By Rhiannon Hoyle

SYDNEYSHY--The world's biggest mining company BHP Billiton Ltd.

unveiled its weakest annual earnings since 2003 on Tuesday and cut

its long-term forecast for Chinese steel demand. But its top

executive expresses confidence its most important customer, China,

is on track, despite its current bout of market and economic

turbulence.

Speaking after his company revealed an 86% dive in net profit

for the year ended June to $1.91 billion, BHP Chief Executive

Andrew Mackenzie said China's economic-reform program would likely

make world markets more volatile. Still, he said the mining company

expects China's broader economy to lift in the second half, meeting

its 7% growth target for 2015. Interest-rate cuts, along with moves

to support the property market and infrastructure spending, should

buttress growth for the rest of the year, he said.

As the world's leading commodities producer, with interests in

iron ore, coal, oil and gas and copper, BHP is arguably one of the

major global businesses most exposed to China's fortunes. The

mining company relies on China for roughly 30% of its revenue, UBS

estimates.

Weaker prices for all the commodities it produces cut into

earnings last year, and it wrote down the value of assets including

a gas field and nickel mine by more than $2 billion.

BHP also lowered its closely watched forecast of peak Chinese

steel demand to between 935 million tons and 985 million tons in

the mid-2020s, from a previous projection of 1 billion-to-1.1

billion tons.

Still, Mr. Mackenzie said China's leaders had a clearly

articulated strategy, and that his company had adapted

accordingly.

"You have to look deeply and you have to look across at the

sectors, and that is what we do," he said. "We have been at this

game for decades. We have made very sound business decisions off

those forecasts that have proved to be correct."

Global financial markets have been pummeled and commodities

dumped in a broad-based selloff in recent days, rooted in concerns

over China's economic slowdown. An equity-market rout in China

continued for a second day on Tuesday, after its main Shanghai

stock market recorded its worst single-day loss in more than eight

years the previous day.

Concerns about China's economy, and particularly its demand for

commodities, have been escalating since the surprise devaluation of

the yuan two weeks ago. Recent economic data have also been

uninspiring.

BHP's own London-listed shares slumped by 9.1% Monday. But they

recovered by 5.6% Tuesday despite the profit slide, as the company

said it had paid down debt, cut costs more than expected and would

keep paying a steady-or-rising dividend each year.

"Cycles are part of our industry," Mr. Mackenzie said. "We have

to get better in the way we operate" rather than rely on markets

improving, he said.

China's breakneck economic growth during the 2000s led to a

seemingly endless appetite for commodities used to build new cities

and in the factories that fed an export boom. That led mining

companies such as BHP to aggressively dig new pits and build new

processing plants to profit from surging resources demand.

Now that demand growth has cooled, several commodities face a

period of oversupply. Iron ore, BHP's primary money spinner, has

been at the sharp end of the deceleration, with the commodity

recently slumping to a decade low. It traded above $190 a metric

ton in 2011 but now trades at roughly $50 a ton.

China's appetite for steel, used in skyscrapers and bridges, has

been eroded by a cooling construction sector, resulting in a glut

of the material and the materials used to make it, iron ore and

coal.

"The problem lies in infrastructure-led growth," said Steve

Johnson, chief investment officer at Sydney-based Forager Funds

Management, adding that he was "very negative" on the outlook for

China. "A collapse in that part of the economy is very bad for

resources demand."

Still, he said BHP is better placed to deal with the slowdown

than smaller rivals. "You know they are still going to throw off

cash, and they are a company that is going to be around in 20

years' time," he said.

China is now trying to direct its economy away from exports and

manufacturing to consumer-led growth. BHP has already been

adjusting its strategy to account for that.

It has no plans for big new investments in iron ore or coal,

instead choosing to prioritize growth in copper and petroleum,

which it thinks a more urbanized, wealthy China will need in

greater volumes.

BHP consequently feels "to some extent vindicated" by the shifts

in the Chinese economy, Mr. Mackenzie said.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 25, 2015 07:01 ET (11:01 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

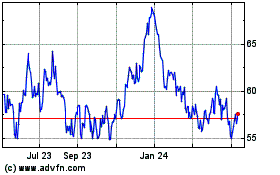

BHP (NYSE:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

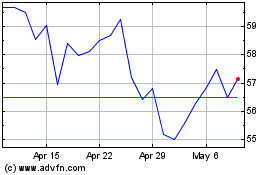

BHP (NYSE:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024