BHP Chairman To Resign, Ending A Rocky Tenure -- WSJ

October 21 2016 - 3:03AM

Dow Jones News

Jac Nasser, who joined board of mining giant in 2006, won't seek

re-election next year

By Scott Patterson

LONDON -- BHP Billiton Ltd. Chairman Jac Nasser plans to step

down from the mining giant, ending a tumultuous six-year run during

which he replaced a chief executive, cut its dividend and struggled

with an environmental disaster in Brazil.

Mr. Nasser told shareholders on Thursday he wouldn't seek

re-election as its chairman at next year's general meeting. The

former CEO of Ford Motor Co. said he had planned to announce his

retirement last year but decided to stay due to the tailings dam

disaster at its Brazilian joint venture Samarco, which it operates

with Vale SA, the Brazilian iron-ore giant.

"Now that the basic structure of the Samarco response is in

place...I have decided that I will not seek re-election" next year,

he said.

Mr. Nasser joined the board in 2006 and became BHP's chairman in

2010 at the height of a global commodities boom driven by voracious

demand in China. It ends amid the fallout of the collapse of the

boom, which has ravaged the stocks of miners such as BHP and

competitors such as Rio Tinto PLC, Anglo American PLC and Glencore

PLC.

While shares in mining companies have rebounded this year amid

signs of renewed appetite in China, they largely remain well below

the peaks they hit about five years ago. When Mr. Nasser joined

BHP, the mining industry, flush with cash, was in the midst of a

rapid expansion and voracious merger boom that ballooned miners'

balance sheets with debt.

In 2010, the same year Mr. Nasser become chairman of the

company, BHP launched a hostile campaign to take over Canadian

potash titan Potash Corp. of Saskatchewan Inc. Led by BHP's

then-CEO Marius Kloppers, the $38.6 billion takeover battle, seen

as one of the most contentious hostile bids in years, failed amid

opposition from the Canadian government.

Three year later, Mr. Nasser replaced Mr. Kloppers with BHP's

current chief, Andrew Mackenzie, then head of the miner's

nonferrous-metals division.

BHP didn't say who it expects to nominate as chairman to replace

Mr. Nasser; he also plans to leave the company's board.

BHP, along with other miners, saw its earnings sag in recent

years during a bust in demand for commodities, including the

high-grade iron ore that accounts for a large chunk of BHP's sales.

But BHP was seen by Wall Street as among the most resilient miners,

due to its portfolio of low-cost iron-ore operations in

Australia.

Buoyed by its iron-ore profits, the company vowed it would

maintain its progressive dividend. When asked in August 2015

whether BHP would contemplate a dividend cut, Mr. Mackenzie told

analysts: "Over my dead body sounds a little strong, but it is

almost right."

But in February, BHP slashed its dividend after recording a

$5.67 billion first half loss due in part to a massive write down

of its U.S. energy assets. Mr. Nasser at the time said the company

now believed "the period of weaker prices and higher volatility

will be prolonged."

Much of Mr. Nasser's time in the past year has been spent

dealing with the Samarco tailings dam disaster, which killed 19

people and saddled BHP and Vale with billions in reparations

payments. He said Thursday that the past year has been "one of the

most challenging periods in the long history" of BHP, "none more

serious than Samarco."

"We are deeply sorry for all those impacted by this tragedy," he

said. Mr. Mackenzie said Thursday that the Samarco disaster has

"left a deep scar on our company."

Write to Scott Patterson at scott.patterson@wsj.com

(END) Dow Jones Newswires

October 21, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

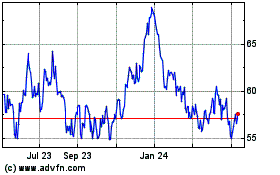

BHP (NYSE:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

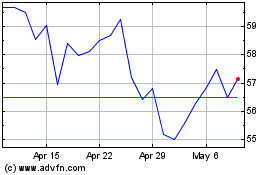

BHP (NYSE:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024