BHP Says It Won't Cut Payout

November 20 2015 - 3:02AM

Dow Jones News

(FROM THE WALL STREET JOURNAL 11/20/15)

By Stephen Bell

PERTH -- BHP Billiton Ltd. said it won't change its dividend

policy until February at the earliest, despite shareholder concerns

the mining company won't be able to sustain the payout given the

slump in global commodity prices.

Speaking at an annual general meeting of the world's largest

miner, BHP Chairman Jacques Nasser said shareholders have recently

questioned its long-held pledge to avoid dividend cuts, following

what he called "one of the most difficult" years in the company's

130-year history.

Earlier this month, a dam burst at an iron-ore mine operated by

Samarco Minerao SA, BHP's Brazilian joint venture with local mining

company Vale SA, leading to widespread flooding. BHP said Thursday

the disaster had so far caused 11 deaths, with eight people still

missing.

Mr. Nasser said BHP was proud of its decadelong policy of at

least holding its dividendsteady. But, he said,"the one thing we

never risk is the strength of the balance sheet through the

cycle."

The comments were less robust than those made in August by BHP

Chief Executive Andrew Mackenzie on whether the company would

continue to stand by its dividend policy.

"Over my dead body sounds a little strong, but it is almost

right," Mr. Mackenzie said then, referring to the possibility of a

dividend cut.

Asked on Thursday whether BHP was now prepared to soften its

stance,Mr. Mackenzie said, "you can expect us to say some things in

February -- now isn't the time to comment further."

BHP, which is listed in both Australia and the U.K., rose 3% in

Sydney and 2% in London.

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 20, 2015 02:47 ET (07:47 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

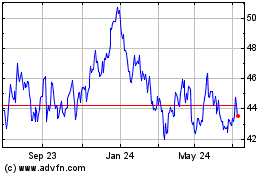

BHP (ASX:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

BHP (ASX:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024