TIDMAVON

RNS Number : 4475Y

Avon Rubber PLC

01 December 2014

1 December 2014

Avon Rubber p.l.c. ("the Company")

Directors' and PDMRs' Interest in Shares

On the 28 November 2014, pursuant to the Company's deferred

bonus arrangement, a portion of the annual bonus payments due to

the Executive Directors and certain PDMRs in respect of the 2013/14

financial year were deferred into Company shares. 25% of the annual

bonus linked to financial targets, as distinct from personal

performance targets, was subjected to tax and national

insurance/social security and the net amount was used to purchase

Company shares. The shares are to be held for two years and are not

subject to the Company's shareholding guidelines. The table below

sets out the number of deferred bonus shares for each Executive

Director and PDMR. This is the first time this arrangement has been

implemented under the Remuneration Policy approved by shareholders

in February 2014.

Executive Directors Deferred bonus shares

---------------------- ----------------------

Peter Slabbert 7,477

---------------------- ----------------------

Andrew Lewis 5,710

---------------------- ----------------------

PDMRs

---------------------- ----------------------

Miles Ingrey-Counter 1,824

---------------------- ----------------------

Paul McDonald 1,809

---------------------- ----------------------

John Kime 2,600

---------------------- ----------------------

In addition, as disclosed in the 2014 annual report, awards

representing 100% of the maximum possible award under the Avon

Rubber p.l.c. Performance Share Plan 2010, were granted to

Executive Directors, persons discharging managerial

responsibilities ('PDMRs') and other employees (together

'Participants') on 1 December 2011 ('the 2011 Awards').

The Awards were made subject to performance conditions based on

the Company's Total Shareholder Return ('TSR') and Earnings Per

Share ('EPS'), to be measured over a 3 year performance period

which commenced on 1 October 2011 and ended on 30 September 2014.

The Company's TSR performance by reference to the comparator group

was measured over the 5 days following the announcement of the

Company's annual results for the year ended 30 September 2014. The

Company's EPS performance was measured by reference to the EPS in

the 2014 year end results.

The Remuneration Committee confirmed on 28 November 2014 that

96% of the Awards vested.

The Company received valid notices from the Participants in

respect of the 2011 Awards. As a result, on 28 November 2014, the

UK Participants, pursuant to the terms of the relevant joint

ownership awards, sold their vested interests over all jointly

owned shares in the market and exercised their nil cost options to

acquire whole shares in the Company (all tax and National Insurance

liabilities associated with the vesting of the 2011 Awards have

been met out of the sale proceeds due to the UK Participants). US

Participants have acquired whole shares pursuant to their 2011

Awards and sold a number of shares to meet tax and social security

liabilities. A number of sales by Participants and their connected

persons were also carried out for personal reasons.

Following these transactions, in accordance with the

shareholding guidelines referred to in the annual report, both the

Executive Directors have a retained shareholding equivalent to at

least two times base salary.

The table below sets out the total number of shares over which

the 2011 Awards were made to the Executive Directors and PDMRs,

total disposals, the net increase or decrease in the shares owned

by the relevant individuals and their total shareholdings following

these transactions (details in respect of connected persons are set

out in the notes):

Total Whole shares Whole Net increase/(decrease) Total shareholding***

Vested acquired shares in shareholding

Award* under nil disposed**

cost option

or conditional

award

---------------------- -------- ---------------- ------------ ------------------------ ----------------------

Executive Directors

------------------------------------------------------------------------------------------------------------------

Peter Slabbert 84,000 39,548 104,548 (65,000) 137,690

---------------------- -------- ---------------- ------------ ------------------------ ----------------------

Andrew Lewis 48,000 22,599 62,599 (40,000) 81,155

---------------------- -------- ---------------- ------------ ------------------------ ----------------------

PDMRs

------------------------------------------------------------------------------------------------------------------

Miles Ingrey-Counter 20,701 9,746 9,746 nil 40,303

---------------------- -------- ---------------- ------------ ------------------------ ----------------------

Paul McDonald 21,600 10,170 nil 10,170 49,044

---------------------- -------- ---------------- ------------ ------------------------ ----------------------

John Kime

(US) 27,020 27,020 9,282 17,738 33,257

---------------------- -------- ---------------- ------------ ------------------------ ----------------------

*96% of the total number of the 2011 Awards. Each executive held

an interest in the number of shares shown in the above table which

was sold, on 28 November, following the vesting of the 2011 Awards.

The proceeds due to the executives on sale of the jointly owned

shares were determined by the 2011 Joint Ownership Agreements as

GBP3.72 per share.

** Some of the whole shares disposed were sold from pre-existing

holdings by spouses and, in the case of Peter Slabbert, his son.

Specifically, Desiree Slabbert sold 53,000 shares, Simon Slabbert

sold 12,000 shares, Karen Lewis sold 40,000 shares and Emma

Ingrey-Counter sold 3,000 shares.

***This excludes interests held under unvested joint ownership

awards. The total shareholding number includes shares held by

connected persons. In respect of Peter Slabbert, the total share

number is constituted by 27,069 shares held by Peter Slabbert,

102,621 shares held by Desiree Slabbert and 8,000 shares held by

Simon Slabbert. In the case of Andrew Lewis, the total share number

is constituted by 804 shares held by Andrew Lewis and 80,351 shares

held by Karen Lewis. In the case of Miles Ingrey-Counter, the total

share number is constituted by 3,804 shares held by Miles

Ingrey-Counter and 36,499 shares held by Emma Ingrey-Counter. In

the case of Paul McDonald, the total share number is constituted by

28,607 shares held by Paul McDonald and 20,437 shares held by

Deborah McDonald. John Kime's shareholding is in his own name.

Other employees accounted for total vested awards of 125,809

shares. Other UK participants sold their jointly owned interests in

50,477 shares and acquired nil cost options over 23,765 whole

shares, of which 8,529 were sold for personal reasons. Other US

participants acquired 75,332 whole shares of which 48,441 were sold

to pay tax and for personal reasons.

Contact Information:

Peter Slabbert, Chief Executive 01225 896870

Andrew Lewis, Group Finance Director 01225 896830

Miles Ingrey-Counter, Company Secretary 01225 896850

This information is provided by RNS

The company news service from the London Stock Exchange

END

RDSUAVKRSRAURRA

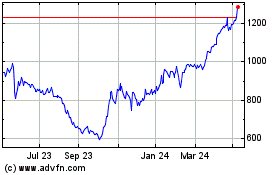

Avon Protection (LSE:AVON)

Historical Stock Chart

From Mar 2024 to Apr 2024

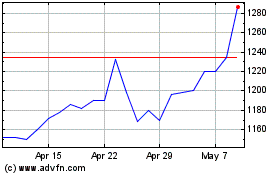

Avon Protection (LSE:AVON)

Historical Stock Chart

From Apr 2023 to Apr 2024