The financial sector, which accounts for around one-fifth of the

S&P 500 index, had an outstanding 2013. An improved asset

market and sound balance sheet primarily helped the sector regain

its ground lost five years bank in recession. However, things

faltered at the start of this year as evident from the

not-so-encouraging first quarter earnings results from the major

banking organizations.

Industry dynamics for banking and brokerage concerns seems to have

weakened of late thanks to lackluster activities both at household

and corporate levels, high frequency trading concerns, increased

regulatory scrutiny and sluggish mortgage as well as capital market

business.

As per Zacks Industry Trends, the financial sector was to fall 3.9%

on bottom line in Q1 with the slide being sharp (down 6.8%) for

major banks. Banks and Thrifts and Insurance will likely

deteriorate about 15% in the quarter being reported. Sequentially,

earnings growth will likely exhibit a flat trend for the major

banks and remain down for Insurance and Investment Brokers/Managers

(read: Broker Dealer ETF (IAI) in Focus on High Frequency Trading).

Amid such a scenario, some top banks like JP Morgan, Goldman Sachs,

Bank of America reported last week. Let’s delve a little deeper

into the big banks’ Q1 earnings and see how things are shaping up

for the sector:

Big Bank Earnings in Detail

JP Morgan (JPM) kicked off the season with sagging

numbers after booking solid earnings in the last quarter. Its

earnings of $1.28 per share fell short of the Zacks Consensus

Estimate of $1.41 and deteriorated from the year-ago number of

$1.59. Net revenue of $23.9 billion was down 8% from the year-ago

quarter and was also below the consensus estimate of $24.6

billion.

Bank of America (BAC) too had a flop in Q1. It

reported a loss of $0.05 per share against earnings of $0.10 in the

year-ago quarter and missed the Zacks Consensus Estimate of

earnings of $0.05. However, its fully taxable-equivalent revenues

(net of interest expense) fell 4% to $22.7 billion which was higher

than the Zacks Consensus Estimate of $22.5 billion (read: Can Bank

ETFs Bounce Back After Recent Downgrade?).

However, there are some dark horses in this otherwise pale banking

sector. Wells Fargo earned $1.05 in 1Q14, marking the seventeenth

consecutive quarter of earnings per share growth. Results improved

from $0.92 per share earned in the year-ago quarter.

The reported figure bettered the Zacks Consensus Estimate by $0.08

per share. The quarter’s total revenue came in at $20.6 billion,

outpacing the Zacks Consensus Estimate of $20.5 billion. However,

revenues were down 3.3% year over year.

Citigroup (C) also emerged a winner in this

quarter erasing its some of its past failures. Its earnings

of $1.30 per share outpaced the Zacks Consensus Estimate of $1.18

and improved a penny from the prior-year earnings. Revenues dropped

1% year over year to $20.12 billion but surpassed the Zacks

Consensus Estimate.

Goldman Sachs (GS) earned $4.02 per share in the

first quarter, down from the year-ago earnings of $4.29, but ahead

of the Zacks Consensus Estimate of $3.43. Net revenue declined 8%

year over year to $9.3 billion, but outpaced the Zacks Consensus

Estimate of $8.9 billion. Though by a slight margin, shares were in

the green in immediate trading after the earnings

release.

Morgan Stanley (MS) continued its positive

surprise streak, delivering another beat in this quarter and

posting $0.68 per share of adjusted earnings. Net revenue went up

4% year-over-year to $8.8 billion and outpaced the Zacks Consensus

Estimate of $8.6 billion. Morgan Stanley gained 2.91%

following the earnings release.

ETF Impact

All the aforementioned companies have considerable exposure in

funds like

iShares U.S. Financial Services ETF

(

IYG),

PowerShares KBW Bank

(

KBWB),

Market Vectors Bank and Brokerage

ETF (

RKH),

Financial Select

Sector SPDR (

XLF),

U.S.

Broker-Dealers Index Fund (

IAI) and

Vanguard Financials ETF (

VFH)

(see all the financial ETFs here).

All these ETFs gained as four out of six baking giants put up a

relatively better show. IAI added the most (4.34%) last week while

the S&P 500 index gained about 1.89%. RKH, IYG, XLF, VH

returned about 2.33%, 1.87%, 1.91%, 1.66%, respectively. KBWB,

however, nudged up 0.68%. Excessive focus on the laggards like J P

Morgan and Bank of America might have restricted KBWB from

generating more returns.

What Lies Ahead?

We would like to note that the inertia in JP Morgan and Bank of

America was something anticipated and investors should not be

bogged down by this fact as others had a decent Q1. Also, with the

passage of harsh winter which restricted consumer activity, the

sector should see some tailwinds.

Morgan Stanley already noticed month-on-month loan growth in March

after two successive fragile months and believes consumer balance

sheets will likely pickup momentum through Q2. In fact, earnings

growth for the financial sector should resume from Q3.

Overall, the sector has a positive undercurrent as evident from the

clearance of the Fed’s stress test by major banks. As many as 29

out of the 30 banks passed the Fed test, hinting at enough capital

that big banks presently have to endure harsh losses during a

crisis situation.

Also, financial institutions, which are more into the

broker-dealer/capital markets segment, might get their share of aid

next year once the Fed fully wraps up its bond buying program

(read: 3 Financial ETFs to Play the Bank Stress Tests).

Bottom Line

While a single stock pick is always an option, a basket

approach can also be considered to minimize risk and bet on the

best of the financial spectrum. And to do this, investors can

consider the aforementioned financial ETFs almost all of which are

top rated.

XLF and IAI carry a Zacks ETF Rank of 1 or Strong Buy rating with a

high risk outlook. VFH and IYG carry a Zacks ETF Rank of 2 or Buy

rating with a high risk outlook while KBWB has a 2 rank with a

medium risk outlook. Only RKH presently has a Zacks ETF Rank of 3

(Hold rating) with a medium risk outlook, so it appears as though

most financial ETFs are looking strong as we head further into

Q2.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

BANK OF AMER CP (BAC): Free Stock Analysis Report

CITIGROUP INC (C): Free Stock Analysis Report

ISHARS-US BR-D (IAI): ETF Research Reports

ISHARS-US FN SV (IYG): ETF Research Reports

JPMORGAN CHASE (JPM): Free Stock Analysis Report

PWRSH-KBW BP (KBWB): ETF Research Reports

MKT VEC-BANK&BR (RKH): ETF Research Reports

SPDR-FINL SELS (XLF): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

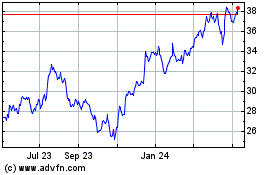

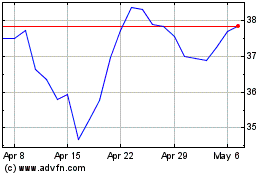

Bank of America (NYSE:BAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bank of America (NYSE:BAC)

Historical Stock Chart

From Apr 2023 to Apr 2024