BHP Billiton Venture to Invest $204 Million in Australian Coal Mine

April 20 2017 - 11:39PM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--BHP Billiton Ltd. (BHP.AU) is planning a

US$204 million expansion of its coking-coal operations in eastern

Australia to increase production of the steelmaking ingredient and

reduce overall operating costs.

BHP and venture partner Mitsubishi Corp. (8058.TO) on Friday

approved the investment in their Caval Ridge mine, where they plan

to build a 6.8-mile overland conveyer system to transport coal from

the neighboring Peak Downs mine to a preparation plant.

The project is expected to create up to 400 jobs during

construction and 200 ongoing operations roles, said Mike Henry,

president of BHP's Australian minerals division. Construction is

set to begin mid-year and take 18 months to complete.

The investment in the coking-coal business comes after several

tough years for the operations. Coal prices have recovered over the

past few months, including a surge in recent weeks after a tropical

cyclone flooded mines across Australia's Queensland state. Mr.

Henry said coking-coal prices were expected to pull back as mines

returned to normal operations, but even at longer-term forecasts,

the expansion of Caval Ridge was expected to offer a high return

for the company.

The bulk of BHP's coal operations are in eastern Australia,

centered on coking-coal mines in the Bowen Basin of central

Queensland and energy-coal production in New South Wales. It also

has a coal operation in Indonesia and owns an equal share alongside

partners Anglo American PLC (AAL.LN) and Glencore PLC (GLEN.AU) in

Colombia's Cerrejon, one of the world's largest open-pit

energy-coal mines.

Coal operations contributed US$4.52 billion to BHP's revenue in

the last fiscal year through June, including US$3.35 billion from

the Queensland operations that also include a venture with Mitsui

& Co. (8031.TO).

Rio Tinto PLC (RIO.LN) in late January moved to capitalize on

last year's sharp gains in commodity prices, agreeing to sell a

major piece of its coal business for US$2.45 billion to

China-controlled Yancoal Australia Ltd. (YAL.AU). Last week, it

received approval from Australia's Foreign Investment Review Board

for the deal to exit its Coal & Allied Industries Ltd.

subsidiary.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

April 20, 2017 23:24 ET (03:24 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

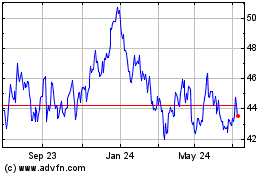

BHP (ASX:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

BHP (ASX:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024