Badger Meter Plans Stock Split, Dividend Increase

August 12 2016 - 6:30PM

Dow Jones News

Industrial company Badger Meter Inc., which had been considering

a sale, said Friday that it instead planned to raise its dividend

15% and split its stock 2-for-1 in an effort to boost shareholder

returns.

The Milwaukee company said that after reviewing its options, its

board had determined this two-step plan was the best way to

increase shareholder value.

The company makes meters and other products that measure water,

oil and chemicals. Customers include oil-and-gas companies and

municipal-water utilities, its largest segment by sales volume. In

2015, it reported that profit fell 13% to $25.9 million on $377.7

million in sales.

Chief Executive Richard A. Meeusen said Friday that Badger Meter

intends to look for opportunities, including acquisitions, and

further international expansion. Still, while the company is no

longer pursuing a sale, Mr. Meeusen left the door open for possible

deal-making.

"There's nothing precluding anyone from making an offer," the

chief executive said.

The dividend of 23 cents a share, up from 20 cents, and the

2-for-1 split will be paid on Sept. 15 to shareholders of record

Aug. 31.

Shares, up 21% this year, fell 6% to $66.98 in after-hours

trading.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

August 12, 2016 18:15 ET (22:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

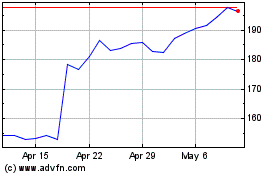

Badger Meter (NYSE:BMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

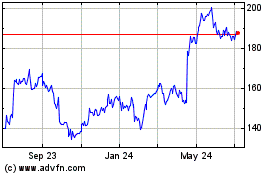

Badger Meter (NYSE:BMI)

Historical Stock Chart

From Apr 2023 to Apr 2024