TIDMAVON

RNS Number : 3817X

Avon Rubber PLC

19 November 2014

News Release

Strictly embargoed until 07:00 19 November 2014

AVON RUBBER p.l.c.

("Avon", the "Group" or the "Company")

Audited results for the year ended 30 Sept 30 Sept

30 September 2014 2014 2013

GBPMillions GBPMillions

REVENUE 124.8 124.9

ADJUSTED EBITDA (*) 22.9 20.0

ADJUSTED OPERATING PROFIT (*) 17.0 14.2

ADJUSTED PROFIT BEFORE TAX (*) 16.6 13.7

NET CASH / (DEBT) 2.9 (10.9)

EARNINGS PER SHARE:

Adjusted basic (*) 43.7p 33.8p

Basic 36.2p 30.0p

Adjusted diluted (*) 42.3p 32.5p

Diluted 35.0p 28.8p

DIVIDEND PER SHARE 5.61p 4.32p

FINANCIAL HIGHLIGHTS:

-- Operating profit growth of 20% (26% at constant currency) and

profit before tax increased 21%

-- Return on sales (EBITDA divided by revenue) improved 2% from 16% to 18%

-- Diluted earnings per share increased 30% (37% at constant currency)

-- 156% conversion of operating profit to operating cash; debt

eliminated, GBP2.9m cash at year end

-- Dividend of 5.61p per share increased 30%

OPERATIONAL HIGHLIGHTS:

-- Order intake in Protection & Defence up 26% to GBP93m;

order book GBP33m for delivery in 2015

-- Growth in non-DOD sales from strong opening order book and

higher order intake; Protection & Defence operating margin

increased from 11.9% to 14.6%

-- 11 new product approvals including our Deltair self-contained

breathing apparatus (SCBA) and emergency escape breathing device

(EEBD)

-- The consolidation of our Lawrenceville site into our Cadillac site is substantially complete

-- Dairy operating margins increased from 16.3% to 17.9%

-- Cluster Exchange service successfully launched in EU and US

-- Dairy facility open for business in Brazil in Q1 2015

(*) Note:

The Directors believe that adjusted measures provide a more

useful comparison of business trends and performance. Adjusted

results exclude exceptional items, the amortisation of acquired

intangibles and defined benefit pension scheme costs. The term

adjusted is not defined under IFRS and may not be comparable with

similarly titled measures used by other companies.

All profit and earnings per share figures in this news release

relate to adjusted business performance (as defined above) unless

otherwise stated.

A reconciliation of adjusted measures to statutory measures is

provided below:

Statutory Adjustments Adjusted

-------------------------------- ---------- ------------ ---------

Group EBITDA (GBPm) 20.5 2.4 22.9

-------------------------------- ---------- ------------ ---------

Group Operating profit

(GBPm) 14.3 2.7 17.0

-------------------------------- ---------- ------------ ---------

Group Profit before Taxation

(GBPm) 13.9 2.7 16.6

-------------------------------- ---------- ------------ ---------

Group Profit for the year

(GBPm) 10.8 2.2 13.0

-------------------------------- ---------- ------------ ---------

Basic Earnings per Share

(pence) 36.2p 7.5p 43.7p

-------------------------------- ---------- ------------ ---------

Diluted Earnings per Share

(pence) 35.0p 7.3p 42.3p

-------------------------------- ---------- ------------ ---------

Protection & Defence EBITDA

(GBPm) 16.5 2.0 18.5

-------------------------------- ---------- ------------ ---------

Protection & Defence Operating

profit (GBPm) 11.3 2.3 13.6

-------------------------------- ---------- ------------ ---------

The adjustments comprise:

-- amortisation of acquired intangibles of GBP0.3m

-- defined benefit pension scheme costs of GBP0.4m, which relate

to a scheme closed to future accrual and therefore do not relate to

current operations

-- exceptional item of GBP2.0m relating to the consolidation of

Protection & Defence sites

-- tax effect of exceptional item of GBP0.5m

Further details are provided in note 3.

Commenting on the results, Peter Slabbert, Chief Executive

said:

"2014 has been an excellent year reflecting the strategic

decisions made over the last three years to invest in innovative

new products and technologies while expanding our international

markets. This strategy will continue to drive growth in the years

ahead."

For further enquiries, please contact:

Avon Rubber p.l.c.

Peter Slabbert, Chief Executive 020 7067 0700

Andrew Lewis, Group Finance Director (until 12 noon)

Sophie Williams, Group Public Relations Manager 01225 896 563

Weber Shandwick Financial

Nick Oborne 020 7067 0700

AN ANALYST MEETING WILL BE HELD AT 09.30AM THIS MORNING AT THE

OFFICES OF

WEBER SHANDWICK FINANCIAL, 2 WATERHOUSE SQUARE, 140 HOLBORN,

LONDON, EC1N 2AE.

Note to editors: The Group has transformed itself over recent

years into an innovative design and engineering group specialising

in two core markets, Protection & Defence and Dairy. With a

strong emphasis on research and development we design, test and

manufacture specialist products from a number of sites in the US

and UK, serving markets around the world. We achieve this through

nurturing the talent and aspirations of our employees to realise

their highest potential.

Avon Protection is the recognised global market leader in

advanced Chemical, Biological, Radiological and Nuclear (CBRN)

respiratory protection systems technology for the world's military,

homeland security, first responder, fire and industrial markets.

With an unrivalled pedigree in mask design dating back to the

1920's, Avon Protection's advanced products are the first choice

for Personal Protective Equipment (PPE) users worldwide and are

placed at the heart of many international defence and tactical PPE

deployment strategies. Our expanding global customer base now

includes military forces, civil and first line defence troops,

emergency service teams and industrial, marine, mineral and oil

extraction site personnel. All put their trust in Avon's advanced

respiratory solutions to shield them from every possible

threat.

Our world-leading Dairy business and its Milkrite brand have a

global market presence. With a long history of manufacturing liners

and tubing for the dairy industry, Milkrite has become the leading

innovator and designer for products and services right at the heart

of milking. Our goal is always to improve and maintain animal

health. Working with the leading scientists and health specialists

in the global dairy industry we continue to invest in technology to

further improve the milking process and animal welfare. Our

products provide exceptional results for both the animal and the

milker, making the milk extraction process run smoothly. As our

market share and milking experience continue to grow, so does our

global presence.

For further information please visit the Group's website

www.avon-rubber.com

AVON RUBBER p.l.c.

INTRODUCTION

Avon has delivered another year of exceptionally strong growth

in 2014. We have further strengthened our business, improved our

margins and through sound operational management provided strong

cash generation moving us to a net cash position.

STRATEGY

In addition to the strong financial performance, we end the year

with a more robust and sustainable business. Both Protection &

Defence and Dairy are generating increased opportunities for

growth. In Protection & Defence we have 11 new product

approvals and are growing in all our market sectors. In Dairy we

are increasing our own brand Milkrite's market share, expanding our

product and service offerings and developing our distribution in

emerging markets. We have also invested GBP2m across the Group in

upgrading our IT systems over the past 18 months which will deliver

a single Group-wide ERP infrastructure to provide better business

integration and support our growing global business.

Our continued investment in product, brand and market

development and in our operational capability in 2014 should

position us to make further progress in the coming years.

GROUP RESULTS

Revenue was flat at GBP124.8m (2013: GBP124.9m) but increased 5%

on a constant currency basis.

Operating profit before depreciation and amortisation (EBITDA)

rose 14% to GBP22.9m (2013: GBP20.0m) and operating profit rose 20%

to GBP17.0m (2013: GBP14.2m) (an increase of 26% at constant

currency).

The progressive strengthening of sterling during the year gave

the Group a foreign exchange translation headwind. The US $/GBP

average rate was $1.65 (2013: $1.56) and this 9 cent headwind was

equivalent to GBP5.7m at a revenue level and GBP0.8m at an

operating profit level.

SEGMENTAL PERFORMANCE

PROTECTION & DEFENCE

Protection & Defence represented 74% (2013: 75%) of total

Group revenues. The business saw revenues decrease by 0.3% from

GBP93.2m to GBP92.8m (an increase of 4.7% at constant currency).

Underlying growth was due to growing non-DOD mask sales. Our strong

manufacturing capability and existing capacity allowed us to meet

this increase in customer demand.

Operating profit grew strongly to GBP13.6m (2013: GBP11.0m) up

23.0% and EBITDA was GBP18.5m (2013: GBP16.1m), representing a

return on sales (defined as EBITDA divided by revenue) of 20.0%

(2013: 17.3%). This reflects a richer mix of non-DOD sales and

improved operational performance, slightly offset by continued

investment in the infrastructure of the business.

Order intake was GBP93m with increased orders from the DOD, EMEA

and North American customers. Our DOD long-term M50 mask contract

is in its seventh year and we supplied 168,000 systems during the

year, bringing the total to over 1.2m systems so far under this

contract. As a result of higher order intake of 246,000 mask

systems we enter 2015 with an order book covering the first half

year sales at a slightly accelerated rate. Follow-on DOD M50 orders

are expected in the first half as 2015 DOD budgets are

released.

The filter requirement has less short-term visibility, but we

expect this consumable item to be a good source of repeat revenue

in the long term as more masks enter service. Whilst uncertainty

continues in the US regarding budget cuts and sequestration, we are

an established programme, delivering to schedule and the largest

user, the Army, has begun taking product. This gives us a

reasonable degree of comfort that mask system volumes will continue

at good levels for the foreseeable future.

During the year the Joint Service Aircrew Mask (JSAM) programme

design, development and testing work progressed well. This will

provide respiratory protection to a wide range of operators on the

DOD's fleet of fixed wing aircraft. This $6.7m development contract

is due to conclude at the end of our 2015 financial year and should

lead to a production contract which could be worth up to $74m.

Our newly developed Emergency Escape Breathing Device (EEBD)

received NIOSH approval to the new standard, with Avon being the

only manufacturer to date to achieve this. This product has

applications on board navy ships and in the mining sector. The US

Navy has an open solicitation to replace its ageing installed base

to which we will respond in our 2015 financial year.

DOD sales are a lower proportion of the division's sales as, in

line with our strategy, we have successfully grown our non-DOD

sales. Sales to US law enforcement and non-US military and law

enforcement increased from GBP25.0m to GBP31.0m as a result of

strong order intake in 2014 as we experience the benefit of the

increased sales and marketing resource added in prior years. We won

an industrial order in the final quarter of the year for 27,000

escape hoods of which the majority is for delivery in 2015.

Sales to the fire market were flat in the first half of the year

as purchasers put procurement decisions on hold pending release of

the new, delayed, NFPA standard. Our new Deltair SCBA, designed to

meet these new US regulations and to enhance operational

performance, was approved in April 2014. It is one of only three

units to receive approval to date and has been well received by the

market in early customer trials. This led to a relatively stronger

conclusion to the year and our target of converting this pipeline

of opportunity into revenue in 2015 has begun well as we carry

forward confirmed orders for 600 Deltair units.

AEF again made a positive contribution to divisional operating

profit, winning hovercraft skirt and fuel and water storage tank

orders. We enter 2015 with order coverage for the first half of the

year, which gives us excellent visibility in this part of the

business.

DOD spares sales have grown this year, as expected; as the

installed base of masks grows so does the DOD's requirement to fill

its supply chain.

We have consolidated our Protection & Defence operations

from four US sites into three ahead of the expiry of the lease on

our Lawrenceville, Georgia facility in 2015. The move is

substantially complete and we are pleased that our operations team

brought the project in on time and on budget. Our Cadillac,

Michigan facility is now the centre of excellence for both mask

manufacture and filter technology as well as the supplied air

products previously manufactured in Lawrenceville.

DAIRY

Dairy revenues increased by 0.8% to GBP32.0m (2013: GBP31.7m)

(up 5.0% on a constant currency basis) reflecting the success of

our Cluster Exchange service and growth of the Milkrite brand in

Europe.

Operating profit increased by 10.7% to GBP5.7m (2013: GBP5.2m)

(up 17.0% at constant currency). EBITDA was GBP6.6m (2013:

GBP5.8m), giving a return on sales (as defined above) of 20.7%, up

from 18.4% in 2013.

The difficult market conditions experienced during the latter

part of the previous financial year began to improve as a result of

the better 2013 harvest which resulted in lower animal feed costs.

This, together with higher milk prices, reduced the pressure on

farmer revenues and margins and led to a return of more normal

levels of demand for our consumable products.

Milkrite increased as a proportion of total revenue providing a

richer sales mix. Only four years ago OEM customers represented 47%

of our revenue; at the end of this year this had fallen to 31%,

reflecting the success of the Milkrite brand.

In recent years the business has demonstrated through the launch

of its ImpulseAir liner that the industry is receptive to new

technology which improves farm efficiency and animal health, with

our proprietary product now enjoying a 21% market share in the US

(2013: 19%).

The launch of the ImpulseAir liner in Europe, where market share

grew to 2.5%, contributed to an increase in Milkrite's overall

market share (now 16.5%), delivering returns on our investment in

the sales force, enhanced technical support and a larger

distributor network.

This success has given us the confidence to invest further in

product development resource and to commence work on the next

generation of products. The first example of this, our Cluster

Exchange service, which was successfully launched in the US and

Europe at the end of 2013, gained momentum as the year developed

and by the end of the year was servicing 256,000 cows on 887 farms.

This add-on service for the farmer increases the value of each

direct liner sale we make and should lead to a more robust business

model. Under this programme farmers outsource to us their liner

change process, which we deliver through service centres

established in our existing facilities, with the support of our

dealers and third-party logistics specialists.

In China, after a softer first half when the dairy industry was

restructured following a number of issues, including contaminated

milk, contaminated feed and an outbreak of foot and mouth disease,

we were pleased to see volumes returning to expected levels in a

market which has excellent long-term potential.

In many other emerging markets, including Brazil and India, the

number of dairy cows being milked using automated milking processes

is growing strongly. This is adding to the market potential for the

consumable products we sell. We plan to harness this potential by

establishing sales and distribution functions in these markets as

they develop and consequently we have established a sales and

distribution centre in Brazil in the first quarter of the new

financial year.

FINANCE EXPENSES

Net interest costs remained constant at GBP0.3m (2013: GBP0.3m).

Other (non-cash) finance expenses associated with the unwinding of

discounts on provisions were GBP0.2m (2013: GBP0.2m).

TAXATION

The statutory tax charge totalled GBP3.1m (2013: GBP3.6m) on a

statutory profit before tax of GBP13.9m (2013: GBP12.4m). In 2014

the Group paid tax in the US, but not in the UK due to brought

forward tax losses. The effective tax rate for the year is 22%

(2013: 29%), reflecting a more favourable geographic mix of

profits.

The adjusted effective tax rate, where the tax charge and the

profit before taxation are adjusted for exceptional items, the

amortisation of acquired intangibles and defined benefit pension

scheme costs is 21% (2013: 27%). In 2014 the US Federal tax rate

was 34% and the Group's effective tax rate reflects the

predominance of US revenues and earnings. Unrecognised deferred tax

assets in respect of tax losses in the UK amounted to GBP1.4m

(2013: GBP2.8m).

EARNINGS PER SHARE

Basic earnings per share were 43.7p (2013: 33.8p) and diluted

earnings per share were 42.3p (2013: 32.5p).

NET CASH AND CASHFLOW

Net cash at the end of the year was GBP2.9m (2013: net debt of

GBP10.9m). The Group had no borrowings at the year end; total bank

facilities were GBP24.5m, which are US dollar denominated and

committed to 30 November 2017.

In the year we invested GBP6.8m (2013: GBP11.1m) in property,

plant and equipment and new product development. In the Protection

& Defence business this focused on our new product development

programme, Project Fusion. In Dairy we invested in the hardware

required to support our Cluster Exchange service offering. Across

the Group we continued our investment in a common IT platform to

support the Group's future growth ambitions.

Operating activities generated cash of GBP26.5m (2013:

GBP15.5m), representing 156% of operating profit (2013: 109%).

Through sound operational management the Group has driven a strong

conversion of profits into cash and this was supplemented by the

phasing of customer payments including GBP3.5m of accelerated

payments from a major customer ahead of its financial year-end.

Receivables at 30 September 2014 were lower than the previous year

due to this phasing and these accelerated payments.

UK RETIREMENT BENEFIT OBLIGATIONS

The balance, as measured under IAS 19 Revised, associated with

the Group's UK retirement benefit obligation, which has been closed

to future accrual, has moved from a GBP11.3m deficit at 30

September 2013 to a GBP16.0m deficit at 30 September 2014. This

movement has resulted from a decrease in the discount rate. IAS 19

Revised specifies the use of AA corporate bond (rather than gilt)

yields to set the discount rate.

During 2014, the Group paid total contributions of GBP0.5m. A

new triennial actuarial valuation took place as at 31 March 2013.

That valuation showed the scheme to be 98.0% funded on a continuing

basis and this has given rise to a new deficit recovery plan under

which the payments for the Group financial years ending 30

September will be as follows: 2015: GBP550,000, 2016: GBP675,000,

2017: GBP700,000 and 2018: GBP700,000. These amounts include

GBP250,000 p.a. in respect of administration expenses. An update to

the actuarial position as at 30 September 2014 has been obtained

and this shows a deficit of GBP10m, which represents a funding

level of 97%.

RESEARCH AND DEVELOPMENT

Intangible assets totalling GBP17.2m (2013: GBP16.5m) form a

significant part of the balance sheet as we invest in new product

development. This can be seen from our expanding product range,

particularly respiratory protection products. The annual charge for

amortisation of intangible assets was GBP1.8m (2013: GBP1.9m).

Our total investment in research and development (capitalised

and expensed) amounted to GBP7.0m (2013: GBP6.4m) of which GBP4.5m

(2013: GBP2.1m) was customer funded and has been recognised as

revenue.

In Dairy we have started to expand our product range under the

Milkrite brand beyond liners and tubing into non-rubber goods such

as liner shells and claws.

We have started to see the benefits of these efforts, which

underpin the long-term prosperity of the Group, during our 2014

financial year.

DIVIDEND

Based on the Group's improved profitability, cash generation and

the confidence the Board has in the Group's future prospects, the

Board is pleased to propose a 30% increase in the final dividend to

shareholders of 3.74p per ordinary share (2013: 2.88p).

This, combined with the 2014 interim dividend of 1.87p, results

in a full year dividend of 5.61p (2013: 4.32p), up 30%.

OPPORTUNITIES

Last year we highlighted that the nature of our challenge had

changed and that management was now firmly focused on growth and

margin enhancement. Both of these are clearly reflected in the 2014

results.

Looking forward we see our global market leading positions

delivering further opportunities for organic growth. We will

continue to invest in innovative new technologies and products and

in building our brand and market reach to bring these opportunities

to fruition. Our strong balance sheet will also support

complementary acquisitions which can deliver synergistic

benefits.

BOARD CHANGES

After serving as a Non-Executive Director since March 2005

Stella Pirie will stand down at the AGM in January 2015. Stella has

made a significant contribution during a period of remarkable

progress and change for the Group, for which she has our

considerable thanks. A recruitment process to appoint a suitable

replacement is underway and an announcement will be made at the

appropriate time.

OUTLOOK

Our strategy has significantly improved the shape of the Group,

reduced the risk profile and improved margins. This is providing

continued growth and the outlook for the future remains

positive.

In our global Protection & Defence business we have good

visibility of DOD revenues for 2015 and expect to see growth in the

fire and industrial markets. New products will contribute to growth

and we should see a positive operational gearing effect from a

stable cost base.

The Dairy business is well positioned with positive current

market conditions and long-term market growth potential. We expect

volume growth from our investment in the emerging markets of China

and Brazil and from the Cluster Exchange programme. We continue to

invest in enhanced milking technologies.

Peter Slabbert Andrew Lewis

Chief Executive Group Finance Director

19 November 2014 19 November 2014

Consolidated Statement of Comprehensive

Income

for the year ended 30 September 2014

Year to 30 Sept 2014 Year to 30 Sept 2013

Statutory Adjustments Adjusted Statutory Adjustments Adjusted

(restated**)

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------- ----- ---------- ------------ --------- ------------- ------------ ----------

Revenue 2 124,779 - 124,779 124,851 - 124,851

Cost of sales (83,264) - (83,264) (91,140) - (91,140)

----------------------- ----- ---------- ------------ --------- ------------- ------------ ----------

Gross profit 41,515 - 41,515 33,711 - 33,711

Selling and

distribution

costs (11,505) - (11,505) (9,101) - (9,101)

General and

administrative

expenses (15,685) 2,678 (13,007) (11,607) 1,220 (10,387)

Operating profit 2 14,325 2,678 17,003 13,003 1,220 14,223

----------------------- ----- ---------- ------------ --------- ------------- ------------ ----------

Operating profit

is analysed

as:

Before depreciation

and amortisation 20,486 2,417 22,903 19,220 803 20,023

Depreciation

and amortisation (6,161) 261 (5,900) (6,217) 417 (5,800)

----------------------- ----- ---------- ------------ --------- ------------- ------------ ----------

Operating profit 14,325 2,678 17,003 13,003 1,220 14,223

----------------------- ----- ---------- ------------ --------- ------------- ------------ ----------

Finance income 1 - 1 1 - 1

Finance costs (275) - (275) (348) - (348)

Other finance

expense (187) 12 (175) (253) 33 (220)

----------------------- ----- ---------- ------------ --------- ------------- ------------ ----------

Profit before

taxation 13,864 2,690 16,554 12,403 1,253 13,656

Taxation 4 (3,053) (450) (3,503) (3,566) (122) (3,688)

----------------------- ----- ---------- ------------ --------- ------------- ------------ ----------

Profit for

the year 10,811 2,240 13,051 8,837 1,131 9,968

----------------------- ----- ---------- ------------ --------- ------------- ------------ ----------

Other comprehensive

expense

Actuarial loss

recognised

on retirement

benefit schemes

(***) (4,851) - (4,851) (9,180) - (9,180)

Net exchange

differences

offset in reserves

(****) (306) - (306) (74) - (74)

Other comprehensive

expense for

the year, net

of taxation (5,157) - (5,157) (9,254) - (9,254)

----------------------- ----- ---------- ------------ --------- ------------- ------------ ----------

Total comprehensive

income/(expense)

for the year 5,654 2,240 7,894 (417) 1,131 714

----------------------- ----- ---------- ------------ --------- ------------- ------------ ----------

Consolidated Statement of Comprehensive

Income

for the year ended 30 September 2014

(continued)

Earnings per

share

----------------------- ----- ---------- ------------ --------- ------------- ------------ ----------

Basic 6 36.2p 43.7p 30.0p 33.8p

Diluted 6 35.0p 42.3p 28.8p 32.5p

----------------------- ----- ---------- ------------ --------- ------------- ------------ ----------

**Restated for the change in accounting for pension costs. See

note 1.

*** Items that are not subsequently reclassified to the income

statement.

****Items that may be subsequently reclassified to the income

statement.

Consolidated Balance Sheet

as at 30 September 2014

As at As at

30 Sept 30 Sept

14 13

Note GBP'000 GBP'000

---------------------------------------- ----- --------- ---------

Assets

Non-current assets

Intangible assets 17,240 16,541

Property, plant and equipment 19,575 20,387

36,815 36,928

---------------------------------------- ----- --------- ---------

Current assets

Inventories 12,887 13,374

Trade and other receivables 19,157 20,677

Derivative financial instruments 2 214

Cash and cash equivalents 10 2,925 184

---------------------------------------- -----

34,971 34,449

---------------------------------------- ----- --------- ---------

Liabilities

Current liabilities

Trade and other payables 17,755 16,680

Provisions for liabilities and charges 7 1,846 616

Current tax liabilities 6,852 6,073

---------------------------------------- -----

26,453 23,369

---------------------------------------- ----- --------- ---------

Net current assets 8,518 11,080

---------------------------------------- ----- --------- ---------

Non-current liabilities

Borrowings 10 - 11,059

Deferred tax liabilities 2,315 2,977

Retirement benefit obligations 16,029 11,279

Provisions for liabilities and charges 7 1,973 1,997

---------------------------------------- -----

20,317 27,312

--------- ---------

Net assets 25,016 20,696

---------------------------------------- ----- --------- ---------

Shareholders' equity

Ordinary shares 8 31,023 30,723

Share premium account 34,708 34,708

Capital redemption reserve 500 500

Translation reserve (932) (626)

Accumulated losses (40,283) (44,609)

---------------------------------------- -----

Total equity 25,016 20,696

---------------------------------------- ----- --------- ---------

Consolidated Cash Flow Statement

for the year ended 30 September 2014

Year

Year to to

30 Sept 30 Sept

14 13

Note GBP'000 GBP'000

---------------------------------------------- ----- --------- ---------

Cash flows from operating activities

---------------------------------------------- ----- --------- ---------

Cash generated before the impact of

exceptional items 26,500 15,541

Cash impact of exceptional items (983) (241)

---------------------------------------------- ----- --------- ---------

Cash generated from operations 9 25,517 15,300

Finance income received 1 1

Finance costs paid (315) (365)

Retirement benefit deficit recovery

contributions (513) (592)

Tax paid (2,903) (2,229)

Net cash generated from operating activities 21,787 12,115

---------------------------------------------- ----- --------- ---------

Cash flows from investing activities

Proceeds from sale of property, plant

and equipment 19 2

Purchase of property, plant and equipment (3,753) (6,339)

Capitalised development costs and purchased

software (3,062) (4,715)

Acquisition of VR Technology Holdings (50) (439)

Net cash used in investing activities (6,846) (11,491)

---------------------------------------------- ----- --------- ---------

Cash flows from financing activities

Net movements in loans (10,805) 2,281

Dividends paid to shareholders (1,422) (1,132)

Purchase of own shares - (1,765)

Net cash used in financing activities (12,227) (616)

---------------------------------------------- ----- --------- ---------

Net increase in cash, cash equivalents

and bank overdrafts 2,714 8

Cash, cash equivalents and bank overdrafts

at beginning of the year 184 176

Effects of exchange rate changes 27 -

---------------------------------------------- ----- --------- ---------

Cash, cash equivalents and bank overdrafts

at end of the year 10 2,925 184

---------------------------------------------- ----- --------- ---------

Consolidated Statement of Changes

in Equity

for the year ended 30 September 2014

Share Share Other Accumulated

capital Premium reserves losses Total

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- ----- -------- -------- --------- ------------ --------

At 1 October 2012 30,723 34,708 (52) (41,482) 23,897

Profit for the year** - - - 8,837 8,837

Unrealised exchange

differences on overseas

investments - - (74) - (74)

Actuarial loss recognised

on retirement benefit

scheme** - - - (9,180) (9,180)

--------------------------- ----- -------- -------- --------- ------------ --------

Total comprehensive

expense for the year - - (74) (343) (417)

Dividends paid - - - (1,132) (1,132)

Purchase of shares by

the employee benefit

trust - - - (1,765) (1,765)

Movement in respect

of employee share scheme - - - 113 113

--------------------------- ----- -------- -------- --------- ------------ --------

At 30 September 2013 30,723 34,708 (126) (44,609) 20,696

Profit for the year - - - 10,811 10,811

Unrealised exchange

differences on overseas

investments - - (306) - (306)

Actuarial loss recognised

on retirement benefit

scheme - - - (4,851) (4,851)

--------------------------- ----- -------- -------- --------- ------------ --------

Total comprehensive

income for the year - - (306) 5,960 5,654

Dividends paid 5 - - - (1,422) (1,422)

Issue of shares 8 300 - - - 300

Purchase of shares by

employee benefit trust 8 - - - (300) (300)

Movement in respect

of employee share scheme - - - 88 88

At 30 September 2014 31,023 34,708 (432) (40,283) 25,016

--------------------------- ----- -------- -------- --------- ------------ --------

Other reserves consist of the capital redemption reserve of

GBP500,000 (2013: GBP500,000) and the translation reserve of

GBP932,000 (2013: GBP626,000).

All movements in other reserves relate to the translation

reserve.

**Restated for the change in accounting for pension costs. See

note 1.

NOTES TO THE PRELIMINARY FINANCIAL STATEMENTS FOR THE YEAR ENDED

30 SEPTEMBER 2014

1. Basis of preparation

a) These financial results do not comprise statutory accounts

for the year ended 30 September 2014 within the meaning of Section

434 of the Companies Act 2006. Statutory accounts for the year

ended 30 September 2013 were approved by the Board of Directors on

20 November 2013 and delivered to the Registrar of Companies.

Statutory accounts for the year ended 30 September 2014 will be

delivered to the Registrar following the Company's Annual General

Meeting. The report of the auditors on these accounts was

unqualified, did not contain an emphasis of matter paragraph and

did not contain any statement under Section 498 of the Companies

Act 2006.

b) This financial information has been prepared in accordance

with International Financial Reporting Standards and International

Financial Reporting Interpretations Committee (IFRIC)

interpretations as adopted by the European Union (collectively

'IFRSs') and with those parts of the Companies Act 2006 applicable

to companies reporting under IFRS.

c) Standards, amendments and interpretations effective in 2014

The following amendment has been adopted in preparing the

condensed consolidated financial information for the year ended 30

September 2014:

- IAS 19 (revised), 'Employee benefits'

The main changes affecting the Group are as follows:

-- Interest income or expense has been calculated by applying

the discount rate to the net defined benefit liability or asset as

at the previous year end. Previously interest cost was calculated

on the defined benefit obligation and expected return calculated on

plan assets.

-- Costs associated with investment management are deducted from

the return on plan assets (which is unchanged from the previous

standard). Other expenses are recognised in the consolidated

statement of comprehensive income as incurred.

This resulted in an increase in the amounts charged to the

income statement of GBP0.8m for the year ended 30 September 2014

over the cost under the previous standard and a 2.6p reduction in

earnings per share, with a similar impact on the statutory

comparatives for the year ended 30 September 2013, as shown

below:

Year to 30 Sept

2013

Reported Restate Restated

GBP'000 GBP'000 GBP'000

----------------------------------------- --------- -------- ---------

Operating profit 13,423 (420) 13,003

Finance income 1 - 1

Finance costs (348) - (348)

Other finance income/(expense) 118 (371) (253)

----------------------------------------- --------- -------- ---------

Profit before taxation 13,194 (791) 12,403

Taxation (3,566) - (3,566)

----------------------------------------- --------- -------- ---------

Profit for the year 9,628 (791) 8,837

----------------------------------------- --------- -------- ---------

Other comprehensive expense

Actuarial loss recognised on retirement

benefit scheme (9,971) 791 (9,180)

Net exchange differences offset

in reserves (74) - (74)

----------------------------------------- --------- -------- ---------

Other comprehensive expense for

the year, net of taxation (10,045) 791 (9,254)

----------------------------------------- --------- -------- ---------

Total comprehensive expense for

the year (417) - (417)

----------------------------------------- --------- -------- ---------

Earnings per share

Basic 32.7p (2.7p) 30.0p

Diluted 31.4p (2.6p) 28.8p

----------------------------------------- --------- -------- ---------

In the analysis above, the discount rate has been applied to the

net deficit. Administration costs have been charged against

operating profit and investment management costs have been included

in other comprehensive income.

On the face of the consolidated statement of comprehensive

income, adjusted results have been disclosed which exclude defined

benefit pension scheme costs as these relate to a scheme closed to

future accrual and are not therefore relevant to current

operations. No adjustment has been made to other comprehensive

income.

d) The classification of overhead costs between selling and

distribution costs and general and administrative expenses has been

represented to provide more relevant information. There is no

impact on operating profit.

2. Segmental analysis

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision-maker.

The chief operating decision maker, who is responsible for

allocating resources and assessing performance of the operating

segments, has been identified as the Group Executive team.

The Group has two clearly defined business segments, Protection

& Defence and Dairy, and operates out of the UK and the US.

Business Segments

Year ended 30 September 2014

Protection & Defence Dairy Unallocated Group

GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------------------------- --------------------- -------- ------------ --------

Revenue 92,818 31,961 124,779

------------------------------------------------------- --------------------- -------- ------------ --------

Segment result before depreciation, amortisation,

exceptional items and defined pension scheme

costs 18,542 6,600 (2,239) 22,903

Depreciation of property, plant and equipment (3,289) (771) (67) (4,127)

Amortisation of development costs and software (1,670) (94) (9) (1,773)

------------------------------------------------------- --------------------- -------- ------------ --------

Segment result before amortisation of acquired

intangibles, exceptional items and defined

pension scheme costs 13,583 5,735 (2,315) 17,003

Amortisation of acquired intangibles (261) (261)

Exceptional items (2,017) (2,017)

Defined benefit pension scheme costs (400) (400)

------------------------------------------------------- --------------------- -------- ------------ --------

Segment result 11,305 5,735 (2,715) 14,325

Finance income 1 1

Finance costs (275) (275)

Other finance expense (187) (187)

------------------------------------------------------- --------------------- -------- ------------ --------

Profit before taxation 11,305 5,735 (3,176) 13,864

Taxation (3,053) (3,053)

------------------------------------------------------- --------------------- -------- ------------ --------

Profit for the year 11,305 5,735 (6,229) 10,811

------------------------------------------------------- --------------------- -------- ------------ --------

Segment assets 52,128 13,501 6,157 71,786

------------------------------------------------------- --------------------- -------- ------------ --------

Segment liabilities 12,011 1,946 32,813 46,770

------------------------------------------------------- --------------------- -------- ------------ --------

Other segment items

Capital expenditure

- intangible assets 2,725 337 - 3,062

- property, plant and equipment 1,898 1,825 8 3,731

------------------------------------------------------- --------------------- -------- ------------ --------

Year ended 30 September

2013

Protection Dairy Unallocated Group

& Defence

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- ----------- -------- ------------ --------

Revenue 93,137 31,714 124,851

---------------------------------- ----------- -------- ------------ --------

Segment result before

depreciation, amortisation,

exceptional items and

defined benefit pension

scheme costs 16,136 5,835 (1,948) 20,023

Depreciation of property,

plant and equipment (3,221) (623) (52) (3,896)

Amortisation of development

costs and software (1,868) (32) (4) (1,904)

---------------------------------- ----------- -------- ------------ --------

Segment result before

amortisation of acquired

intangibles, exceptional

items and defined benefit

pension scheme costs 11,047 5,180 (2,004) 14,223

Amortisation of acquired

intangibles (417) (417)

Exceptional items (383) (383)

Defined benefit pension

scheme costs (420) (420)

---------------------------------- ----------- -------- ------------ --------

Segment result 10,247 5,180 (2,424) 13,003

Finance income 1 1

Finance costs (348) (348)

Other finance expense (253) (253)

---------------------------------- ----------- -------- ------------ --------

Profit before taxation 10,247 5,180 (3,024) 12,403

Taxation (3,566) (3,566)

---------------------------------- ----------- -------- ------------ --------

Profit for the year 10,247 5,180 (6,590) 8,837

---------------------------------- ----------- -------- ------------ --------

Segment assets 57,556 11,748 2,073 71,377

---------------------------------- ----------- -------- ------------ --------

Segment liabilities 10,691 3,371 36,619 50,681

---------------------------------- ----------- -------- ------------ --------

Other segment items

Capital expenditure

- intangible assets 3,474 304 809 4,587

- property, plant and

equipment 4,665 1,419 91 6,175

---------------------------------- ----------- -------- ------------ --------

3. Amortisation of acquired intangible assets and exceptional items

2014 2013

GBP'000 GBP'000

-------------------------------------------- -------- --------

Amortisation of acquired intangible assets 261 417

------------------------------------------------- -------- --------

Exceptional items 2014 2013

GBP'000 GBP'000

-------------------------------------------- -------- --------

Relocation of AEF facility - 304

Relocation of Lawrenceville facility 2,017 -

Acquisition costs - 79

------------------------------------------------- -------- --------

2,017 383

-------------------------------------------- -------- --------

The tax impact of the above is a GBP0.45m reduction in overseas

tax payable (2013: GBP0.12m)

In the consolidated statement of comprehensive income the

exceptional items are included within administrative expenses.

The acquisition costs in 2013 relate to the purchase of VR

Technology Holdings and other potential acquisitions investigated

that year.

4. Taxation

2014 2013

GBP'000 GBP'000

----------------------------- -------- --------

United Kingdom - -

Overseas 3,053 3,566

------------------------------ -------- --------

3,053 3,566

Effect of exceptional items 450 122

------------------------------ -------- --------

Adjusted tax charge 3,503 3,688

------------------------------ -------- --------

The effective tax rate for the year is 22% (30 September 2013:

29%).

The adjusted effective tax rate, where the tax charge and the

profit before taxation are adjusted for exceptional items, the

amortisation of acquired intangibles and defined benefit pension

scheme costs is 21% (30 September 2013: 27%).

5. Dividends

On 6 Feburary 2014, the shareholders approved a final dividend

of 2.88p per qualifying ordinary share in respect of the year ended

30 September 2013. This was paid on 21 March 2014 absorbing

GBP862,000 of shareholders' funds.

On 30 April 2014, the Board of Directors declared an interim

dividend of 1.87p (2013: 1.44p) per qualifying ordinary share in

respect of the year ended 30 September 2014. This was paid on 5

September 2014 absorbing GBP560,000 (2013: GBP424,000) of

shareholders' funds.

After the balance sheet date the Board of Directors proposed a

final dividend of 3.74p per qualifying ordinary share in respect of

the year ended 30 September 2014, which will absorb an estimated

GBP1,119,000 of shareholders' funds. Subject to shareholder

approval, the dividend will be paid on 20 March 2015 to

shareholders on the register at the close of business on 20

February 2015. In accordance with accounting standards this

dividend has not been provided for and there are no corporation tax

consequences.

6. Earnings per share

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares in issue during the year, excluding those

held in the employee share ownership trust. The company has

dilutive potential ordinary shares in respect of the Performance

Share Plan. Adjusted earnings per share adds back to profit the

effect of the amortisation of acquired intangible assets,

exceptional items and defined benefit pension costs.

Reconciliations of the earnings and weighted average number of

shares used in the calculations are set out below.

2014 2013

----------------------------------- ---- -------- ------ -------- -------- ------- -----------------

Weighted average number of

ordinary shares in

issue used in basic calculations

(thousands) 29,871 29,451

Potentially dilutive shares

(weighted average) (thousands) 979 1,231

Fully diluted number of

ordinary shares

(weighted average) (thousands) 30,850 30,682

----------------------------------------- -------- ------ -------- -------- ------- -----------------

2014 2014 2014 2013 2013 2013

Basic Diluted Basic Diluted

eps eps eps eps

GBP'000 pence pence GBP'000 pence pence

----------------------------------- ---- -------- ------ -------- -------- ------- -----------------

Profit attributable

to equity shareholders

of the Company 10,811 36.2 35.0 8,837 30.0 28.8

Adjustments 2,240 7.5 7.3 1,131 3.8 3.7

Profit excluding amortisation

of acquired intangibles

assets, exceptional

items and defined benefit

pension scheme costs 13,051 43.7 42.3 9,968 33.8 32.5

----------------------------------------- -------- ------ -------- -------- ------- -----------------

7. Provisions for liabilities and charges

Facility Property

Relocation obligations Total

GBP'000 GBP'000 GBP'000

--------------------------- ----------- ------------ --------

Balance at 1 October 2012 - 2,993 2,993

Unwinding of discount - 220 220

Payments in the year - (600) (600)

--------------------------- ----------- ------------ --------

Balance at 30 September

2013 - 2,613 2,613

Charged in the year 1,637 1,632 3,269

Unwinding of discount - 175 175

Payments in the year (1,191) (1,056) (2,247)

Exchange difference 8 1 9

--------------------------- ----------- ------------ --------

Balance at 30 September

2014 454 3,365 3,819

--------------------------- ----------- ------------ --------

8. Share capital

2014 2013

------------------------------ ------- -------

Number of shares (thousands) 31,023 30,723

Ordinary shares (GBP'000) 31,023 30,723

------------------------------- ------- -------

During the year, 300,000 ordinary shares with a nominal value of

GBP1 per share were issued at par to the Avon Rubber p.l.c.

Employee Share Ownership Trust No. 1.

9. Cash generated from operations

2014 2013

GBP'000 GBP'000

--------------------------------------- -------- --------

Profit for the year 10,811 8,837

Adjustments for:

Taxation 3,053 3,566

Depreciation 4,127 3,896

Amortisation of intangible assets 2,034 2,321

Defined benefit pension scheme cost 400 420

Finance income (1) (1)

Finance costs 275 348

Other finance expense 187 253

Loss on disposal of intangibles 149 62

Loss on disposal of property, plant

and equipment 209 24

Movement in respect of employee share

scheme 88 113

Decrease in inventories 370 2,259

Decrease/(increase)

in receivables 1,479 (6,295)

Increase/(decrease) in payables and

provisions 2,336 (503)

25,517 15,300

--------------------------------------- -------- --------

10. Analysis of net cash / (debt)

This note sets out the calculation of net cash / (debt), a

measure considered important in explaining our financial

position.

At 30

At 1 Oct Exchange Sept

Cash

2013 flow movements 2014

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- --------- -------- ---------- --------

Cash at bank and in hand 184 2,714 27 2,925

--------------------------------- --------- -------- ---------- --------

Net cash and cash equivalents 184 2,714 27 2,925

Debt due in more than 1 year (11,059) 10,805 254 -

(10,875) 13,519 281 2,925

------------------------------- --------- -------- ---------- --------

On 9 June 2014 the Group agreed new bank facilities with

Barclays Bank and Comerica Bank. The combined facility comprises a

revolving credit facility of $40m and expires on 30 November 2017.

This facility is priced on the dollar LIBOR plus a margin of 1.25%

and includes financial covenants which are measured on a quarterly

basis. The Group was in compliance with its financial covenants

during 2014 and 2013.

11. Exchange rates

The following significant exchange

rates applied during the year.

Average Closing Average Closing

rate rate rate rate

2014 2014 2013 2013

--------------- ----------- ---------- -------- --------

US Dollar 1.654 1.631 1.559 1.612

Euro 1.221 1.281 1.188 1.191

----------------- ----------- ---------- -------- --------

Fair value of financial instruments

The fair value of forward exchange contracts is determined by

using valuation techniques using year end spot rates, adjusted for

the forward points to the value date of the contract.

12. Annual Report & Accounts

Copies of the Directors' report and the audited financial

statements for the year ended 30 September 2014 will be posted to

shareholders who have elected to receive a copy and may also be

obtained from the Company's registered office at Hampton Park West,

Semington Road, Melksham, Wiltshire, SN12 6NB, England. Full

audited financial statements will be available on the Company's

website at www.avon-rubber.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR GGGGPGUPCGMR

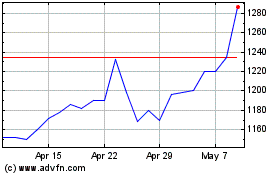

Avon Protection (LSE:AVON)

Historical Stock Chart

From Mar 2024 to Apr 2024

Avon Protection (LSE:AVON)

Historical Stock Chart

From Apr 2023 to Apr 2024