Aviva Suspends U.K. Property Fund in Brexit Turmoil

July 05 2016 - 10:10AM

Dow Jones News

LONDON—Aviva Investors has stopped investors from pulling money

out of a U.K. focused property trust, the second big insurer to

suspend a fund after Britain's vote to leave the European

Union.

The U.K. fund management arm of the insurer Aviva said on

Tuesday that investors have been asking to pull out more money than

normal from its £ 1.8 billion ($2.36 billion) Aviva Investors

Property Trust following "the extraordinary market circumstances,

which are impacting the wider industry."

"We have acted to safeguard the interests of all our investors

by suspending dealing in the fund with immediate effect," the firm

said in a statement.

"Suspension of dealing will give Aviva Investors greater control

in managing cash flows and conducting orderly asset sales to meet

our obligations to investors wishing to redeem their holdings."

Aviva's decision comes one day after Standard Life Investments

suspended trading in a £ 2.9 billion U.K. commercial real-estate

fund. The decision was taken following an increase in redemption

requests as a result of uncertainty for the U.K. commercial

real-estate market following the EU referendum result," Standard

Life Investments said in a statement.

A spokeswoman said the fund will be closed for the foreseeable

future to give the fund manager more time to sell assets to raise

its cash levels at the best possible price.

It is rare for fund managers to impose such so-called gates on

funds, although it became more of an issue after the financial

crisis, notably when New Star prevented withdrawals to one of its

property funds in late 2008. At that time, fears of falling

property prices triggered high levels of requests from investors to

pull their money out. Funds were unable to meet these requests.

Analysts and consultants have said it is still too soon to tell

the full impact of Brexit on the property sector, but the vote to

leave the EU has heightened uncertainty among buyers and sellers.

The Bank of England's Financial Stability Report, issued Tuesday,

said flows from foreign investors into commercial real estate fell

by almost 50% in the first quarter this year.

Numis analysts, in a research note, said that Standard Life's

decision to close its property fund to redemptions "is spooking the

market."

"Without wishing to be alarmist or sensationalist, Standard

Life's decision to close its open-ended property fund to

redemptions concerns us," they wrote. "There is clearly fear that

prices tomorrow will be substantially lower than pricing

today."

Total net outflows from U.K. property rose to £ 360 million in

May, according to data from the Investment Association. Numis said

it expected significant outflows in June and July.

Mike Prew, an analyst at Jefferies Group LLC, said it was likely

more retail property funds will put so-called gates up as investors

look to meet high redemptions from investors.

"It is symptomatic of the nature of these open ended funds,

taking by definition, cash which is by nature liquid, and putting

it into an illiquid asset class," he said.

He added that the market is also facing a "Mexican standoff"

following the Brexit vote, in part because sellers are unable to

find buyers who will meet their internal valuations. "But the

market is cracking quite clearly," he said.

Shares in U.K property companies sold off sharply Tuesday as

investors responded to the suspension of trading in a U.K.

commercial real-estate fund on Monday.

Land Securities Group PLC and British Land Company PLC, two of

the largest real-estate investment trusts, were both down by more

than 2.5% just after midday.

Bill Oliver, chief executive of St. Modwen Properties PLC, a

residential land and development specialist whose share price was

down 8.6% after it reported earnings for the first half of the year

Tuesday, said following the referendum result on June 23, "we are

now operating in a period of uncertainty in relation to many

factors that impact the property market."

"Whilst it is too early to accurately predict how the U.K.

property market will respond, until we have more clarity we believe

it is appropriate to take a more cautious approach to the delivery

of our development strategy," he said

â "Gren Manuel contributed to this article.

WSJ City provides insight and intelligence on how the Brexit

vote is impacting the city.

(END) Dow Jones Newswires

July 05, 2016 09:55 ET (13:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

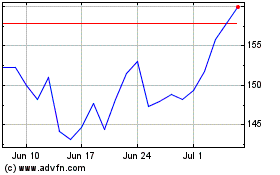

Abrdn (LSE:ABDN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Abrdn (LSE:ABDN)

Historical Stock Chart

From Apr 2023 to Apr 2024