BT Cuts 4,000 Jobs and CEO Bonus as Profit Falls -- 2nd Update

May 11 2017 - 6:47AM

Dow Jones News

By Rory Gallivan

LONDON-- BT Group PLC, reeling from an accounting scandal at its

Italian business and other issues, said Thursday it would cut 4,000

jobs and pay no bonus to its chief executive.

The telecommunications and television provider, one of the

U.K.'s best-known companies, said the moves come as it accelerates

cost cuts in areas including global services, which provides

communications services to businesses around the world.

BT shares were down 3% in morning trading in London.

The global-services business includes BT's Italian operations,

which were responsible for a GBP530 million ($684 million)

write-down after the discovery of yearslong "improper" accounting

practices and transactions. They led to the suspension of several

executives who have since left the business.

Chief Executive Gavin Patterson said a review of global services

found BT no longer needs to own so many assets around the world.

Global services accounts for nearly a quarter of BT's revenue, with

the rest mainly coming from fixed-line, cellphone, internet and TV

services in the U.K. BT owns much of the U.K.'s telecommunications

infrastructure, a legacy from being the state-owned telecom

monopoly until the 1980s.

The company said Mr. Patterson and outgoing finance director

Tony Chanmugam won't receive a bonus for the year ended March 31.

The pay decision followed the problems in Italy in addition to

issues related to the U.K. infrastructure business Openreach and

other challenges, the company said.

Mr. Patterson will receive GBP1.3 million for the period, down

from GBP5.3 million the previous year, while Mr. Chanmugam's total

payment falls to GBP258,000 from GBP2.8 million.

BT said it also will wring savings out of the technology,

services and operations division, which operates its networks,

platforms and information-technology systems.

The company reported pretax profit of GBP440 million in the

three months to end-March, down 48% from GBP845 million in the same

period the previous year, on a 9.9% rise in revenue to GBP6.12

billion.

The final dividend rises 10% to 10.55 pence a share. BT said

dividend growth will be lower in the current year.

BT also trimmed its current-year forecast for earnings before

interest, taxes, depreciation and amortization to a range of GBP7.5

billion to GBP7.6 billion, against a previous prediction of around

GBP7.6 billion.

Write to Rory Gallivan at rory.gallivan@wsj.com

(END) Dow Jones Newswires

May 11, 2017 06:32 ET (10:32 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

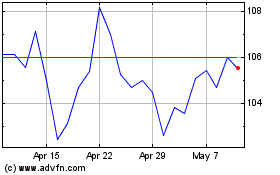

Bt (LSE:BT.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

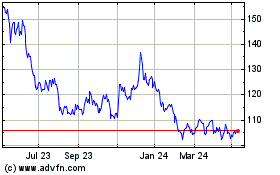

Bt (LSE:BT.A)

Historical Stock Chart

From Apr 2023 to Apr 2024