BHP Billiton to Contest A$1 Billion Australia Tax Bill -- Update

September 20 2016 - 8:02PM

Dow Jones News

By Rhiannon Hoyle

SYDNEY--BHP Billiton Ltd. (BHP.AU) said Australia's tax office

has sought 1 billion Australian dollars (US$756 million) in

additional taxes, interest and penalties from the mining company in

a dispute over the price at which it sold commodities to its

Singapore-based marketing business over more than a decade.

BHP said it will contest the bill from the Australian Taxation

Office and take court action if needed, arguing the price at which

it sells commodities it digs up in Australia are in line with

international guidelines and market rates.

The Melbourne, Australia-based company, the world's No. 1 miner

by market value, last year said it was being probed by the

country's tax office as executives faced questions from lawmakers

over whether BHP was using its Singapore unit to minimize tax

bills. Australia has followed other nations in Europe and elsewhere

in seeking to close taxation loopholes allegedly being used by some

of the world's biggest companies to divert profits to lower tax

jurisdictions.

On Wednesday, BHP said the Australian Taxation Office has issued

it with A$1.02 billion in so-called amended assessments, which

includes A$661 million of primary tax, for its 2003-2013 fiscal

years.

BHP said it will contest all of the revised assessments,

although head of tax Jane Michie said the miner would consider a

settlement with the tax office. "If we are too far apart, the way

to resolve it is to go to court," she said.

BHP said it has made partial payments on some of the claims from

the tax office.

BHP and rival Rio Tinto PLC (RIO.LN), which also has a Singapore

marketing unit, have argued their presence in the tiny city-state

is critical for marketing commodities such as iron ore, a key

steelmaking ingredient, to Asian buyers.

Chief Financial Officer Peter Beaven said the Singapore business

"created value" for BHP and that the prices it charged were not

abnormal. "We are very confident the prices that we charge are in

accordance" with Organisation for Economic Co-operation and

Development guidelines and in line with BHP's peers, said Mr.

Beaven.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

September 20, 2016 19:47 ET (23:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

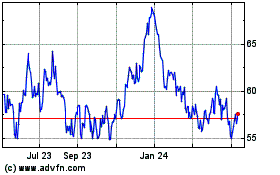

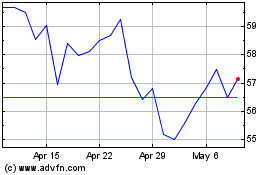

BHP (NYSE:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

BHP (NYSE:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024