel every coal-fired

power plant in the country for more than 80 days, up from about 70

days' worth in July 2015, according to the most recent data from

the U.S. Energy Information Administration.

"Without a reset button, there's no need for prices to go

anywhere," said Colin Hamilton, head of commodity research at

Macquarie Group Ltd. "It is a long grind."

Natural-gas prices have had a stronger rebound this year, but

they, too, are still below the highs of 2013 and 2014. U.S. coal

benchmarks have followed, with Central Appalachian coal up nearly

70% from a record low in the spring, but still down 15% from three

years ago, according to S&P Global Platts.

The long-term decline in prices has led to the bankruptcies, but

also to massive cost-cutting that helped producers keep mines and

wells profitable.

Since 2012, Peabody Energy has laid off 1,650 employees and

slashed annual capital spending to $111 million from $997 million.

The upshot: three big mines in the Powder River Basin recorded a

profit margin of $3.46 a ton in 2015, up from $3.45 a ton in 2011.

Peabody's operations in the region produce over 100 million tons a

year, enough to power 16 million U.S. households, the miner

says.

Midstates Petroleum Co. filed for bankruptcy April 30 and began

drilling a new well the next day. The company stopped running some

rigs ahead of bankruptcy, but kept one going after filing. Many

companies kept honoring some contracts for rigs and well services,

having planned drilling programs months in advance and still in

need to produce revenue for paying off creditors.

Other companies that went through the bankruptcy process are now

embarking on a quick return to stabilization or even growth. Halcón

Resources Corp., SandRidge Energy, Inc., Goodrich Petroleum Corp.

and Penn Virginia Corp. recently emerged from bankruptcy after

spending two to six months restructuring. Combined, they shed about

$7 billion in debt.

Goodrich plans to grow production "pretty dramatically,"

President Robert Turnham told The Wall Street Journal. The recent

rebound in gas prices makes drilling in Louisiana more profitable,

and the company is employing new techniques to save money. They

include reordering its well-site process to cut fracking time by

more than half, Mr. Turnham said.

Ultra Petroleum Corp. has yet to emerge from bankruptcy -- it

filed in April -- and it is already planning to add another rig

within months and triple its fleet to 10 in about two years. The

company has been renegotiating rig contracts and using bankruptcy

laws to force pipeline companies to renegotiate other

contracts.

"We get to run the company, and we're trying to do what the

bankruptcy rules or law suggests, which is to maximize the value of

the company run as a growing concern," Chief Executive Michael

Watford said in an earnings call on Aug. 11.

Bank lenders, reluctant to actually take ownership of assets

that have been used as collateral by borrowers, have been friendly

to troubled companies. During bankruptcy, Halcón, SandRidge,

Goodrich and Penn Virginia raised a combined $1.3 billion in debt,

largely reaffirmed credit lines from their banks.

Coal magnate Robert Murray in 2014 correctly predicted that his

rivals would file for bankruptcy. He pushed his Murray Energy Corp.

to take advantage of the opening with a two-year buying spree

fueled by $4 billion in debt. By this summer, Mr. Murray was

negotiating with lenders, customers and workers on a multipoint

plant he needed to avoid his own company's bankruptcy.

His miscalculation: that his rivals' bankruptcies would force

them to cut back. If they maintain production, "that pulls everyone

into what I call the bankruptcy sewer," Mr. Murray said. "These are

zombie coal companies chasing the ghosts of past markets."

(END) Dow Jones Newswires

October 23, 2016 18:06 ET (22:06 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

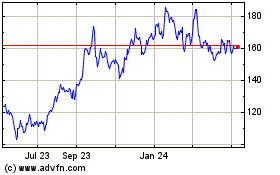

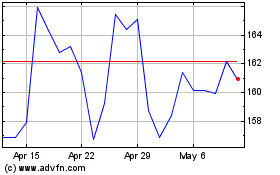

Arch Resources (NYSE:ARCH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arch Resources (NYSE:ARCH)

Historical Stock Chart

From Apr 2023 to Apr 2024