Bank of Ireland(Governor&Co) Potential Additional Tier 1 Transaction (4967P)

June 08 2015 - 5:45AM

UK Regulatory

TIDMBKIR

RNS Number : 4967P

Bank of Ireland(Governor&Co)

08 June 2015

The Governor and Company of the Bank of Ireland (the

"Group")

Potential Additional Tier 1 Transaction

8 June 2015

_______________________________________________________________________________

The Governor and Company of the Bank of Ireland ("the Bank") has

mandated Deutsche Bank and UBS Investment Bank as Joint Structuring

Advisors and Joint Bookrunners and Bank of America Merrill Lynch,

Credit Suisse, Davy and Morgan Stanley as Joint Bookrunners for the

issue of EUR-denominated RegS CRR compliant 5.125% CET1 trigger

Fixed Rate Reset Additional Tier 1 Perpetual Contingent Temporary

Write-Down Securities (the "Securities"). The issue and sale of the

Securities remains subject to market conditions and will follow a

UK and European roadshow which will commence on 9 June 2015.

FCA/ICMA stabilisation.

Ends

For further information please contact:

Bank of Ireland

Andrew Keating Group Chief Financial Officer +353 (0)766 23

5141

Brian Kealy Head of Capital Management +353 (0)766 23 4719

Colin Reddy Deputy Head of Capital Management +353 (0)766 23

4722

Mark Spain Director of Group Investor Relations +353 (0)766 23

4850

Pat Farrell Head of Group Communications +353 (0)766 23 4770

Forward Looking Statement

This document contains certain forward-looking statements within

the meaning of Section 21E of the US Securities Exchange Act of

1934 and Section 27A of the US Securities Act of 1933 with respect

to certain of the Bank of Ireland Group's (the 'Group') plans and

its current goals and expectations relating to its future financial

condition and performance, the markets in which it operates, and

its future capital requirements. These forward-looking statements

often can be identified by the fact that they do not relate only to

historical or current facts. Generally, but not always, words such

as 'may,' 'could,' 'should,' 'will,' 'expect,' 'intend,'

'estimate,' 'anticipate,' 'assume,' 'believe,' 'plan,' 'seek,'

'continue,' 'target,' 'goal', 'would,' or their negative variations

or similar expressions identify forward-looking statements, but

their absence does not mean that a statement is not forward

looking. Examples of forward-looking statements include among

others, statements regarding the Group's near term and longer term

future capital requirements and ratios, level of ownership by the

Irish Government, loan to deposit ratios, expected impairment

charges, the level of the Group's assets, the Group's financial

position, future income, business strategy, projected costs,

margins, future payment of dividends, the implementation of changes

in respect of certain of the Group's pension schemes, estimates of

capital expenditures, discussions with Irish, United Kingdom,

European and other regulators and plans and objectives for future

operations.

Such forward-looking statements are inherently subject to risks

and uncertainties, and hence actual results may differ materially

from those expressed or implied by such forward-looking statements.

Such risks and uncertainties include, but are not limited to, the

following: geopolitical risks, such as those associated with crises

in the Middle East and increasing political tensions in respect of

the Ukraine, which could potentially adversely impact the markets

in which the Group operates; concerns on sovereign debt and

financial uncertainties in the EU and in member countries such as

Greece and the potential effects of those uncertainties on the

Group; general and sector specific economic conditions in Ireland,

the United Kingdom and the other markets in which the Group

operates; the ability of the Group to generate additional liquidity

and capital as required; the effects of extensive asset quality

review and stress tests conducted by the European Central Bank any

capital or other assessments undertaken by regulators; property

market conditions in Ireland and the United Kingdom; the potential

exposure of the Group to various types of market risks, such as

interest rate risk, foreign exchange rate risk, credit risk and

commodity price risk; deterioration in the credit quality of the

Group's borrowers and counterparties, as well as increased

difficulties in relation to the recoverability of loans and other

amounts due from such borrowers and counterparties, have resulted

in significant increases, and could result in further significant

increases in the Group's impaired loans and impairment provisions;

the impact on lending and other activity arising from emerging

macro prudential policies; the performance and volatility of

international capital markets; the effects of the Irish

Government's stockholding in the Group (through the Ireland

Strategic Investment Fund) and possible changes in the level of

such stockholding; the impact of downgrades in the Group's or the

Irish Government's credit ratings or outlook; the stability of the

eurozone; changes in the Irish and United Kingdom banking systems;

changes in applicable laws, regulations and taxes in jurisdictions

in which the Group operates particularly banking regulation by the

Irish and United Kingdom Governments together with the operation of

the Single Supervisory Mechanism and the establishment of the

Single Resolution Mechanism the exercise by regulators of powers of

regulation and oversight in Ireland and the United Kingdom; the

introduction of new government policies or the amendment of

existing policies in Ireland or the United Kingdom; the outcome of

any legal claims brought against the Group by third parties or

legal or regulatory proceedings or any Irish banking inquiry more

generally, that may have implications for the Group; the

development and implementation of the Group's strategy, including

the Group's ability to achieve net interest margin increases and

cost targets; the Group's ability to address weaknesses or failures

in its internal processes and procedures including information

technology issues and equipment failures and other operational

risks; the responsibility of the Group for contributing to

compensation schemes in respect of banks and other authorised

financial services firms in Ireland and the United Kingdom who may

be unable to meet their obligations to customers; the inherent risk

within the Group's life assurance business involving claims, as

well as market conditions generally; potential further

contributions to the Group sponsored pension schemes if the value

of pension fund assets is not sufficient to cover potential

obligations and the impact of the continuing implementation of

significant regulatory developments such as Basel III, Capital

Requirements Directive (CRD) IV, Solvency II and the Recovery and

Resolution Directive.

Nothing in this document should be considered to be a forecast

of future profitability or financial position and none of the

information in this document is or is intended to be a profit

forecast or profit estimate. Any forward-looking statement speaks

only as at the date it is made. The Group does not undertake to

release publicly any revision to these forward-looking statements

to reflect events, circumstances or unanticipated events occurring

after the date hereof. The reader should however, consult any

additional disclosures that the Group has made or may make in

documents filed or submitted or may file or submit to the US

Securities and Exchange Commission.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCEANKPELASEEF

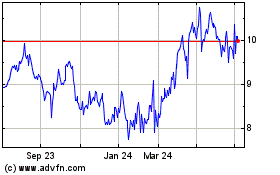

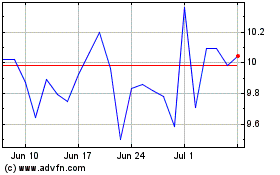

Bank Of Ireland (LSE:BIRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bank Of Ireland (LSE:BIRG)

Historical Stock Chart

From Apr 2023 to Apr 2024