TIDMAVON

RNS Number : 6149L

Avon Rubber PLC

29 April 2015

News Release

Strictly embargoed until 07:00 29 April 2015

AVON RUBBER p.l.c.

("Avon", the "Group" or the "Company")

Unaudited interim results for the six months ended 31 March

2015

31 March 31 March Increase

2015 2014

GBPMillions GBPMillions

REVENUE 62.8 61.5 2%

ADJUSTED EBITDA (*) 12.2 11.1 9%

ADJUSTED OPERATING PROFIT

(*) 8.5 8.2 4%

ADJUSTED PROFIT BEFORE

TAX (*) 8.4 8.0 4%

NET CASH / (DEBT) 7.3 (5.5)

EARNINGS PER SHARE:

Adjusted basic (*) 22.3p 20.4p 9%

Adjusted diluted (*) 21.7p 19.8p 10%

INTERIM DIVIDEND 2.43p 1.87p 30%

FINANCIAL HIGHLIGHTS

-- 10% earnings per share growth against a very strong comparator period last year

-- Continuing strong cash generation increased cash balances to

GBP7.3m in an already strong balance sheet

-- 30% increase in interim dividend to 2.43p per share

OPERATIONAL HIGHLIGHTS

-- Dairy delivered a record half year performance as our

investment in routes to market and innovative products and services

delivered returns

-- Dairy Cluster Exchange service growth of 34% since 30 September 2014

-- Encouraging progress in Dairy in China; Brazil sales and distribution operation opened

-- Healthy order intake in Protection & Defence of GBP47m.

Closing order book of GBP38m with GBP28m for delivery in H2

2015

-- Our new Deltair SCBA gained market share in the US Fire market

Peter Slabbert, Chief Executive commented:

"Avon has enjoyed another positive half year, achieving a 10%

increase in earnings per share against a very strong comparator

period last year that included a 52,000 C50 delivery to a customer

in the Middle East.

Trading is normally second-half weighted in our Protection &

Defence business and we believe this will continue to be the case

this year. We have a strong forward order book in Protection &

Defence and believe that the momentum in Dairy will continue.

The Board therefore expects to make good progress as the year

develops and to meet market expectations for the full year."

(*) Note:

The Directors believe that adjusted measures provide a more

useful comparison of business trends and performance. Adjusted

results exclude exceptional items, defined benefit pension scheme

costs and the amortisation of acquired intangibles. The term

adjusted is not defined under IFRS and may not be comparable with

similarly-titled measures used by other companies.

All profit and earnings per share figures in these interim

results relate to adjusted business performance (as defined above)

unless otherwise stated. A reconciliation of adjusted measures to

non-adjusted measures is provided below:

Statutory Adjustments Adjusted

-------------------------------- ---------- ------------ ---------

Group EBITDA (GBPm) 12.7 (0.5) 12.2

-------------------------------- ---------- ------------ ---------

Group operating profit

(GBPm) 8.9 (0.4) 8.5

-------------------------------- ---------- ------------ ---------

Other finance expense

(GBPm) 0.4 (0.3) 0.1

-------------------------------- ---------- ------------ ---------

Basic earnings per share

(pence) 22.4 (0.1) 22.3

-------------------------------- ---------- ------------ ---------

Diluted earnings per share

(pence) 21.8 (0.1) 21.7

-------------------------------- ---------- ------------ ---------

Protection & Defence operating

profit (GBPm) 6.2 0.1 6.3

-------------------------------- ---------- ------------ ---------

The adjustments comprise:

-- amortisation of acquired intangibles of GBP0.1m

-- defined benefit pension scheme costs which relate to a scheme

closed to future accrual and therefore do not relate to current

operations:

o Administrative expenses of GBP0.2m

o Settlement gain of GBP0.7m following a trivial commutation

exercise

o Other finance expense of GBP0.3m

Avon Rubber p.l.c. Weber Shandwick

Financial

Peter Slabbert, Chief Executive: Nick Oborne: 020

020 7067 0000 7067 0000

Andrew Lewis, Group Finance Director:

01225 896 830

Sarah Matthews-DeMers, Group Financial

Controller: 01225 896 835

Jo Wotton, Public Relations Manager:

01225 896 563

An analyst meeting will be held at 9.30am this morning at the

offices of Weber Shandwick Financial, 2 Waterhouse Square, 140

Holborn, London, EC1N 2AE.

NOTES TO EDITORS:

The Group has transformed itself over recent years into an

innovative design and engineering group specialising in two core

markets, Protection & Defence and Dairy. With a strong emphasis

on research and development we design, test and manufacture

specialist products from a number of sites in the US and UK,

serving markets around the world. We achieve this through nurturing

the talent and aspirations of our employees to realise their

highest potential.

Avon Protection is the recognised global market leader in

advanced Chemical, Biological, Radiological and Nuclear (CBRN)

respiratory protection systems technology for the world's military,

homeland security, first responder, fire and industrial markets.

With an unrivalled pedigree in mask design dating back to the

1920's, Avon Protection's advanced products are the first choice

for Personal Protective Equipment (PPE) users worldwide and are

placed at the heart of many international defence and tactical PPE

deployment strategies. Our expanding global customer base now

includes military forces, civil and first line defence troops,

emergency service teams and industrial, marine, mineral and oil

extraction site personnel. All put their trust in Avon's advanced

respiratory solutions to shield them from every possible

threat.

Our world-leading Dairy supplies business and its Milkrite brand

have a global market presence. With a long history of manufacturing

liners and tubing for the dairy industry, we have become the

leading innovator and designer for products and services right at

the heart of milking. Our goal is always to improve and maintain

animal health. Working with the leading scientists and health

specialists in the global dairy industry we continue to invest in

technology to further improve the milking process and animal

welfare. Our products provide exceptional results for both the

animal and the milker, making the milk extraction process run

smoothly. As our market share and milking experience continue to

improve, so does our global presence.

For further information please visit the Group's website:

www.avon-rubber.com

Interim Management Report

Introduction

Avon has enjoyed another positive half year with a 10% increase

in earnings per share against a very strong comparator period last

year. Our Dairy division returned record results as our strategy of

product and service innovation and geographic expansion continues

to deliver success. In Protection & Defence revenues for the

half year were, as planned, weighted towards US Department of

Defense (DOD) sales under our 10 year sole source contract and

gross margins were, as a consequence, lower than in the record

prior period. Despite this, net margins for the division increased,

continuing the long-term trend of improvement. We have also made

encouraging progress in generating opportunities in the North

American Fire market and in the Middle East which are likely to be

realised in the second half.

Group Results

Group revenue at GBP62.8m (2014: GBP61.5m) increased by 2% and

operating profit of GBP8.5m (2014: GBP8.2m) increased by 4%.

Earnings before interest, tax, depreciation and amortisation

('EBITDA') increased by 9% to GBP12.2m (2014: GBP11.1m)

representing a return on sales (defined as EBITDA divided by

revenue) of 19.4% (2014: 18.1%).

The impact of foreign exchange translation was a slight tailwind

of GBP0.4m as the $/GBP average rate of $1.54 was lower than the

$1.63 prevailing in the same period last year. This translation

benefit has been offset by transactional losses, where the

weakening Euro together with US dollar transactions covered by

forward contracts at rates higher than the average rate have given

rise to mark to market foreign exchange losses of GBP0.3m in the

period.

If the currently stronger US dollar were to prevail throughout

the remainder of the financial year, it would create further

translation tailwinds for the full year. Our sensitivity analysis

on the full year 2014 results showed that a 5c movement in the

$/GBP exchange rate would result in a GBP0.4m impact on annual

operating profit.

Profit before tax was GBP8.4m (2014: GBP8.0m) and after a tax

charge of GBP1.7m (2014: GBP1.9m), an effective rate of 20% (2014:

24%), the Group recorded a profit for the period after tax of

GBP6.7m (2014: GBP6.1m). The reduced tax rate reflects the

anticipated geographic split of taxable profits for 2015. Basic

earnings per share were up 9% at 22.3p (2014: 20.4p) and fully

diluted earnings per share were up 10% at 21.7p (2014: 19.8p).

Net Debt and Cashflow

Net cash at the half year was GBP7.3m, up from GBP2.9m at the

2014 year end, which had benefitted from early payments from

certain customers.

Operating cash conversion remained strong at 138% of operating

profit. Turning profits into cash has enabled us to continue to

invest in the future of the business with GBP3.1m of capital

investment, while, at the same time, increasing dividends to

shareholders by 30%.

Total bank facilities at 31 March 2015 were $40m. These

facilities are committed until 30 November 2017.

Protection & Defence

Performance

Revenue for the division was GBP45.3m (2014: GBP45.6m) and

operating profit was GBP6.4m (2014: GBP6.8m). The decrease was

expected and arose from the mix of product shipped in the period

being heavily DOD biased, whereas the comparable period had a heavy

non-DOD weighting. As we have always said, while predicting the

timing of non-DOD orders and sales is difficult, our long-term DOD

contract and manufacturing excellence affords us the flexibility to

fulfil non-DOD orders as and when they arise and to meet the DOD's

demand in periods when non- DOD orders are lower.

EBITDA was up 1% at GBP9.4m (2014: GBP9.2m) as the effect of the

change in mix towards DOD sales was more than offset by cost

savings following the consolidation of our US sites, increases in

sales to Fire customers as our new Deltair product gained traction

and AEF enjoying another successful period. Return on sales, as

defined above, was 21% (2014: 20%).

Markets

M50 respirator sales to the DOD were, as expected, significantly

higher in the first half of the year at 112,000 (2014: 58,000) mask

systems. During the period we received a further order for 160,000

mask systems which means we exit the half year with mask order

coverage well into 2016, providing good visibility of revenue under

this sole source long-term contract.

We did not deliver any M61 filters during the period (2014:

162,000 pairs). We understand that the second source has

successfully qualified its filter and has fulfilled its first

order. In the long term, we believe the end user demand for this

consumable product will grow as fielding of the mask accelerates

but we continue to recognise that, in the current DOD procurement

environment, obtaining short-term visibility of future filter

orders remains challenging. However, we do expect to see some

further filter requirements later this year.

Since the comparable period last year included delivery of the

52,000 C50 order, as expected, sales to foreign military, law

enforcement and first responder customers reduced year on year.

However, during the period we have been encouraged by the level of

international enquiries for our respiratory protection products

and, although the timing of converting some of the larger

opportunities has not fallen into the first half, we are encouraged

that the underlying pipeline of individually smaller sales

opportunities has grown and we have a number of opportunities that

leave us well placed to deliver a richer mix of sales in the second

half of the year.

We saw strong growth in sales to the North American Fire market

this period following the release of our new NFPA-approved Deltair

SCBA. Our product, which is designed to meet the new US regulations

and to deliver enhanced operational performance, has been well

received by the market and remains one of only four units to

receive approval to date. The product procurement cycle in the Fire

market is longer than in the Law Enforcement market due to trial

and evaluation processes and the level of enquires and continuing

customer trials gives us confidence that this product has the

opportunity to enhance our market share further.

Other DOD spares sales were lower than the same period last year

reflecting normal variability in the timing of orders and delivery

schedules. Order intake for spares has however been positive and

thus we expect higher levels of revenue in this area in the second

half. Our industrial escape product, launched in 2014, has

continued to be well received in oil and gas markets. AEF has seen

a continuation of the high level of order intake experienced last

year and has contributed positively again this period.

Order intake for the first half totalled GBP47m. Of the closing

order book of GBP38m, GBP28m is for delivery in the second half of

our financial year giving good visibility for the remainder of the

year.

Opportunities

Our funded development programme with the US Air Force to design

and test the MM53 Joint Service Aircrew Mask (JSAM) has progressed

well with the prototype product passing the customer's critical

design review during the period. The customer has also confirmed

that it has budget monies allocated to the production phase of the

programme and that it expects this to commence in 2017.

Our Emergency Escape Breathing Device (EEBD) received NIOSH

approval late in 2014. In December 2014 we responded to a US Navy

solicitation to supply EEBDs to replace its existing fielded

product. We have not yet received a response from the US Navy to

this solicitation but expect to hear during the second half of the

year.

Dairy

Performance

Revenue for the Dairy business was 10% higher at GBP17.5m (2014:

GBP15.9m) as we grew in all of our markets, supplemented by the

positive translation effect of the stronger US dollar. An

increasing proportion of higher-margin Milkrite product and service

sales contributed to an increased operating profit of GBP3.3m

(2014: GBP2.7m). Return on sales, as defined above, increased to

22% (2014: 20%).

Markets

Market conditions have been positive during the period. In

global markets, milk prices have remained at acceptable levels and

farmer input costs have been favourable meaning there has been less

pressure on farmer revenues and margins and therefore normal levels

of demand for our consumable products.

In Europe, Milkrite's market share has increased as a result of

our increased sales force, enhanced technical support and a larger

distributor network. Our Impulse Air mouthpiece vented liner, first

launched in Europe late in 2013, continues to gain traction, with

its market share increasing to 3.0% (31 March 2014: 2.0%, 30

September 2014: 2.6%).

In the US, the Milkrite Impulse Air mouthpiece vented liner

continued to perform well, with its market share increasing to 22%

(31 March 2014: 20%, 30 September 2014: 21%).

Our Cluster Exchange service was launched in the US and Europe

in 2014 and growth rates are now exceeding our expectations. By the

end of the period it was servicing 342,000 cows on 1,100 farms in

the US and Europe. This added-value service enhances the value of

each direct liner sale we make and should lead to a more robust and

sustainable business model.

In China, year on year revenue grew strongly against a weak

comparator period. The industrialisation of the milking process

continues apace, creating excellent long-term potential for our

consumable products.

Opportunities

In many other emerging markets, including Brazil and India, the

number of dairy cows being milked using automated milking processes

is growing rapidly. This is adding to the market potential for the

products we sell. We opened a sales and distribution centre in

Brazil in the period to service Brazil and the wider South

American market. Our first sales were made late in the period and

we expect a full period of trading in the second half of our

financial year. As with any start up, we expect this to be a

short-term drag on divisional profit growth but our target for this

operation is to make a positive contribution to profit in 2017.

Retirement Benefit Obligations

The IAS 19R valuation of the Group's UK retirement benefit

obligations has moved from a deficit of GBP16.0m at 30 September

2014 to a reduced deficit of GBP15.6m at 31 March 2015. This arose

from a strong asset performance from our return-seeking assets

offset by a fall in AA corporate bond rates which increased

liabilities.

During the period the Group made cash contributions in respect

of deficit recovery payments and administration costs of GBP275,000

(2014: GBP237,000).

The last actuarial valuation undertaken as at 31 March 2013

showed the scheme to be 98.0% funded.

Dividends

The final dividend for the 2014 financial year of 3.74p per

ordinary share was paid to shareholders on 20 March 2015 and

absorbed GBP1,127,000 of shareholders' funds.

Following the period end, the Board has declared an interim

dividend of 2.43p per ordinary share for 2015, an increase of 30%

on the 2014 interim dividend. This will be paid on 4 September 2015

to shareholders on the register on 7 August 2015. It is expected to

absorb GBP732,000 of shareholders' funds and there are no

corporation tax consequences.

Board Changes

The Board is separately announcing today that Peter Slabbert has

informed the Board of his intention to step down from his role as

Chief Executive and retire from the Company.

This change will become effective 30 September 2015. The search

for a successor has already commenced.

Outlook

The Board remains confident that the Group will continue to

deliver organic growth in this financial year in line with current

market expectations and that our strong cash generation and balance

sheet will allow us to invest in future growth opportunities.

As is usual, we expect a second half bias to the financial

performance of our Protection & Defence business. Although the

timing of receipt of orders remains difficult to predict, the DOD

order we received late in the first half and our sales pipeline of

other opportunities give us confidence that Protection &

Defence will make further progress in the second half of this

year.

In Dairy, the business has good momentum with our high

technology differentiated products and services gaining market

share. This, together with the sales and distribution platforms we

have established in China and Brazil to service the rapidly growing

emerging markets, means we have a Dairy business with excellent

short and longer term growth prospects.

Peter Slabbert Andrew Lewis

Chief Executive Group Finance Director

29 April 2015 29 April 2015

Statement of Directors' Responsibilities

The Directors confirm that this condensed consolidated interim

financial information has been prepared in accordance with the

International Accounting Standard 34, 'Interim Financial Reporting'

as adopted by the European Union, and that the interim management

report herein includes a fair review of the information required by

DTR 4.2.7 and DTR 4.2.8, namely:

-- an indication of important events that have occurred during

the first six months and their impact on the condensed consolidated

interim financial information, and a description of the principal

risks and uncertainties for the remaining six months of the

financial year; and

-- material related party transactions in the first six months and any material changes in the related--party transactions described in the last annual report

The Directors are as listed on page 41 of the 2014 Annual

Report, except that Stella Pirie retired from the Board on 29

January 2015 and Pim Vervaat was appointed on 1 March 2015.

Forward--looking statements

Certain statements in this half year report are

forward--looking. Although the Group believes that the expectations

reflected in these forward--looking statements are reasonable, we

can give no assurance that these expectations will prove to have

been correct. Because these statements involve risks and

uncertainties, actual results may differ materially from those

expressed or implied by these forward--looking statements.

We undertake no obligation to update any forward--looking

statements whether as a result of new information, future events or

otherwise.

Company website

The interim statement is available on the Company's website at

www.avon--rubber.com. The maintenance and integrity of the website

is the responsibility of the Directors. Legislation in the United

Kingdom governing the preparation and dissemination of financial

statements may differ from legislation in other jurisdictions.

Miles Ingrey-Counter

Company Secretary

29 April 2015

Consolidated Statement of Comprehensive

Income

Half year to 31 March Half year to 31 March Year to 30 Sep 2014

2015 2014

Statutory Adjustments Adjusted Statutory Adjustments Adjusted Statutory Adjustments Adjusted

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ ----- ---------- ------------ --------- ---------- ------------ --------- ---------- ------------ ----------

Revenue 4 62,821 - 62,821 61,491 - 61,491 124,779 - 124,779

Cost of sales (41,389) - (41,389) (40,718) - (40,718) (83,264) - (83,264)

------------------ ----- ---------- ------------ --------- ---------- ------------ --------- ---------- ------------ ----------

Gross profit 21,432 - 21,432 20,773 - 20,773 41,515 - 41,515

Selling and

distribution

costs (6,984) - (6,984) (4,894) - (4,894) (11,505) - (11,505)

General and

administrative

expenses (5,540) (363) (5,903) (9,983) 2,330 (7,653) (15,685) 2,678 (13,007)

Operating profit 4 8,908 (363) 8,545 5,896 2,330 8,226 14,325 2,678 17,003

------------------ ----- ---------- ------------ --------- ---------- ------------ --------- ---------- ------------ ----------

Operating profit

is analysed

as:

Before

depreciation

and amortisation 12,662 (493) 12,169 8,933 2,200 11,133 20,486 2,417 22,903

Depreciation

and amortisation (3,754) 130 (3,624) (3,037) 130 (2,907) (6,161) 261 (5,900)

------------------ ----- ---------- ------------ --------- ---------- ------------ --------- ---------- ------------ ----------

Operating profit 8,908 (363) 8,545 5,896 2,330 8,226 14,325 2,678 17,003

------------------ ----- ---------- ------------ --------- ---------- ------------ --------- ---------- ------------ ----------

Finance income 6 9 - 9 - - - 1 - 1

Finance costs 6 (51) - (51) (103) - (103) (275) - (275)

Other finance

expense 6 (453) 329 (124) (97) 6 (91) (187) 12 (175)

------------------ ----- ---------- ------------ --------- ---------- ------------ --------- ---------- ------------ ----------

Profit before

taxation 8,413 (34) 8,379 5,696 2,336 8,032 13,864 2,690 16,554

Taxation 7 (1,683) - (1,683) (1,590) (350) (1,940) (3,053) (450) (3,503)

------------------ ----- ---------- ------------ --------- ---------- ------------ --------- ---------- ------------ ----------

Profit for

the period 6,730 (34) 6,696 4,106 1,986 6,092 10,811 2,240 13,051

------------------ ----- ---------- ------------ --------- ---------- ------------ --------- ---------- ------------ ----------

Consolidated Statement of Comprehensive Income

(continued)

Half year to 31 March Half year to 31 March Year to 30 Sep 2014

2015 2014

Statutory Adjustments Adjusted Statutory Adjustments Adjusted Statutory Adjustments Adjusted

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ ----- ---------- ------------ --------- ---------- ------------ --------- ---------- ------------ ----------

Other

comprehensive

income/(expense)

Actuarial

gain/(loss)

recognised

in retirement

benefit scheme

(*) 22 - 22 5,446 - 5,446 (4,851) - (4,851)

Net exchange

differences

offset in

reserves

(**) 3,008 - 3,008 (1,147) - (1,147) (306) - (306)

Other

comprehensive

income/(expense)

for the period,

net of taxation 3,030 - 3,030 4,299 - 4,299 (5,157) - (5,157)

------------------ ----- ---------- ------------ --------- ---------- ------------ --------- ---------- ------------ ----------

Total

comprehensive

income for

the period 9,760 (34) 9,726 8,405 1,986 10,391 5,654 2,240 7,894

------------------ ----- ---------- ------------ --------- ---------- ------------ --------- ---------- ------------ ----------

Earnings per

share

Basic 9 22.4 22.3 13.8p 20.4p 36.2p 43.7p

Diluted 9 21.8 21.7 13.3p 19.8p 35.0p 42.3p

* Items that are not subsequently reclassified to the income

statement

**Items that may be subsequently reclassified to the income

statement

Consolidated Balance Sheet

As at As at As at

31 Mar 31 Mar 30 Sep

15 14 14

Note GBP'000 GBP'000 GBP'000

---------------------------------- ----- ---------- ---------- ---------

Assets

Non-current assets

Intangible assets 19,011 16,317 17,240

Property, plant and equipment 20,249 19,832 19,575

39,260 36,149 36,815

---------------------------------- ----- ---------- ---------- ---------

Current assets

Inventories 16,722 15,431 12,887

Trade and other receivables 15,630 16,276 19,157

Derivative financial instruments - 137 2

Cash and cash equivalents 13 7,273 217 2,925

---------------------------------- -----

39,625 32,061 34,971

---------------------------------- ----- ---------- ---------- ---------

Liabilities

Current liabilities

Trade and other payables 17,947 15,236 17,755

Derivative financial instruments 284 - -

Provisions for liabilities

and charges 10 689 1,830 1,846

Current tax liabilities 7,711 6,158 6,852

---------------------------------- -----

26,631 23,224 26,453

---------------------------------- ----- ---------- ---------- ---------

Net current assets 12,994 8,837 8,518

---------------------------------- ----- ---------- ---------- ---------

Non-current liabilities

Borrowings 13 - 5,755 -

Deferred tax liabilities 2,716 2,481 2,315

Retirement benefit obligations 15,568 5,802 16,029

Provisions for liabilities

and charges 10 1,241 2,659 1,973

---------------------------------- -----

19,525 16,697 20,317

---------- ---------- ---------

Net assets 32,729 28,289 25,016

---------------------------------- ----- ---------- ---------- ---------

Shareholders' equity

Ordinary shares 11 31,023 31,023 31,023

Share premium account 11 34,708 34,708 34,708

Capital redemption reserve 500 500 500

Translation reserve 2,076 (1,773) (932)

Accumulated losses (35,578) (36,169) (40,283)

---------------------------------- -----

Total equity 32,729 28,289 25,016

---------------------------------- ----- ---------- ---------- ---------

Consolidated Cash Flow

Statement

Half year Half year Year

to to to

31 Mar 31 Mar 30 Sep

15 14 14

Note GBP'000 GBP'000 GBP'000

---------------------------------- ----- ---------- ---------- ---------

Cash flows from operating

activities

---------------------------------- ----- ---------- ---------- ---------

Cash generated before

the impact of exceptional

items 11,828 11,302 26,500

Cash impact of exceptional

items (694) - (983)

---------------------------------- ----- ---------- ---------- ---------

Cash generated from operations 12 11,134 11,302 25,517

Finance income received 9 - 1

Finance costs paid (51) (101) (315)

Retirement benefit deficit

recovery contributions (275) (237) (513)

Tax paid (1,232) (1,778) (2,903)

Net cash generated from

operating activities 9,585 9,186 21,787

---------------------------------- ----- ---------- ---------- ---------

Cash flows from investing

activities

Proceeds from sale of

property, plant and equipment - 17 19

Purchase of property,

plant and equipment (1,411) (1,893) (3,753)

Capitalised development

costs and software (1,733) (1,265) (3,062)

Acquisition of VR Technology

Holdings (25) - (50)

Net cash used in investing

activities (3,169) (3,141) (6,846)

---------------------------------- ----- ---------- ---------- ---------

Cash flows from financing

activities

Net movements in loans - (5,149) (10,805)

Dividends paid to shareholders (1,127) (862) (1,422)

Purchase of own shares (1,152) - -

Net cash used in financing

activities (2,279) (6,011) (12,227)

---------------------------------- ----- ---------- ---------- ---------

Net increase in cash,

cash equivalents and bank

overdrafts 4,137 34 2,714

Cash, cash equivalents

and bank overdrafts at

beginning of the year 2,925 184 184

Effects of exchange rate

changes 211 (1) 27

---------------------------------- ----- ---------- ---------- ---------

Cash, cash equivalents

and bank overdrafts at

end of the period 13 7,273 217 2,925

---------------------------------- ----- ---------- ---------- ---------

Consolidated Statement of Changes

in Equity

Share Share Other Accumulated

capital Premium reserves losses Total

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- ----- -------- -------- --------- ------------ ---------

At 30 September 2013 30,723 34,708 (126) (44,609) 20,696

Profit for the period - - - 4,106 4,106

Unrealised exchange

differences on overseas

investments - - (1,147) - (1,147)

Actuarial gain recognised

in retirement benefit

scheme - - - 5,446 5,446

---------------------------- ----- -------- -------- --------- ------------ ---------

Total comprehensive

income for the period - - (1,147) 9,552 8,405

Dividends paid - - - (862) (862)

Issue of shares 300 - - - 300

Purchase of shares by

the employee benefit

trust - - - (300) (300)

Movement in respect

of employee share schemes - - - 50 50

---------------------------- ----- -------- -------- --------- ------------ ---------

At 31 March 2014 31,023 34,708 (1,273) (36,169) 28,289

Profit for the period - - - 6,705 6,705

Unrealised exchange

differences on overseas

investments - - 841 - 841

Actuarial loss recognised

in retirement benefit

scheme - - - (10,297) (10,297)

---------------------------- ----- -------- -------- --------- ------------ ---------

Total comprehensive

expense for the period - - 841 (3,592) (2,751)

Dividends paid 8 - - - (560) (560)

Movement in respect

of employee share schemes - - - 38 38

---------------------------- ----- -------- -------- --------- ------------ ---------

At 30 September 2014 31,023 34,708 (432) (40,283) 25,016

Profit for the period - - - 6,730 6,730

Unrealised exchange

differences on overseas

investments - - 3,008 - 3,008

Actuarial gain recognised

in retirement benefit

scheme - - - 22 22

---------------------------- ----- -------- -------- --------- ------------ ---------

Total comprehensive

income for the period - - 3,008 6,752 9,760

Dividends paid 8 - - - (1,127) (1,127)

Movement in shares held

by the employee benefit

trust 11 - - - (962) (962)

Movement in respect

of employee share schemes - - - 42 42

---------------------------- ----- -------- -------- --------- ------------ ---------

At 31 March 2015 31,023 34,708 2,576 (35,578) 32,729

---------------------------- ----- -------- -------- --------- ------------ ---------

Notes to the Interim Financial Statements

1. General information

The company is a limited liability company incorporated in

England and domiciled in the UK. The address of its registered

office is Hampton Park West, Semington Road, Melksham, Wiltshire,

SN12 6NB. The company has its primary listing on the London Stock

Exchange.

This unaudited condensed consolidated interim financial

information was approved for issue on 29 April 2015.

These interim financial results do not comprise statutory

accounts within the meaning of Section 434 of the Companies Act

2006. Statutory accounts for the year ended 30 September 2014 were

approved by the Board of Directors on 19 November 2014 and

delivered to the Registrar of Companies. The report of the auditors

on those accounts was unqualified, did not contain an emphasis of

matter paragraph and did not contain any statement under Section

498 of the Companies Act 2006.

2. Basis of preparation

This condensed consolidated interim financial information for

the half year ended 31 March 2015 has been prepared in accordance

with the Disclosure and Transparency Rules of the Financial

Services Authority and with IAS 34, 'Interim financial reporting'

as adopted by the European Union. These interim financial results

should be read in conjunction with the annual financial statements

for the year ended 30 September 2014, which have been prepared in

accordance with IFRSs as adopted by the European Union.

Having considered the Group's funding position, budgets for 2015

and three year plan, the Directors have formed a judgment that

there is a reasonable expectation that the Group has adequate

resources to continue in operational existence for the foreseeable

future. For this reason the Directors continue to adopt the going

concern basis in preparing the condensed consolidated interim

financial information.

3. Accounting policies

The accounting policies adopted are consistent with those of the

annual financial statements for the year ended 30 September 2014,

as described in those financial statements, except as described

below. For the period ended 31 March 2014 , the classification of

overhead costs between selling and distribution costs and general

and administrative expenses has been represented to provide more

relevant information. There is no impact on operating profit.

Recent accounting developments

The following standards, amendments and interpretations have

been issued by the International Accounting Standards Board (IASB)

or by the International Financial Reporting Interpretations

Committee (IFRIC). The Group's approach to these is as follows:

a) Standards, amendments and interpretations effective in 2015

The following standards and amendments have been adopted in

preparing the condensed consolidated half-yearly financial

information and will be adopted for the year ending 30 September

2015 but have no impact on the interim financial information:

- IAS 32, 'Offsetting Financial Assets and Financial Liabilities'

- IAS 36, 'Recoverable Amount Disclosures for Non-Financial Assets'

- IAS 39, 'Novation of Derivatives and Continuation of Hedge Accounting'

- IFRIC 21, 'Levies'

- Amendments to IFRS 10, IFRS 12 and IAS 27, 'Investment Entities'

- Amendments to IAS 19, 'Defined Benefit Plans: Employee Contributions'

- Annual improvements cycle 2010-2012

- Annual improvements cycle 2011-2013

b) Standards, amendments and interpretations to existing

standards issued but not yet effective in 2015 and not adopted

early:

- IFRS 9, 'Financial instruments'

- IFRS 14, 'Regulatory Deferral Accounts'

- IFRS 15, 'Revenue from Customer Contracts'

- Amendments to IAS 1, 'Disclosure initiative'

- Amendment to IFRS 10 and IAS 28, 'Sale or Contribution of

Assets between and Investor and its Associate or Joint Venture'

- Amendments to IFRS 10, IFRS 12 and IAS 28, 'Applying the consolidation exemption'

- Amendments to IFRS 11, 'Accounting for Acquisition Interests in Joint Operations'

- Amendments to IAS 16 and IAS 38, 'Clarification of Acceptable

Methods of Depreciation and Amortisation'

- Amendments to IAS 16 and IAS 41, 'Agriculture - Bearer Plants'

- Amendments to IAS 27, 'Equity Method in Separate Financial Statements'

- Annual improvements cycle 2012-2014

4. Segment information

Operating segments are reported in a manner

consistent with the internal reporting provided

to the chief operating decision-maker. The

chief operating decision-maker, who is responsible

for allocating resources and assessing performance

of the operating segments, has been identified

as the Group Executive team.

The Group has two clearly defined business

segments, Protection & Defence and Dairy,

and operates out of the UK and the US.

Business segments

Half year to 31 March

2015

Protection

& Defence Dairy Unallocated Group

GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------------- -------------- -------- ------------ --------

Revenue 45,333 17,488 62,821

---------------------------------------

Segment result before

depreciation, amortisation

and defined benefit

pension scheme credit 9,358 3,872 (1,061) 12,169

Depreciation of property,

plant and equipment (1,724) (533) (26) (2,283)

Amortisation of intangibles (1,275) (61) (5) (1,341)

--------------------------------------- -------------- -------- ------------ --------

Segment result before

amortisation of acquired

intangibles and defined

benefit pension scheme

credit 6,359 3,278 (1,092) 8,545

Amortisation of acquired

intangibles (130) (130)

Defined benefit pension

scheme credit 493 493

--------------------------------------- -------------- -------- ------------ --------

Segment result 6,229 3,278 (599) 8,908

Finance costs (42) (42)

Other finance expense (453) (453)

--------------------------------------- -------------- -------- ------------ --------

Profit before taxation 6,229 3,278 (1,094) 8,413

Taxation (1,683) (1,683)

---------------------------------------

Profit for the period 6,229 3,278 (2,777) 6,730

--------------------------------------- -------------- -------- ------------ --------

Half year to 31 March

2014

Protection

& Defence Dairy Unallocated Group

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ ----------- -------- ------------ --------

Revenue 45,639 15,852 61,491

------------------------------

Segment result before

depreciation, amortisation,

exceptional items and

defined benefit pension

scheme costs 9,237 3,176 (1,280) 11,133

Depreciation of property,

plant and equipment (1,597) (382) (30) (2,009)

Amortisation of intangibles (837) (57) (4) (898)

------------------------------ ----------- -------- ------------ --------

Segment result before

amortisation of acquired

intangibles, exceptional

items and defined benefit

pension scheme costs 6,803 2,737 (1,314) 8,226

Amortisation of acquired

intangibles (130) (130)

Exceptional items (2,000) (2,000)

Defined benefit pension

scheme costs (200) (200)

------------------------------ ----------- -------- ------------ --------

Segment result 4,673 2,737 (1,514) 5,896

Finance costs (103) (103)

Other finance expense (97) (97)

------------------------------ ----------- -------- ------------ --------

Profit before taxation 4,673 2,737 (1,714) 5,696

Taxation (1,590) (1,590)

------------------------------

Profit for the period 4,673 2,737 (3,304) 4,106

------------------------------ ----------- -------- ------------ --------

Year to 30 September

2014

Protection

& Defence Dairy Unallocated Group

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ ----------- -------- ------------ --------

Revenue 92,818 31,961 124,779

------------------------------

Segment result before

depreciation, amortisation,

exceptional items and

defined benefit pension

scheme costs 18,542 6,600 (2,239) 22,903

Depreciation of property,

plant and equipment (3,289) (771) (67) (4,127)

Amortisation of intangibles (1,670) (94) (9) (1,773)

------------------------------ ----------- -------- ------------ --------

Segment result before

amortisation of acquired

intangibles, exceptional

items and defined benefit

pension scheme costs 13,583 5,735 (2,315) 17,003

Amortisation of acquired

intangibles (261) (261)

Exceptional items (2,017) (2,017)

Defined benefit pension

scheme costs (400) (400)

------------------------------ ----------- -------- ------------ --------

Segment result 11,305 5,735 (2,715) 14,325

Finance income 1 1

Finance costs (275) (275)

Other finance expense (187) (187)

------------------------------ ----------- -------- ------------ --------

Profit before taxation 11,305 5,735 (3,176) 13,864

Taxation (3,053) (3,053)

------------------------------

Profit for the year 11,305 5,735 (6,229) 10,811

------------------------------ ----------- -------- ------------ --------

Revenue by origin

Half year Half year Year

to to to

31 Mar 31 Mar 30 Sep

15 14 14

GBP'000 GBP'000 GBP'000

----------------------- ------------ ----------- ---------

UK 11,819 14,725 23,508

US 51,002 46,766 101,271

62,821 61,491 124,779

----------------------- ------------ ----------- ---------

Segment assets in the UK and US were GBP17.3m and

GBP61.6m respectively (30 September 2014: GBP14.0m

and GBP57.8m, 31 March 2014: GBP12.9m and GBP55.3m).

5. Amortisation of acquired intangibles, exceptional

items and defined benefit pension scheme costs

Half year Half year Year

to to to

31 Mar 31 Mar 30 Sep

15 14 14

GBP'000 GBP'000 GBP'000

----------------------------- ---------- ---------- --------

Amortisation of acquired

intangible assets 130 130 261

------------------------------ ---------- ---------- --------

Exceptional items GBP'000 GBP'000 GBP'000

Relocation of Lawrenceville

facility - 2,000 2,017

- 2,000 2,017

----------------------------- ---------- ---------- --------

The tax impact of the above is a GBPnil reduction in overseas

tax payable (31 March 2014: GBP0.35m, 30 September 2014:

GBP0.45m).

The statutory results have also been adjusted to exclude items

in relation to the defined benefit pension scheme as this is closed

to future accrual and therefore does not relate to current

operations. The adjustments comprise:

o Administrative expenses of GBP0.2m

o Settlement gain of GBP0.7m following a trivial commutation exercise

o Other finance expense of GBP0.3m

6. Finance income and

costs

Half year Half year Year

to to to

31 Mar 31 Mar 30 Sep

15 14 14

GBP'000 GBP'000 GBP'000

--------------------------------------------------------- ---- ----------- ------------ --------

Interest payable on bank loans

and overdrafts 51 103 275

Finance income (9) - (1)

42 103 274

-------------------------------------------------------------- ----------- ------------ --------

Other finance expense

Half year Half year Year

to to to

31 Mar 31 Mar 30 Sep

15 14 14

GBP'000 GBP'000 GBP'000

--------------------------------------------------------- ---- ----------- ------------ --------

Net interest cost: UK defined

benefit pension scheme 329 6 12

Provisions: Unwinding

of discount 124 91 175

453 97 187

-------------------------------------------------------------- ----------- ------------ --------

7. Taxation

Half year Half year Year

to to to

31 Mar 31 Mar 30 Sep

15 14 14

GBP'000 GBP'000 GBP'000

---------------------------------------------------------- --- ----------- ------------ --------

United Kingdom - - -

Overseas 1,683 1,590 3,053

---------------------------------------------------------- --- ----------- ------------ --------

1,683 1,590 3,053

Effect of exceptional

items - 350 450

---------------------------------------------------------- --- ----------- ------------ --------

Adjusted tax charge 1,683 1,940 3,503

---------------------------------------------------------- --- ----------- ------------ --------

The statutory effective tax rate for the period

is 20% (31 March 2014: 28%, 30 September 2014: 22%).

The adjusted effective tax rate, where the tax charge

and the profit before taxation are adjusted for

exceptional items, the amortisation of acquired

intangibles and defined benefit pension scheme charges

is 20% (31 March 2014: 24%, 30 September 2014: 21%).

8. Dividends

On 29 January 2015, the shareholders approved a

final dividend of 3.74p per qualifying ordinary

share in respect of the year ended 30 September

2014. This was paid on 20 March 2015 absorbing GBP1,127,000

of shareholders' funds.

The Board of Directors has declared an interim dividend

of 2.43p (2014: 1.87p) per qualifying ordinary share

in respect of the year ended 30 September 2015.

This will be paid on 4 September 2015 to shareholders

on the register at the close of business on 7 August

2015. In accordance with accounting standards this

dividend has not been provided for and there are

no corporation tax consequences. It will be recognised

in shareholders' funds in the year to 30 September

2015 and is expected to absorb GBP732,000 (2014:

GBP560,000) of shareholders' funds.

9. Earnings per share

Basic earnings per share is based on a profit attributable

to ordinary shareholders of GBP6,730,000 (2014:

GBP4,106,000) and 30,077,000 (2014: 29,800,000)

ordinary shares being the weighted average number

of shares in issue during the period.

Adjusted earnings per share is based on a profit

attributable to ordinary shareholders of GBP6,696,000

(2014: GBP6,092,000) after adding back amortisation

of acquired intangible assets, exceptional items

and defined benefit pension scheme costs.

The Company has 824,000 (2.7%) (2014: 953,000 (3.2%))

potentially dilutive ordinary shares in respect

of the Performance Share Plan.

10. Provisions for liabilities

and charges

Facility Property

relocation obligations Total

GBP'000 GBP'000 GBP'000

--------------------------------------------------------- --- ------------ ------------ --------

Balance at 30 September

2014 454 3,365 3,819

Payments in the period (471) (1,578) (2,049)

Unwinding of discount - 124 124

Exchange difference 17 19 36

Balance at 31 March 2015 - 1,930 1,930

-------------------------------------------------------------- ------------ ------------ --------

11. Share capital

Half year Half year Year to

to to

31 Mar 31 Mar 30 Sep

15 14 14

--------------------------------------------------------- --- ------------ ------------ --------

Number of shares (thousands) 31,023 31,023 31,023

Ordinary shares (GBP'000) 31,023 31,023 31,023

Share premium (GBP'000) 34,708 34,708 34,708

-------------------------------------------------------------- ------------ ------------ --------

During the period 162,095 ordinary shares with a nominal value

of GBP1 each were purchased by the Avon Rubber p.l.c. Employer

Share Ownership Trust at a cost of GBP1,152,000 and 29,459 ordinary

shares of GBP1 each were issued in relation to the 2014 annual

incentive plan.

12. Cash generated from

operations

Half year Half year Year to

to to

31 Mar 31 Mar 30 Sep

15 14 14

GBP'000 GBP'000 GBP'000

------------------------------------------------- -------- ----------- ---------- --------

Profit for the period 6,730 4,106 10,811

Adjustments for:

Taxation 1,683 1,590 3,053

Depreciation 2,283 2,009 4,127

Amortisation of intangible

assets 1,471 1,028 2,034

Defined benefit pension scheme

(credit)/costs (493) 200 400

Net finance expense 42 103 274

Other finance expense 453 97 187

Loss on disposal of intangible

assets and property, plant

and equipment - - 358

Movements in working capital

and provisions (1,077) 2,119 4,185

Other movements 42 50 88

------------------------------------------------- -------- ----------- ---------- --------

11,134 11,302 25,517

----------------------------------------------------------- ----------- ---------- --------

13. Analysis of net

cash

As at Exchange As at

30 Sep Cash flow movements 31 Mar

14 15

GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------------- ------------------ ----------- ---------- --------

Cash at bank and in

hand 2,925 4,137 211 7,273

--------------------------------------- ------------------ ----------- ---------- --------

Cash and cash equivalents 2,925 4,137 211 7,273

--------------------------------------- ------------------ ----------- ---------- --------

Borrowing facilities As at As at As at

31 Mar 31 Mar 30 Sep

15 14 14

GBP'000 GBP'000 GBP'000

--------------------------------------- ------------------ ----------- ---------- --------

Total undrawn committed

facilities 26,521 17,247 24,191

Bank loans and overdrafts

utilised - 5,755 -

Utilised in respect

of guarantees 370 330 337

Total Group facilities 26,891 23,332 24,528

--------------------------------------- ------------------ ----------- ---------- --------

The above facilities are with Barclays Bank and

Comerica Bank. The combined facility comprises a

revolving credit facility of $40m and expires on

30 November 2017. This facility is priced on the

US dollar LIBOR plus margin of 1.25% and includes

financial covenants which are measured on a quarterly

basis. The Group was in compliance with its financial

covenants during 2015 and 2014.

14. Exchange rates

The following significant exchange

rates applied during the period.

Average Closing Average Closing Average Closing

rate rate rate rate rate rate

H1 2015 H1 2015 H1 2014 H1 2014 FY 2014 FY 2014

------------------------ ------------- -------- -------- ----------- ---------- --------

US dollar 1.539 1.488 1.633 1.664 1.654 1.631

Euro 1.309 1.370 1.198 1.210 1.221 1.281

------------------------ ------------- -------- -------- ----------- ---------- --------

Fair value of financial instruments

The fair value of forward exchange contracts is determined by

using valuation techniques using period end spot rates, adjusted

for the forward points to the value date of the contract.

15. Principal risks and uncertainties

The principal risks and uncertainties impacting the Group are

described on pages 28-31 of our Annual Report 2014 and remain

unchanged at 31 March 2015.

They include: product development, market threat, business

interruption - supply chain, quality risks and product recall,

customer dependency, talent management and non-compliance with

legislation.

CORPORATE INFORMATION

REGISTERED OFFICE

Corporate Headquarters

Hampton Park West

Semington Road

Melksham

Wiltshire

SN12 6NB

Registered in England and Wales No. 32965

V.A.T. No. GB 137 575 643

BOARD OF DIRECTORS

David Evans (Chairman)

Pim Vervaat (Non-Executive Director)

Richard Wood (Non-Executive Director)

Peter Slabbert (Chief Executive)

Andrew Lewis (Group Finance Director)

COMPANY SECRETARY

Miles Ingrey-Counter

INDEPENDENT AUDITORS

PricewaterhouseCoopers LLP

REGISTRARS & TRANSFER OFFICE

Capita Asset Services

The Registry

34 Beckenham Road

Beckenham

BR3 4TU

Tel: 0871 664 0300

(calls cost 10p per minute plus network extras,

lines are open 8.30am-5.30pm Mon-Fri)

BROKERS

Arden Partners plc

SOLICITORS

TLT LLP

PRINCIPAL BANKERS

Barclays Bank PLC

Comerica Inc.

CORPORATE FINANCIAL ADVISER

Arden Partners plc

CORPORATE WEBSITE

www.avon-rubber.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR SEUFWAFISEDL

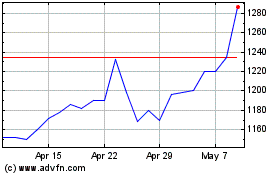

Avon Protection (LSE:AVON)

Historical Stock Chart

From Mar 2024 to Apr 2024

Avon Protection (LSE:AVON)

Historical Stock Chart

From Apr 2023 to Apr 2024