BHP Taps Experienced Executives to Fill Out Changes in Board -- Update

August 23 2017 - 6:21AM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia-- BHP Billiton Ltd. said it plans to

replace two directors amid its monthslong tussle with activist

investor Elliott Management Corp., following the miner's decision

earlier this week to exit its American shale oil and gas

business.

Elliot has built a 5% stake in BHP's British shares, and

specifically called on BHP to exit from the U.S. shale business.

Elliott and others have called for deeper changes, including adding

more industry veterans to the board.

It wasn't clear if Elliott had a role in the board changes BHP

detailed Wednesday, including the departure of Grant King just six

months after his appointment. The New York hedge fund declined to

comment. BHP stressed the decisions by Mr. King and Malcolm Brinded

to step down were their own.

Elliott's agitation, made public in April after months of

earlier discussions, brought into the open shareholder disquiet

over BHP's mistimed investment in shale and subsequent impairment

charges. Its tussle with the British-Australian company threatened

to cast a shadow over annual shareholder meetings in October and

November, when shareholders are to vote on board members.

Among its proposals, Elliott had called for the appointment of

Chairman-elect Ken MacKenzie to be followed by new directors with

the skills and experience to simplify BHP's structure, improve

returns and allocate capital "more wisely." Other shareholders

including Tribeca Investment Partners had sounded out potential

board nominees more sympathetic to focusing on shareholder

returns.

Mr. King's departure is a victory for investors unhappy with his

appointment. The new directors bring decades of finance- and

energy-industry experience between them.

Whether a direct response to Elliott or not, the board shuffle

is another victory for the activist fund, which has had mixed

success effecting change at some of its overseas targets recently.

A bid by Elliott to force Dutch paint giant Akzo Nobel to discuss a

merger with U.S. rival PPG ultimately wasn't successful. It also

hit resistance from Australia's government to a proposal that BHP's

dual structure be collapsed around a single main listing in

London.

On Wednesday, outgoing Chairman Jac Nasser said Mr. King had

decided not to stand for election to the board at the annual

meeting because of concerns expressed by some investors.

Mr. Brinded also has opted not to stand for re-election as a

nonexecutive director due to his involvement in ongoing legal

action in Italy related to his past employment at Royal Dutch Shell

PLC, Mr. Nasser said.

In their place, the resource company's board will bring in Terry

Bowen, finance director at Australian coal-to-retailing

conglomerate Wesfarmers Ltd., and former BP PLC veteran John

Mogford from October.

A day earlier, BHP said its American shale operations aren't

core and it would seek to exit, possibly through a series of trade

sales, an initial public offering or other means. Management has

acknowledged the company overpaid to get a foothold in the onshore

U.S. industry and had grown to realize that the business couldn't

be replicated globally as shale-oil opportunities don't exist on

the same scale elsewhere.

Elliott had called for the company to sell the shale operations

and to launch an independent review of its global petroleum

division.

Craig Evans, a portfolio manager at Tribeca in Sydney, said he

applauded the changes at BHP in recent days but declined to comment

on specific directors. "The majority of the board there just

haven't seemed to give adequate direction that shareholders should

expect," he said. "The spread of experience hasn't seemed

appropriate for the type of company that BHP is."

Mr. Nasser, who will step down as chairman at the end of the

month, said he regretted that Mr. King would also leave the board

at the end of the month. Mr. King led Origin energy after it was

spun off from building-products firm Boral Ltd. in early 2000 until

last year, and faced a backlash in Australia at the end of his

tenure for the company's debt-fueled investment in one of three

gas-export projects in Queensland state that launched amid a slump

in prices, weighing heavily on the company's share price.

Mr. Brinded, a director since April 2004, will step down from

the board in October, although Mr. Nasser said he looked forward to

him being able to return in the future. He chose to leave given his

involvement in ongoing legal proceedings in Italy related to Shell,

where he was a director between 2002 and 2012. Italian prosecutors

are investigating Shell's involvement in a US$1.3 billion deal in

2011 with Italian oil firm Eni SpA and the Nigerian government for

a lucrative Atlantic Ocean oil license.

Neither Mr. King nor Mr. Brinded were immediately reachable for

comment.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

August 23, 2017 06:06 ET (10:06 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

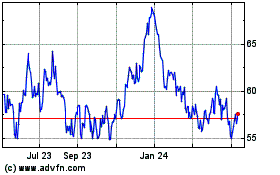

BHP (NYSE:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

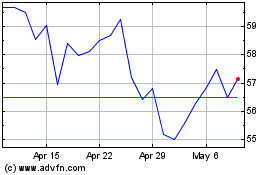

BHP (NYSE:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024