BHP Billiton Cuts Annual Coking Coal, Copper Guidance -- Update

April 25 2017 - 9:14PM

Dow Jones News

By Ben Collins

WELLINGTON, New Zealand--A lengthy strike at a mine in Chile and

cyclone damage to rail lines in eastern Australia dented BHP

Billiton Ltd.'s (BHP.AU) output in the last quarter, prompting it

to scale back annual targets for coking coal and copper.

The world's largest listed miner by market value also narrowed

its guidance for iron-ore production after unseasonably wet weather

but stuck with forecasts for energy coal and petroleum despite some

weakness.

Copper production fell 20% to 939,000 metric tons over the nine

months to March 31, including a 36% quarter-over-quarter drop in

output in the third quarter, as volumes were held back by a 44-day

strike at the Escondida mine in South America.

As a result, BHP said it now expected production for the fiscal

year of between 1.33 million and 1.36 million, a sharp drop on the

1.62 million forecast three months ago when BHP scaled back

guidance by 2% to reflect a fall at its Olympic Dam mine in South

Australia thanks to maintenance and after a state-wide power

outage.

Weak copper production had been widely anticipated after Rio

Tinto PLC (RIO.LN), co-owner of the Escondida mine, reined in its

own mined copper target for 2017 due to the pay strike.

BHP's production of coking coal, used along with iron ore to

produce steel, rose by 2% over the nine-months through March to 31

million tons thanks to record output at five mines in Australia's

eastern Queensland state but was held back in the third quarter by

tropical cyclone Debbie, which struck the east coast with high

winds and heavy rains.

Due to damage to the rain network of operator Aurizon Holdings

Ltd. (AZJ.AU) caused by the cyclone, BHP said it now expected

coking coal production of 39 million-41 million tons, down from a

January target of about 44 million.

Energy-coal production for the nine months was broadly flat at

21 million tons, and BHP said it continued to expect full-year

output of 30 million.

Nine-month iron-ore production from mines in Western Australia

rose 3% on-year to 171.2 million tons, although wet weather in the

third quarter meant a drop of 11% quarter-over-quarter. For the

fiscal year, BHP said it now expected its share of output from its

iron-ore mines to be between 231 million and 234 million tons

against an earlier target of 228 million-237 million.

Rio Tinto's shipments of iron ore from Western Australia fell

13% on-quarter for the first three months of 2017 due to cyclone

activity and heavy rainfall in the period, although it stuck with a

target of 330 million-340 million for the year.

BHP swung back to profit in its fiscal first half, helped by

higher commodity prices, continued cost cutting and the absence of

large writedowns that had dented its bottom line a year earlier.

Still, earlier this month activist investor Elliott Management

Corp. in an open letter urged the company to spin off its U.S.

petroleum assets and unify its dual U.K.-Australia structure to

unlock billions of dollars in shareholder value. BHP has rejected

the New York hedge fund's plans as too costly.

The resources company on Wednesday said it was pushing ahead

with efforts to sell non-core onshore U.S. acreage, with a sale

process well advanced for up to 50,000 acres of the southern

Hawkville and a review underway to potentially sell its

Fayetteville field. Still, it said it was also increasing onshore

activity and had approved two additional rigs for the Haynesville

assets, with natural-gas prices hedged to deliver what it said

would be an attractive rate of return.

Across the company's petroleum business, which includes assets

in the Gulf of Mexico and Australia, production for the nine months

was 15% lower than the same period the year before at 157 million

barrels of oil equivalent but BHP said it still expected output for

the fiscal year of 200 million-210 million barrels.

Write to Ben Collins at ben.collins@wsj.com

(END) Dow Jones Newswires

April 25, 2017 20:59 ET (00:59 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

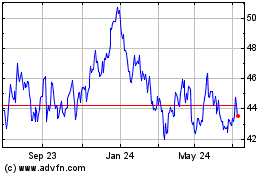

BHP (ASX:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

BHP (ASX:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024