BHP to Boost Production Despite Weak Prices--2nd Update

May 10 2016 - 12:09PM

Dow Jones News

By Alex MacDonald and Scott Patterson

LONDON--Mining giant BHP Billiton Ltd. plans to forge ahead with

investments to boost production, particularly in copper and energy,

despite a continuing rout in commodities prices.

In a presentation to investors Tuesday, BHP Chief Executive

Andrew Mackenzie outlined a plan to lift its current production by

more than 10% by investing in existing operations. He said the

development will cost less than $1.5 billion over a five-year

period.

BHP's assets "have such high returns that they work even at

these very low prices," Mr. Mackenzie said in an interview

following the presentation.

He said the company's plans are primarily focused on expanding

its own mines and wells, not on acquisitions. "You can't be focused

on acquisitions because you're dependent on so many other things,"

said Mr. Mackenzie.

Shares of BHP, down 44% in the past year, closed up 2.1% in

London, Tuesday.

Mr. Mackenzie in his speech said the miner's investments should

earn average returns of about 60% based on current analyst

forecasts of commodity prices.

He said BHP also plans to make investment decisions on at least

two big projects, one in copper and one in oil, within 18 months.

He expects capital expenditure to pick up next year.

Big mining companies like BHP have been hammered by a protracted

slump in commodity prices stemming from slower-than-expected global

growth and slackening demand in China, the world's largest consumer

of many commodities. Prices for some commodities, like oil, have

picked up in recent weeks, though some analysts have said prices

could fall again if Chinese growth remains disappointing.

Under Mr. Mackenzie's three-year stewardship, BHP has focused on

cutting costs, shedding assets and delaying big investments.

Despite those moves, Moody's Investors Service and Standard &

Poor's Ratings Services both recently cut credit ratings on the

company to A3 and single-A, respectively.

Earlier this year, BHP slashed its dividend by 74%, abandoning

its yearslong pledge to keep its annual payout steady or rising, as

it announced a $5.7 billion loss for the six months through

December.

The company's challenges go beyond the tough market. In

November, an iron-ore tailings dam at a BHP joint venture in Brazil

burst, killing 19 people and polluting more than 400 miles of

river. Last week Brazilian federal prosecutors filed a lawsuit that

could force BHP and its joint venture partner Vale SA to pay up to

$44 billion for cleanup and fixing environmental damage.

Mr. Mackenzie said in the interview that the company believes a

settlement reached in March, in which it agreed to spend as little

as 9.46 billion reals -- about $2.7 billion -- through 2030, was

the best solution since it will get cash to the communities

quicker. "We believe that is the fair way forward," he said.

Write to Alex MacDonald at alex.macdonald@wsj.com and Scott

Patterson at scott.patterson@wsj.com

(END) Dow Jones Newswires

May 10, 2016 11:54 ET (15:54 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

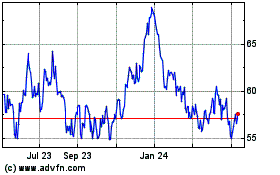

BHP (NYSE:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

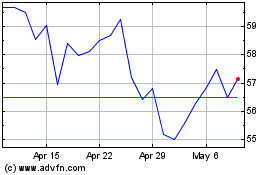

BHP (NYSE:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024