TIDMBGFD

RNS Number : 4770I

Baillie Gifford Japan Trust PLC

26 March 2015

RNS Announcement

----------------

The Baillie Gifford Japan Trust PLC

===================================

Results for the six months to 28 February 2015

----------------------------------------------

In the six months to 28 February 2015, The Baillie Gifford Japan

Trust's net asset value per share (after deducting borrowings at

fair value) increased by 20.5% compared to a 12.3% increase in the

TOPIX total return (in sterling terms). The Company's share price

increased by 20.6%.

3/4 Outperformance versus the benchmark was due to strong stock

selection and the positive effect of gearing over the period.

3/4 Active Share at the period end was 87%, which shows that the

overlap with the index is very small and that an investment

approach which emphasises the individual merits of companies is

being taken.

3/4 Economic policy in Japan remains supportive of the corporate

sector with continued quantitative easing from the Bank of Japan as

it tries to reach an inflation target of 2%.

3/4 There have been further positive developments in corporate

governance in Japan. Company behaviour is clearly changing, with

more emphasis on increasing returns to shareholders.

The Baillie Gifford Japan Trust aims to achieve long term

capital growth principally through investment in medium and smaller

sized Japanese companies which are believed to have above average

prospects for growth, although it invests in larger companies when

considered appropriate. At 28 February 2015, the Company had total

assets of GBP347.0m (before deduction of bank loans of

GBP47.1m).

The Company is managed by Baillie Gifford, an Edinburgh based

fund management group with around GBP127bn under management and

advice as at 25 March 2015.

Past performance is not a guide to future performance. The value

of an investment and any income from it is not guaranteed and may

go down as well as up and investors may not get back the amount

invested. This is because the share price is determined by the

changing conditions in the relevant stock markets in which the

Company invests and by the supply and demand for the Company's

shares. You should view your investment as long term. You can find

up to date performance information about The Baillie Gifford Japan

Trust PLC on the Company website at www.japantrustplc.co.uk.

25 March 2015

For further information please contact:

Alex Blake, Baillie Gifford & Co

Tel: 0131 275 2859

Roland Cross, Director

Broadgate Mainland

Tel: 0207 726 6111

The following is the unaudited Half-Yearly Financial Report for

the six months to 28 February 2015.

Responsibility statement

========================

We confirm that to the best of our knowledge:

a) the condensed set of financial statements has been prepared

in accordance with the Accounting Standards Board's statement

'Half-Yearly Financial Reports';

b) the Half-Yearly Management Report includes a fair review of

the information required by Disclosure and Transparency Rules

4.2.7R (indication of important events during the first six months,

their impact on the financial statements and a description of

principal risks and uncertainties for the remaining six months of

the year); and

c) the Half-Yearly Financial Report includes a fair review of

the information required by Disclosure and Transparency Rules

4.2.8R (disclosure of related party transactions and changes

therein).

By order of the Board

Nick AC Bannerman

Chairman

25 March 2015

Half-yearly management report

=============================

During the six months to the end of February 2015 the net asset

value per share, with borrowings deducted at fair value, rose by

20.5% to 425.9p as the Japanese stock market reached new post-2008

Crisis highs. This compares with a 12.3% increase in the

comparative index in sterling terms after the 7% depreciation of

the yen against sterling. The significant outperformance was due to

both good stock selection and the positive impact of gearing. There

were six stocks each contributing more than 0.5% in relative gains

and only two detracting similarly.

For the first time the Half-Yearly Report includes a figure on

the Active Share of the portfolio. There has been a significant

amount of discussion recently in the financial press about the need

for true active management of portfolios rather than any mimicking

of indices. Japan Trust's figure of an 87% Active Share, which was

the same at the previous year end, shows that the overlap with the

index is very small and that an investment approach which

emphasises the individual merits of companies is being taken. This

figure will continue to be shown in future reports.

The Japanese economy is recovering gradually from the effects of

the consumption tax increase in April 2014 but the overall level of

growth in the last quarter of 2014 was disappointing with GDP only

rising 0.4%. However this figure masks other encouraging trends in

the economy with the labour market tightening further, female

participation in the workforce increasing, wage growth beginning to

accelerate, an ongoing property recovery both in city land prices

and the office market, exports growing and a surge in inbound

tourism particularly from China and other countries in East Asia.

As a result of this, profits have continued to increase and there

are good prospects for further growth in both the economy overall

and corporate profitability.

The yen, which had already weakened significantly, was again

depreciating against sterling in the first half of the period under

review. However since the end of November there has been a shift

and the yen has now risen marginally against sterling. Whilst

direct influences on currency levels are difficult to analyse there

seem to be a number of factors involved. The adoption of

quantitative easing by the ECB, the weakening of the oil price, the

resumption of export growth may all have had an influence. If Japan

does restart some nuclear power stations, as seems increasingly

likely, energy imports will fall significantly and this should also

help support the yen. At current levels Japan is a competitive

place to manufacture and there are many news stories of production

being returned to Japan and further investments being made in

upgrading production capacity.

We have commented in previous reports on the encouraging

improvements in corporate governance in Japan and there have been

further positive developments since then. A Corporate Governance

code has been announced recently in addition to last year's

Stewardship Code. Company behaviour is clearly changing, with more

emphasis on increasing returns to shareholders via higher targets

for return on equity, more share buy-backs and increased cash

dividends. Baillie Gifford welcomes the opportunity for more

constructive engagement with company managements and we feel that

our long term outlook is well aligned to the time scales that

corporate Japan considers. Recent shifts in domestic asset

allocation and the need for Japan to increase returns to support an

ageing population means that pressure for action is increasing and

the scope for improvement in balance sheet management is very large

as cash balances have built up through the years of deflation.

Economic policy in Japan remains supportive of the corporate

sector with continued quantitative easing from the Bank of Japan as

it tries to reach an inflation target of 2%. The government was

returned to power with an improved majority after a snap election

in December and is aiming to enact a significant structural reform

programme. Cuts to corporate taxes have been announced and further

reductions seem likely as the tax system is reformed. Tax revenues

overall are rising strongly as the tax base is extremely cyclical,

although there is still a budget deficit. Whilst hopes for Mr Abe's

Third Arrow have perhaps faded the positive impacts of various

policies are beginning to be felt.

Past performance is not a guide to future performance.

Income statement (unaudited)

============================

For the six months ended For the six months ended For the year ended

28 February 2015 28 February 2014 31 August 2014

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

============================ ======== ======== ======== ======== ======== ======== ======== ======== ========

Gains on sales of

investments - 2,728 2,728 - 1,883 1,883 - 7,538 7,538

Changes in investment

holding gains - 44,826 44,826 - 2,495 2,495 - 11,263 11,263

Currency gains (note 4) - 2,633 2,633 - 3,630 3,630 - 3,927 3,927

Income from investments and

interest receivable 2,087 - 2,087 1,690 - 1,690 3,746 - 3,746

Investment management fee (993) - (993) (835) - (835) (1,693) - (1,693)

Other administrative

expenses (273) - (273) (185) - (185) (386) - (386)

============================ ======== ======== ======== ======== ======== ======== ======== ======== ========

Net return before finance

costs and taxation 821 50,187 51,008 670 8,008 8,678 1,667 22,728 24,395

============================ ======== ======== ======== ======== ======== ======== ======== ======== ========

Finance costs of borrowings (507) - (507) (470) - (470) (1,004) - (1,004)

============================ ======== ======== ======== ======== ======== ======== ======== ======== ========

Net return on ordinary

activities before taxation 314 50,187 50,501 200 8,008 8,208 663 22,728 23,391

============================ ======== ======== ======== ======== ======== ======== ======== ======== ========

Tax on ordinary activities (209) - (209) (135) - (135) (341) - (341)

============================ ======== ======== ======== ======== ======== ======== ======== ======== ========

Net return on ordinary

activities after taxation 105 50,187 50,292 65 8,008 8,073 322 22,728 23,050

============================ ======== ======== ======== ======== ======== ======== ======== ======== ========

Net return per ordinary

share (note 6) 0.15p 72.23p 72.38p 0.10p 11.92p 12.02p 0.47p 33.45p 33.92p

============================ ======== ======== ======== ======== ======== ======== ======== ======== ========

All revenue and capital items in this statement derive from

continuing operations.

A Statement of Total Recognised Gains and Losses is not required

as all gains and losses of the Company have been reflected in the

above statement.

Balance sheet (unaudited)

=========================

At 28 February 2015 At 28 February 2014 At 31 August 2014

GBP'000 GBP'000 GBP'000

Fixed assets

Investments 339,797 261,228 286,275

============================================== =================== =================== =================

Current assets

Debtors 757 754 369

Cash and short term deposits 7,429 10,270 5,231

============================================== =================== =================== =================

8,186 11,024 5,600

============================================== =================== =================== =================

Creditors

Amounts falling due within one year:

Bank loans (note 7) (8,119) (16,370) -

Other creditors (956) (823) (1,428)

============================================== =================== =================== =================

(9,075) (17,193) (1,428)

============================================== =================== =================== =================

Net current liabilities (889) (6,169) 4,172

============================================== =================== =================== =================

Total assets less current liabilities 338,908 255,059 290,447

============================================== =================== =================== =================

Creditors

Amounts falling due after more than one year:

Bank loans (note 7) (38,973) (25,724) (41,733)

============================================== =================== =================== =================

Net assets 299,935 229,335 248,714

============================================== =================== =================== =================

Capital and reserves

Called up share capital 3,479 3,403 3,467

Share premium 48,009 42,754 47,092

Capital redemption reserve 203 203 203

Capital reserve 254,155 189,248 203,968

Revenue reserve (5,911) (6,273) (6,016)

============================================== =================== =================== =================

Shareholders' funds 299,935 229,335 248,714

============================================== =================== =================== =================

Net asset value per ordinary share

(after deducting borrowings at fair value) 425.9p 335.4p 353.3p

============================================== =================== =================== =================

Net asset value per ordinary share

(after deducting borrowings at par) 431.1p 337.0p 358.7p

============================================== =================== =================== =================

Ordinary shares in issue (note 8) 69,581,750 68,056,750 69,331,750

============================================== =================== =================== =================

Reconciliation of movements in shareholders' funds (unaudited)

==============================================================

For the six months ended 28 February 2015

Share Capital redemption Capital Shareholders'

capital Share premium reserve reserve* Revenue reserve funds

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

======================== ======== ============= ======================== ========= =============== =============

Shareholders' funds at 1

September 2014 3,467 47,092 203 203,968 (6,016) 248,714

Shares issued 12 917 - - - 929

Net return on ordinary

activities after

taxation - - - 50,187 105 50,292

Shareholders' funds at

28 February 2015 3,479 48,009 203 254,155 (5,911) 299,935

======================== ======== ============= ======================== ========= =============== =============

For the six months ended 28 February 2014

Share Capital redemption Capital Shareholders'

capital Share premium reserve reserve* Revenue reserve funds

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

======================== ======== ============= ======================== ========= =============== =============

Shareholders' funds at 1

September 2013 3,251 32,019 203 181,240 (6,338) 210,375

Shares issued 152 10,735 - - - 10,887

Net return on ordinary

activities after

taxation - - - 8,008 65 8,073

Shareholders' funds at

28 February 2014 3,403 42,754 203 189,248 (6,273) 229,335

======================== ======== ============= ======================== ========= =============== =============

For the year ended 31 August 2014

Share Capital redemption Capital Shareholders'

capital Share premium reserve reserve* Revenue reserve funds

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

======================== ======== ============= ======================== ========= =============== =============

Shareholders' funds at 1

September 2013 3,251 32,019 203 181,240 (6,338) 210,375

Shares issued 216 15,073 - - - 15,289

Net return on ordinary

activities after

taxation - - - 22,728 322 23,050

Shareholders' funds at

31 August 2014 3,467 47,092 203 203,968 (6,016) 248,714

======================== ======== ============= ======================== ========= =============== =============

* The Capital Reserve balance as at 28 February 2015 includes

investment holding gains on fixed asset investments of

GBP148,458,000 (28 February 2014 - gains of GBP94,864,000; 31

August 2014 - gains of GBP103,632,000).

Condensed cash flow statement (unaudited)

=========================================

Six months to Six months to Year to

28 February 2015 28 February 2014 31 August 2014

GBP'000 GBP'000 GBP'000

Net cash inflow from operating activities 653 455 1,652

Net cash outflow from servicing of finance (502) (425) (884)

Total tax paid (181) (109) (330)

Net cash outflow from financial investment (6,689) (12,659) (22,491)

=============================================================== ================= ================= ===============

Net cash outflow before financing (6,719) (12,738) (22,053)

=============================================================== ================= ================= ===============

Financing

Shares issued 929 10,887 15,289

Bank loans drawn down 8,070 11,023 27,410

Bank loans repaid - - (16,387)

--------------------------------------------------------------- ----------------- ----------------- ---------------

Net cash inflow from financing 8,999 21,910 26,312

=============================================================== ================= ================= ===============

Increase in cash 2,280 9,172 4,259

=============================================================== ================= ================= ===============

Reconciliation of net cash flow to movement in net debt

Increase in cash in the period 2,280 9,172 4,259

Net cash inflow from bank loans (8,070) (11,023) (11,023)

Exchange differences on bank loans 2,711 4,508 4,869

Exchange differences on cash (83) (762) (888)

=============================================================== ================= ================= ===============

Movement in net debt in the period (3,162) 1,895 (2,783)

Net debt at start of the period (36,502) (33,719) (33,719)

=============================================================== ================= ================= ===============

Net debt at end of the period (39,664) (31,824) (36,502)

=============================================================== ================= ================= ===============

Reconciliation of net return before finance costs and taxation

to net cash inflow from operating

activities

Net return before finance costs and taxation 51,008 8,678 24,395

Gains on investments (47,554) (4,378) (18,801)

Currency gains (2,633) (3,630) (3,927)

Changes in debtors and creditors (168) (215) (15)

=============================================================== ================= ================= ===============

Net cash inflow from operating activities 653 455 1,652

=============================================================== ================= ================= ===============

Twenty largest holdings at 28 February 2015 (unaudited)

=======================================================

Value % of total

Name Business GBP'000 assets*

====================== ======================================== ======== ==========

Toyo Tyre & Rubber Tyre manufacturer 10,873 3.1

Don Quijote Discount store operator 10,746 3.1

Fuji Heavy Industries Subaru cars 9,934 2.9

Sysmex Medical equipment 9,841 2.8

Cyberagent Internet advertising and content 9,669 2.8

Rakuten Internet retail and financial services 9,210 2.7

Misumi Group Precision machinery parts distributor 8,866 2.5

Iriso Electronics Specialist auto connectors 8,697 2.5

SoftBank Telecom operator and internet investor 8,601 2.5

Japan Exchange Group Stock Exchange operator 8,391 2.4

M3 Online medical database 8,287 2.4

Kubota Agricultural machinery 8,252 2.4

H.I.S. Travel agency and theme parks 8,060 2.3

Itochu Trading conglomerate 7,596 2.2

Temp Holdings Employment and outsourcing services 7,211 2.1

Sony Consumer electronics, films and finance 7,079 2.0

Yaskawa Electric Robots and factory automation 6,807 2.0

Isuzu Motors Trucks and pick-ups 6,659 1.9

Asics Sports shoes and clothing 6,438 1.8

Otsuka Corp IT solutions for SMEs 6,181 1.8

====================== ======================================== ======== ==========

167,398 48.2

=============================================================== ======== ==========

* Before deduction of bank loans

Notes to the condensed financial statements (unaudited)

=======================================================

1. The condensed financial statements for the six months to 28 February 2015 comprise the statements

set out on pages 6 to 10 together with the related notes on pages 11 and 12. They have been

prepared on the basis of the same accounting policies as set out in the Company's Annual Report

and Financial Statements at 31 August 2014 and in accordance with the ASB's Statement 'Half-Yearly

Financial Reports' and have not been audited or reviewed by the Auditors pursuant to the Auditing

Practices Board Guidance on 'Review of Interim Financial Information'. The Company's assets,

the majority of which are investments in quoted securities which are readily realisable, exceed

its liabilities significantly. All borrowings require the prior approval of the Board. Gearing

levels and compliance with borrowing covenants are reviewed by the Board on a regular basis.

In accordance with the Company's Articles of Association, shareholders have the right to vote

annually at the Annual General Meeting on whether to continue the Company. The next continuation

vote will be in November 2015. The Directors have no reason to believe that the continuation

resolution will not be passed at the Annual General Meeting. Accordingly, the Half-Yearly

Financial Report has been prepared on the going concern basis as it is the Directors' opinion

that the Company will continue in operational existence for the foreseeable future.

2. The financial information contained within this Half-Yearly Financial Report does not constitute

statutory accounts as defined in sections 434 to 436 of the Companies Act 2006. The financial

information for the year ended 31 August 2014 has been extracted from the statutory accounts

which have been filed with the Registrar of Companies. The Auditor's Report on those accounts

was not qualified and did not contain statements under sections 498(2) or (3) of the Companies

Act 2006.

3. The management agreement with Baillie Gifford & Co Limited is terminable on not less than

6 months' notice, or on shorter notice in certain circumstances. With effect from 1 April

2013 the annual management fee was changed to 0.95% on the first GBP50 million of net assets

and 0.65% on the remaining net assets, calculated and payable quarterly. The annual fee previously

was 1.0% of net assets, calculated and payable quarterly.

==========================================================================================================

4. Currency gains/(losses) Six months to Six months to Year to

28 February 2015 28 February 2014 31 August 2014

GBP'000 GBP'000 GBP'000

============================================ ==================== =================== =================

Exchange differences on:

Cash balances (83) (762) (888)

Bank loans 2,711 4,508 4,869

Other items 5 (116) (54)

================================================ ==================== =================== =================

2,633 3,630 3,927

================================================ ==================== =================== =================

5. No interim dividend will be declared.

Notes to the condensed financial statements (unaudited) (continued)

===================================================================

6. Net return per ordinary share Six months to Six months to Year to

28 February 2015 28 February 2014 31 August 2014

GBP'000 GBP'000 GBP'000

======================================================= ================= ================= ===============

Revenue return on ordinary activities after taxation 105 65 322

Capital return on ordinary activities after taxation 50,187 8,008 22,728

============================================================ ================= ================= ===============

Net return per ordinary share is based on the above totals of revenue and capital and on 69,482,579

ordinary shares (28 February 2014 - 67,184,926; 31 August 2014 - 67,942,092), being the weighted

average number of ordinary shares in issue during each period.

There are no dilutive or potentially dilutive shares in issue.

7. Bank loans of GBP47.1 million (Yen8.7 billion) have been drawn down under yen loan facilities

which are repayable between November 2017 and August 2020 (28 February 2014 - GBP42.1 million

(Yen7.2 billion); 31 August 2014 - GBP41.7 million (Yen7.2 billion)). The November 2017 loan

is shown under short term creditors as this is a revolving facility which can be drawn for

1, 2, 3 or 6 months and repaid at the end of each drawdown period without incurring breakage

costs.

8. The Company has the authority to issue shares/sell treasury shares at a premium to net asset

value as well as to buy back shares at a discount to net asset value. During the period, 250,000

shares (28 February 2014 - 3,025,000; 31 August 2014 - 4,300,000) were issued at a premium

to net asset value raising proceeds of GBP929,000 (28 February 2014 - GBP10,887,000; 31 August

2014 - GBP15,289,000).

9. Transaction costs incurred on the purchase and sale of the investments are added to the purchase

cost or deducted from the sales proceeds, as appropriate. During the period, transaction costs

on purchases amounted to GBP10,000 (28 February 2014 - GBP18,000; 31 August 2014 - GBP32,000)

and transaction costs on sales amounted to GBP6,000 (28 February 2014 - GBP11,000; 31 August

2014 - GBP19,000).

10. Principal Risks and Uncertainties

The principal risks facing the Company relate to the Company's investment activities. These

risks are market risk (comprising currency risk, interest rate risk and other price risk),

liquidity risk and credit risk. An explanation of these risks and how they are managed is

contained in note 19 of the Company's Annual Report and Financial Statements for the year

to 31 August 2014. The principal risks and uncertainties have not changed since the publication

of the Annual Report and Financial Statements which can be obtained free of charge from Baillie

Gifford & Co and is available on the Japan Trust page of the Managers' website www.japantrustplc.co.uk

. Other risks facing the Company include the following: regulatory risk (that the loss of

investment trust status or a breach of applicable legal and regulatory requirements could

have adverse financial consequences and cause reputational damage); operational/financial

risk (failure of service providers' accounting systems could lead to inaccurate reporting

or financial loss); the risk that the premium/discount at which the Company's shares trade

can change; and gearing risk (the use of borrowing can magnify the impact of falling markets).

Further information can be found on pages 6 and 7 of the Annual Report and Financial Statements.

11. The Half-Yearly Financial Report is available at www.japantrustplc.co.uk and will be posted

to shareholders on or around 16 April 2015.

None of the views expressed in this document should be construed as advice to buy or sell

a particular investment.

Neither the contents of the Managers' website nor the contents

of any website accessible from hyperlinks on the Managers' website

(or any other website) is incorporated into, or forms part of, this

announcement.

- Ends -

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BLGDXBXDBGUU

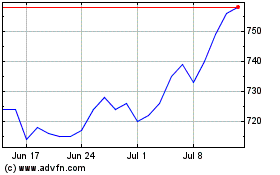

Baillie Gifford Japan (LSE:BGFD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Baillie Gifford Japan (LSE:BGFD)

Historical Stock Chart

From Apr 2023 to Apr 2024