TIDMBARC

FORM 8.3

PUBLIC OPENING POSITION DISCLOSURE/DEALING DISCLOSURE BY

A PERSON WITH INTERESTS IN RELEVANT SECURITIES REPRESENTING 1%

OR MORE

Rule 8.3 of the Takeover Code (the "Code")

1. KEY INFORMATION

(a) Full name of discloser: Barclays PLC.

(b) Owner or controller of

interest and short

positions disclosed, if

different from 1(a):

(c) Name of offeror/offeree PLATFORM SPECIALTY PRODS CORPORATION

in relation to whose

relevant securities

this form relates:

(d) If an exempt fund manager

connected with an

offeror/offeree, state this

and specify identity of

offeror/offeree:

(e) Date position held/dealing 08 October 2015

undertaken:

(f) In addition to the YES:

company in 1(c)

above, is the discloser making

disclosures in respect of any ALENT PLC

other party to the offer?

2. POSITIONS OF THE PERSON MAKING THE DISCLOSURE

If there are positions or rights to subscribe to disclose in

more than one class of relevant securities of the offeror or

offeree named in 1(c), copy table 2(a) or (b) (as appropriate) for

each additional class of relevant security.

(a) Interests and short positions in the relevant securities of

the offeror or offeree to which the disclosure relates following

the dealing (if any)

Class of relevant ORD

security:

Interests Short Positions

Number (%) Number (%)

(1) Relevant securities owned

and/or controlled: 596,127 0.28% 1,242,725 0.59%

(2) Cash-settled derivatives:

1,692,725 0.80% 592,878 0.28%

(3) Stock-settled derivatives (including options)

and agreements to purchase/DEALING: 0 0.00% 0 0.00%

TOTAL: 2,288,852 1.09% 1,835,603 0.87%

All interests and all short positions should be disclosed.

Details of any open stock-settled derivative positions

(including traded options), or agreements to purchase or sell

relevant securities, should be given on a Supplemental Form 8 (Open

Positions).

(b) Rights to subscribe for new securities (including directors'

and other employee options)

Class of relevant security in relation

to which subscription right exists:

Details, including nature of the rights

concerned and relevant percentages:

3. DEALINGS (IF ANY) BY THE PERSON MAKING THE DISCLOSURE

Where there have been dealings in more than one class of

relevant securities of the offeror or offeree named in 1(c), copy

table 3(a), (b), (c) or (d) (as appropriate) for each additional

class of relevant security dealt in.

The currency of all prices and other monetary amounts should be

stated.

(a) Purchases and sales

Class of relevant Purchase/DEALING Number of Price per unit

security securities

ORD Purchase 100 13.1200 USD

ORD Purchase 100 13.4200 USD

ORD Purchase 119 12.9397 USD

ORD Purchase 300 12.7620 USD

ORD Purchase 311 13.0084 USD

ORD Purchase 400 13.4175 USD

ORD Purchase 400 12.6625 USD

ORD Purchase 500 12.6540 USD

ORD Purchase 629 12.9618 USD

ORD Purchase 700 12.6564 USD

ORD Purchase 900 12.5366 USD

ORD Purchase 1,119 12.6504 USD

ORD Purchase 1,201 12.6500 USD

ORD Purchase 1,400 12.6539 USD

ORD Purchase 1,701 12.8207 USD

ORD Purchase 1,727 12.5944 USD

ORD Purchase 2,200 12.7565 USD

ORD Purchase 2,275 12.4418 USD

ORD Purchase 3,300 12.5961 USD

ORD Purchase 4,000 12.6201 USD

ORD Purchase 5,021 12.4930 USD

ORD Purchase 6,696 12.5290 USD

ORD Purchase 12,141 12.5024 USD

ORD Purchase 16,909 12.4985 USD

ORD Purchase 22,603 12.5338 USD

ORD Purchase 40,900 13.2538 USD

ORD Purchase 46,000 12.5906 USD

ORD Purchase 46,478 13.0223 USD

ORD Purchase 51,100 12.6471 USD

ORD Purchase 63,750 12.4825 USD

ORD Purchase 67,110 12.4761 USD

ORD Purchase 450,000 13.4000 USD

ORD Sale 100 12.1750 USD

ORD Sale 100 13.3900 USD

ORD Sale 100 12.5000 USD

ORD Sale 100 12.6900 USD

ORD Sale 200 13.2800 USD

ORD Sale 486 13.4076 USD

ORD Sale 600 13.4100 USD

ORD Sale 700 13.3121 USD

ORD Sale 700 12.5950 USD

ORD Sale 700 13.1300 USD

ORD Sale 800 12.7056 USD

ORD Sale 800 12.7970 USD

ORD Sale 900 12.8288 USD

ORD Sale 1,000 12.6580 USD

ORD Sale 1,200 12.4017 USD

ORD Sale 1,300 12.9561 USD

ORD Sale 1,701 12.6500 USD

ORD Sale 1,730 12.6267 USD

ORD Sale 1,870 12.6386 USD

ORD Sale 1,950 13.4041 USD

ORD Sale 2,074 13.3646 USD

ORD Sale 2,184 13.3432 USD

ORD Sale 2,400 13.1062 USD

ORD Sale 2,900 12.6924 USD

ORD Sale 3,186 13.4190 USD

ORD Sale 3,200 13.3948 USD

ORD Sale 3,400 13.4073 USD

ORD Sale 9,800 13.3644 USD

ORD Sale 11,050 13.4003 USD

ORD Sale 11,200 12.8777 USD

ORD Sale 12,478 12.6462 USD

ORD Sale 13,379 12.6303 USD

ORD Sale 14,070 13.4126 USD

ORD Sale 15,900 12.5390 USD

ORD Sale 32,300 12.6273 USD

ORD Sale 48,700 12.6245 USD

ORD Sale 65,692 12.4924 USD

ORD Sale 131,340 12.4913 USD

(b) Cash-settled derivative transactions

Class of relevant Product Nature of Number of reference Price per unit

security description dealing securities

e.g. CFD e.g.

opening/closing

a long/short

position,

increasing/reducing

a long/short

position

(c) Stock-settled derivative transactions (including

options)

(i) Writing, selling, purchasing or varying

Class of Product Writing, Number Exercise Type Expiry date Option

relevant description purchasing, of price e.g. money

security e.g. selling, securities per unit American, paid/

call varying to European received

option etc. which etc. per

option unit

relates

(ii) Exercise

Class of relevant Product Exercising/ Number Exercise price

security description exercised of securities per unit

e.g. call against

option

(d) Other dealings (including subscribing for new

securities)

Class of relevant Nature of dealing Details Price per unit (if

security e.g. subscription, applicable)

conversion

4. OTHER INFORMATION

(a) Indemnity and other dealing arrangements

Details of any indemnity or option arrangement,

or any agreement or understanding,

formal or informal, relating to relevant securities

which may be an inducement to

deal or refrain from dealing entered into by

the person making the disclosure and any

party to the offer or any person acting

in concert with a party to the offer:

Irrevocable commitments and letters of intent

should not be included. If there

are no such agreements, arrangements or understandings, state "none"

(MORE TO FOLLOW) Dow Jones Newswires

October 09, 2015 09:20 ET (13:20 GMT)

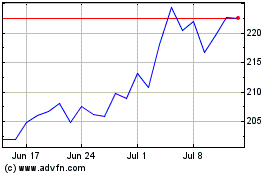

Barclays (LSE:BARC)

Historical Stock Chart

From Mar 2024 to Apr 2024

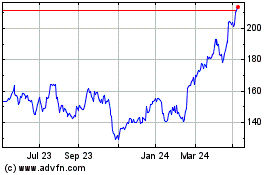

Barclays (LSE:BARC)

Historical Stock Chart

From Apr 2023 to Apr 2024