Bank of Ireland(Governor&Co) BOI Capital Developments (7017S)

December 23 2016 - 3:00AM

UK Regulatory

TIDMBKIR

RNS Number : 7017S

Bank of Ireland(Governor&Co)

23 December 2016

The Governor and Company of the Bank of Ireland (the

"Group")

Capital Developments

23 December 2016

The Group has executed a credit risk transfer transaction on a

portfolio of business banking and corporate loan assets effective

29 December 2016. Separately, the Group is revising its calculation

of capital requirements under the Internal Ratings Based ("IRB")

approach on its Republic of Ireland ("ROI") mortgage portfolio.

On a pro-forma basis, the Group expects the combined net impact

from these capital developments on the Group's transitional CET1

ratio to be a reduction of c.15bps (fully loaded CET1 ratio:

c.20bps).

Credit risk transfer transaction

The Group has executed a credit risk transfer transaction

effective 29 December 2016 on a reference portfolio of c.EUR3

billion of loan assets originated by the Group's Business Banking

and Corporate Banking divisions in the Republic of Ireland. On a

pro-forma basis, the transaction is expected to benefit the Group's

transitional CET1 ratio by c.50bps, the Group's fully loaded CET1

ratio by c.40bps and the Group's transitional Total Capital ratio

by c.65bps.

The transaction involves the execution of a credit default swap

backed by c.EUR185 million of credit linked notes issued by Grattan

Securities DAC to a small group of international investors. The

transaction reduces the Group's credit risk exposure, and

consequently the risk weighted assets on the reference portfolio of

loan assets, through a risk sharing structure whereby the buyers of

the notes assume the credit risk for c.EUR185 million of potential

credit losses on the reference portfolio of loan assets in return

for an initial annual coupon (interest expense) of c.EUR21

million.

No assets will be derecognised from the Group's balance sheet.

The reference portfolio of loan assets and related customer

relationships will continue to be maintained by the Group.

Revision of calculation of capital requirements on the Group's

ROI mortgage portfolio

The Group is revising its calculation of capital requirements

under the IRB approach on its ROI mortgage non-defaulted loan

portfolio. The revision is in advance of the ECB's targeted review

of internal models (TRIM) due to commence early next year and

increases the pro-forma average credit risk weighting on ROI

mortgages to 34%.

On a pro-forma basis, the revision is expected to reduce the

Group's transitional CET1 ratio by c.65bps, the Group's fully

loaded CET1 ratio by c.60bps and the Group's transitional Total

Capital ratio by c.85bps.

Ends

For further information please contact:

Bank of Ireland

Andrew Keating Group Chief Financial Officer +353 (0)766 23

5141

Alan Hartley Director of Group Investor Relations +353 (0)766 23

4850

Pat Farrell Head of Group Communications +353 (0)766 23 4770

Forward Looking Statement

This document contains certain forward-looking statements with

respect to certain of the Group's plans and its current goals and

expectations relating to its future financial condition and

performance, the markets in which it operates, and its future

capital requirements. These forward-looking statements often can be

identified by the fact that they do not relate only to historical

or current facts. Generally, but not always, words such as 'may,'

'could,' 'should,' 'will,' 'expect,' 'intend,' 'estimate,'

'anticipate,' 'assume,' 'believe,' 'plan,' 'seek,' 'continue,'

'target,' 'goal', 'would,' or their negative variations or similar

expressions identify forward-looking statements, but their absence

does not mean that a statement is not forward looking. Examples of

forward-looking statements include among others, statements

regarding the Group's near term and longer term future capital

requirements and ratios, level of ownership by the Irish

Government, loan to deposit ratios, expected impairment charges,

the level of the Group's assets, the Group's financial position,

future income, business strategy, projected costs, margins, future

payment of dividends, the implementation of changes in respect of

certain of the Group's pension schemes, estimates of capital

expenditures, discussions with Irish, United Kingdom, European and

other regulators and plans and objectives for future

operations.

Nothing in this document should be considered to be a forecast

of future profitability or financial position and none of the

information in this document is or is intended to be a profit

forecast or profit estimate. Any forward-looking statement speaks

only as at the date it is made. The Group does not undertake to

release publicly any revision to these forward-looking statements

to reflect events, circumstances or unanticipated events occurring

after the date hereof.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCLIFSDFILVFIR

(END) Dow Jones Newswires

December 23, 2016 03:00 ET (08:00 GMT)

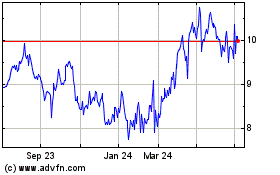

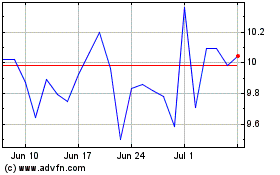

Bank Of Ireland (LSE:BIRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bank Of Ireland (LSE:BIRG)

Historical Stock Chart

From Apr 2023 to Apr 2024