AvalonBay Communities, Inc. (NYSE:AVB) (the “Company”) reported

today Net Income Attributable to Common Stockholders for the

quarter ended December 31, 2014 of $142,642,000. This resulted

in Earnings per Share – diluted (“EPS”) of $1.08 for the three

months ended December 31, 2014, compared to $1.95 per share for the

comparable period of 2013. For the year ended December 31, 2014,

EPS was $5.21 compared to EPS of $2.78 for the year ended December

31, 2013, an increase of 87.4%.

The decrease in EPS for the three months ended December 31, 2014

from the prior year period is due primarily to a decrease in real

estate sales and related gains, partially offset by increases in

Net Operating Income (“NOI”) from newly developed and operating

communities.

The increase in EPS for the year ended December 31, 2014 over

the prior year is due primarily to (i) an increase in joint venture

income resulting from the gains on sales of communities in various

ventures, including the Company’s promoted interests; (ii)

increases in NOI from newly developed and acquired communities;

(iii) a decrease in depreciation expense related to in-place leases

acquired as part of the Archstone acquisition, as described in the

Company’s first quarter 2013 earnings release dated April 30, 2013;

(iv) a decrease in expensed acquisition costs related to the

Archstone acquisition; and (v) a loss on a forward interest rate

contract in 2013 not present in 2014. These increases are partially

offset by a decrease in real estate sales and related gains in 2014

as compared to prior year.

Funds from Operations attributable to common stockholders -

diluted (“FFO”) per share for the three months ended December 31,

2014 increased 16.6% to $1.76 from $1.51 for the comparable period

of 2013. FFO per share for the year ended December 31, 2014

increased 43.6% to $7.25 from $5.05 for the comparable period of

2013. FFO per share adjusted for non-routine items as detailed in

the Definitions and Reconciliations of this release ("Core FFO" per

share) increased by 7.4% to $1.74 and 8.8% to $6.78 for the three

months and year ended December 31, 2014, respectively, over the

prior year periods.

The following table compares the Company’s actual results for

FFO per share and Core FFO per share for the three months ended

December 31, 2014 to its October 2014 outlook:

Fourth Quarter 2014 Results

Comparison to October 2014 Outlook Per Share

FFO Core FFO Projected per share - October

2014 outlook (1) $ 1.77 $ 1.76 Community revenue 0.02 0.01

Community operating expenses (0.02 ) (0.02 ) Joint venture income

0.02 — Income taxes (0.07 ) — Acquisition costs net of recoveries

0.06 — Overhead and other (0.02 ) (0.01 ) Q4 2014 per share

reported results $ 1.76 $ 1.74 (1) Represents

the mid-point of the Company's October 2014 outlook.

The variance in the Company’s actual results for the year ended

December 31, 2014 is largely consistent with the variance for the

three months ended December 31, 2014.

Commenting on the Company’s results, Tim Naughton, Chairman and

CEO, said, "2014 was another outstanding year for AvalonBay. We

delivered Core FFO per share growth of nearly 9% and completed a

record $1.1 billion of new development activity. Together, healthy

apartment demand and continuing development activity supports our

2015 outlook for Core FFO per share growth of over 8% and our

dividend increase of 7.8%."

Operating Results for the Quarter Ended December 31,

2014 Compared to the Prior Year Period

For the Company, including discontinued operations, total

revenue increased by $40,654,000, or 10.2%, to $440,656,000. This

increase is primarily due to growth in revenue from development

communities and growth in Established Community revenue noted

below.

The Company updated its Established Communities portfolio, as of

April 1, 2014, primarily to incorporate the stabilized assets

acquired as part of the Archstone acquisition, which closed in

February 2013. The Company's Established Communities' operating

results for the three months ended December 31, 2014 include most

of the stabilized operating communities acquired as part of the

Archstone acquisition.

For Established Communities as of April 1, 2014, which includes

51,201 apartment homes, average rental rates increased 3.8%, and

Economic Occupancy increased 0.3%, resulting in an increase in

rental revenue of 4.1%. If the Company were to include current and

previously completed redevelopment communities in its Established

Communities portfolio, the increase in Established Communities'

rental revenue would have been 4.2%. Total revenue for Established

Communities increased $13,821,000 to $335,794,000. Operating

expenses for Established Communities increased $893,000, or 0.9%,

to $102,138,000. Accordingly, NOI for Established Communities

increased $12,928,000, or 5.9%, to $233,656,000.

The following table reflects the percentage changes in rental

revenue, operating expenses and NOI for Established Communities for

the fourth quarter of 2014 compared to the fourth quarter of

2013:

Q4 2014 Compared to Q4 2013 Established

Communities as of April 1, 2014 - 51,201 apartment homes

Rental Revenue

AvgRent

Ec % of

Rates

Occ

Opex

NOI

NOI (1)

New England 2.5 % 0.4 % 7.3 % 0.5 % 14.6 % Metro NY/NJ 2.9 % 0.2 %

2.9 % 4.4 % 26.3 % Mid-Atlantic

(0.5

)%

(0.3 )% 1.0 % (1.6 )% 16.0 % Pacific NW 6.3 % 0.0 % (1.0 )% 9.6 %

5.0 % No. California 8.0 % 0.1 % (2.6 )% 12.3 % 19.8 % So.

California 5.2 % 0.6 % (3.1 )% 10.7 % 18.3 % Total 3.8 % 0.3

% 0.9 % 5.9 % 100.0 % (1) Represents each region's % of total NOI

from the Company, including discontinued operations.

Operating Results for the Year Ended December 31, 2014

Compared to the Prior Year

For the Company, including discontinued operations, total

revenue increased by $179,845,000, or 11.9%, to $1,685,640,000.

This increase is primarily attributable to communities acquired as

part of the Archstone acquisition, new developments and growth in

Established Community revenue noted below.

The Company's Established Communities' operating results for the

year ended December 31, 2014 do not include any impact from

communities acquired as part of the Archstone acquisition.

For Established Communities, which includes 36,814 apartment

homes as determined at January 1, 2014, average rental rates

increased 4.0%, and were partially offset by a decrease in Economic

Occupancy of 0.1%, resulting in an increase in rental revenue of

3.9%. If the Company were to include current and previously

completed redevelopment communities in its Established Communities

portfolio, the increase in Established Communities' rental revenue

would have been 4.1%. Total revenue for Established Communities

increased $36,642,000 to $965,015,000. Operating expenses for

Established Communities increased $13,681,000, or 4.9%, to

$291,859,000. Accordingly, NOI for Established Communities

increased $22,961,000, or 3.5%, to $673,156,000.

The following table reflects the percentage changes in rental

revenue, operating expenses and NOI for Established Communities for

the year ended December 31, 2014 compared to the year ended

December 31, 2013:

Full Year 2014 Compared to Full Year 2013

Established Communities as of January 1, 2014 - 36,814 apartment

homes Rental Revenue

AvgRent

Ec % of

Rates

Occ

Opex

NOI

NOI (1)

New England 2.9 % (0.4 )% 5.7 % 0.8 % 14.7 % Metro NY/NJ 3.4 % 0.0

% 4.9 % 3.1 % 26.1 % Mid-Atlantic (0.2 )% (0.3 )% 4.6 % (2.5 )%

16.1 % Pacific NW 6.2 % (0.3 )% 3.2 % 7.0 % 4.8 % No. California

7.6 % 0.1 % 6.2 % 8.2 % 19.8 % So. California 4.7 % (0.1 )% 3.4 %

5.2 % 18.5 % Total 4.0 % (0.1 )% 4.9 % 3.5 % 100.0 % (1)

Represents each region's % of total NOI from the Company, including

discontinued operations.

Development Activity

During the three months ended December 31, 2014, the Company

engaged in the following development activity:

The Company completed the development of four communities:

- Avalon Exeter, located in Boston,

MA;

- Avalon Mosaic, located in Fairfax,

VA;

- Avalon Huntington Station, located in

Huntington Station, NY; and

- Avalon San Dimas, located in San Dimas,

CA.

These four communities contain an aggregate of 1,177 apartment

homes and were constructed for an aggregate Total Capital Cost of

$358,500,000.

The Company started the construction of three communities:

Avalon Green III, located in Elmsford, NY; Avalon Union, located in

Union, NJ; and Avalon Princeton, located in Princeton, NJ. These

communities will contain a total of 550 apartment homes when

completed and will be developed for an aggregate estimated Total

Capital Cost of $168,300,000.

The Company acquired four land parcels for development, for an

aggregate investment of $40,333,000. The Company has started, or

anticipates starting, construction of apartment communities on

these land parcels during the next 12 months.

The Company added two development rights. If developed as

expected, these development rights will contain a total of 462

apartment homes and will be developed for an aggregate estimated

Total Capital Cost of $418,000,000.

The projected Total Capital Cost of overall development rights

increased to $3.2 billion at December 31, 2014 from $2.9

billion at September 30, 2014 due to the addition of new

development rights, a reduction for construction starts and

adjustments to existing development rights.

In January 2015 the Company acquired land for $25,000,000

related to two development rights. If developed as expected, the

development rights related to this land will contain 648 apartment

homes for a projected Total Capital Cost of $174,343,000.

During 2014 the Company:

- completed the development of 17

communities containing an aggregate of 4,121 apartment homes, for a

Total Capital Cost of $1,134,300,000; and

- commenced the development of 14

communities which are expected to contain an aggregate of 3,914

apartment homes and be completed for a Total Capital Cost of

$1,342,800,000.

Redevelopment Activity

During the three months ended December 31, 2014, the Company

completed the redevelopment of one Avalon and two Eaves

communities, which contain an aggregate of 1,055 apartment homes

and were redeveloped for an aggregate Total Capital Cost of

$27,600,000, excluding costs incurred prior to the

redevelopment.

During 2014 the Company:

- completed the redevelopment of five

communities containing an aggregate of 1,887 apartment homes, for a

Total Capital Cost of $53,000,000, excluding costs incurred prior

to redevelopment; and

- commenced the redevelopment of nine

communities containing an aggregate of 3,428 apartment homes, for a

projected Total Capital Cost of $127,000,000, excluding costs

incurred prior to redevelopment.

Acquisition Activity

During the three months ended December 31, 2014, the Company

acquired Avalon Mission Oaks, located in Camarillo, CA. Avalon

Mission Oaks contains 160 apartment homes and was acquired for a

purchase price of $47,000,000.

Disposition Activity

Consolidated Dispositions

During the three months ended December 31, 2014, the Company

sold one wholly-owned community, Archstone Memorial Heights,

located in Houston, TX, which was acquired as part of the Archstone

acquisition in 2013, and was owned through a taxable REIT

subsidiary. Archstone Memorial Heights contains 556 apartment

homes, was sold for $105,500,000, and resulted in a pre-tax gain in

accordance with GAAP of $23,980,000 and an Economic Gain of

$17,212,000.

During 2014 the Company sold four wholly-owned communities,

including two communities acquired as part of the Archstone

acquisition. The four communities, containing 1,337 apartment

homes, were sold for an aggregate sales price of $296,200,000, and

a weighted average Initial Year Market Cap Rate of 5.0%, resulting

in a pre-tax gain in accordance with GAAP of $106,138,000. The two

legacy AvalonBay communities generated an unleveraged IRR of 12.6%

over a 10.9 year weighted average holding period.

In January 2015, the Company sold Avalon on Stamford Harbor, a

wholly-owned community located in Stamford, CT containing 323

apartment homes and a working marina containing 74 boat slips, for

$115,500,000.

Joint Venture Dispositions

During 2014, real estate ventures in which the Company had a

direct investment, or in which the Company held a residual profits

interest sold 10 communities containing 2,389 apartment homes,

resulting in gains from dispositions of $136,732,000, of which

$60,534,000 represents income from the Company’s promoted interest

in two of the ventures.

Liquidity and Capital Markets

During September 2014 the Company entered into a forward

contract to sell 4,500,000 shares of common stock for an initial

forward price of $151.74 per share, net of offering fees and

discounts (the "Forward"). The sales price and proceeds achieved by

the Company will be determined on the date or dates of settlement,

with adjustments during the term of the contract for the Company’s

dividends as well as for a daily interest factor that varies with

changes in the Fed Funds rate. The Company has not sold any shares

of common stock under the Forward. Settlement of the Forward will

occur on one or more dates not later than September 8, 2015.

At December 31, 2014, the Company did not have any

borrowings outstanding under its $1,300,000,000 unsecured credit

facility, and had $605,085,000 in unrestricted cash and cash in

escrow.

The Company’s annualized Net Debt-to-Adjusted EBITDA for the

fourth quarter of 2014 was 5.2 times.

New Financing Activity

In November 2014, the Company issued $300,000,000 principal

amount of unsecured notes in a public offering under its existing

shelf registration statement for net proceeds of approximately

$295,803,000. The notes mature in November 2024 and were issued at

a 3.50% interest rate.

First Quarter 2015 Dividend Declaration

The Company’s Board of Directors declared a dividend for the

first quarter of 2015 of $1.25 per share on the Company’s common

stock (par value of $0.01 per share). The declared dividend is a

7.8% increase over the Company’s prior quarterly dividend of $1.16

per share. The dividend is payable on April 15, 2015 to common

stockholders of record as of March 31, 2015.

In declaring the increased dividend, the Board of Directors

evaluated the Company’s past performance and future prospects for

earnings growth. Additional factors considered in determining the

increase included current common dividend distributions, the

relationship of the current common dividend distribution to the

Company’s FFO, the relationship of dividend distributions to

taxable income, distribution requirements under rules governing

real estate investment trusts, and expected growth in taxable

income.

Edgewater Casualty Loss

A fire occurred on January 21, 2015 at the Company's Avalon at

Edgewater apartment community located in Edgewater, New Jersey

("Edgewater"). Edgewater consists of two residential buildings. One

building, which contained 240 apartment homes, is uninhabitable and

the Company currently believes it suffered a total or near total

loss. The second building, which contains 168 apartment homes, has

been reoccupied and the Company currently believes it only suffered

minimal damage. The Company is currently assessing the loss

resulting from the fire, which could vary based on costs and time

to rebuild and eventual settlement of third party claims. The

Company believes this incident is substantially covered by its

insurance policies, including coverage for the replacement cost of

the building, third party claims, and business interruption loss,

subject to deductibles as well as a self-insured portion of the

property insurance for which the Company is obligated for 12% of

the first $50,000,000 in losses.

2015 Financial Outlook

The following presents the Company’s financial outlook for 2015,

the details of which are summarized in the full earnings

release.

In setting operating expectations for 2015, the Company has

considered third party macroeconomic forecasts that project

continued economic growth. The Company has also adjusted its 2015

financial outlook as presented in this release to reflect its

current estimates of the impact of the Edgewater fire. The expected

impact to the Company's Projected FFO per share is approximately

$0.10 and is composed of casualty and operating losses in equal

amounts.

The Company expects Projected EPS to be within a range of $4.65

to $4.95 for the full year 2015. The Company expects 2015 Projected

FFO per share to be in the range of $7.25 to $7.55. Adjusting for

non-routine items as detailed in the Definitions and

Reconciliations of this release, the Company expects 2015 Projected

Core FFO per share to be in the range of $7.20 to $7.50.

The following table compares the 2015 full year outlook for FFO

per share and Core FFO per share to the Company’s actual results

for the full year 2014:

Full Year 2015 Outlook Comparison to

Full Year 2014 Results Per Share FFO

Core FFO 2014 per share reported results $ 7.25 $

6.78 Established Community NOI 0.30 0.32 Other community NOI 0.69

0.69 Capital markets and transaction activity (0.29 )

(0.35

) Joint venture income and management fees (0.31 ) (0.07 )

Edgewater operating and casualty losses (0.10 ) — Overhead and

other (0.14 )

(0.02

) 2015 per share outlook (1) $ 7.40 $ 7.35 (1)

Represents the mid-point of the Company's January 2015 outlook.

For the first quarter of 2015, the Company expects projected EPS

within a range of $1.57 to $1.61. The Company expects Projected FFO

per share in the first quarter of 2015 within a range of $1.86 to

$1.90. Adjusting for non-routine items as detailed in the

Definitions and Reconciliations of this release, the Company

expects Projected Core FFO per share in the first quarter of 2015

to be in the range of $1.71 to $1.75.

The Company’s 2015 financial outlook is based on a number of

assumptions and estimates, some of which are provided in the full

earnings release. The primary macroeconomic assumptions considered

by the Company include the job growth and personal income growth

that the Company expects for 2015, both for the U.S. as a whole and

for the Company’s markets. In the Company’s markets for 2015, the

Company expects job growth and total personal income growth of 2.5%

and 6.7%, respectively.

The following provides additional information on the Company’s

primary estimates and assumptions for 2015:

Property Operations

The following are the Company’s expectations for full year 2015

growth in its Established Community portfolio:

- The Company expects an increase in

Established Communities’ rental revenue of 3.5% to 4.5%.

- The Company expects an increase in

Established Communities’ operating expenses of 3.0% to 4.0%.

- The Company expects an increase in

Established Communities’ NOI of 3.5% to 5.0%.

Development and Redevelopment

- The Company anticipates starting new

developments in 2015 with an estimated Total Capital Cost of

$1,500,000,000, including communities to be constructed in joint

ventures. The Company’s share of the estimated Total Capital Cost

is $1,250,000,000.

- The Company expects to complete the

development of 11 communities with a Total Capital Cost of

approximately $1,200,000,000 in 2015.

- The Company expects an aggregate

investment of $1,550,000,000 in 2015 related to its planned

development activity, including the cost of acquiring land for

future development and amounts associated with communities

developed in joint ventures. Of this amount the Company’s share is

expected to be $1,500,000,000.

- The Company expects to complete and

deliver approximately 3,700 apartment homes in 2015, and expects to

occupy 3,500 new apartment homes during the year.

- The Company expects to invest

approximately $200,000,000 in its redevelopment communities in

2015. Amounts exclude costs incurred prior to redevelopment.

Capital Markets & Transaction Activity

In 2015, the Company anticipates sourcing approximately

$1,750,000,000 in external funding to support its investment

activity. The Company expects to source $660,000,000 of capital

through settlement of the Forward in the second and third quarters

of 2015, with the remaining funding needs expected to be sourced

through a combination of one or more of the following sources:

asset sales, new unsecured debt, and common stock issuances. The

Company’s funding plan is not dependent on any single source of

capital and the ultimate funding sources used will depend on real

estate, interest rate and capital market conditions at the time

that capital is sourced.

First Quarter Conference Schedule

Management is scheduled to present at Citi's Global Property CEO

Conference from March 1 - 4, 2015. Management may discuss the

Company's current operating environment; operating trends;

development, redevelopment, disposition and acquisition activity;

financial outlook; portfolio strategy and other business and

financial matters affecting the Company. Details on how to access a

webcast of the Company's presentation will be available in advance

of the conference event on the Company's website at

http://www.avalonbay.com/events.

Other Matters

The Company will hold a conference call on January 29, 2015 at

1:00 PM ET to review and answer questions about this release, its

fourth quarter and full year 2014 results, its projections for

2015, the Attachments (described below) and related matters. To

participate on the call, dial 800-753-0487 domestically and

913-312-0411 internationally and use conference id: 1861833.

To hear a replay of the call, which will be available from

January 29, 2015 at 6:00 PM ET to February 3, 2015 at 6:00 PM ET,

dial 800-753-0487 domestically and 913-312-0411 internationally,

and use conference id: 1861833. A webcast of the conference call

will also be available at http://www.avalonbay.com/earnings, and an

on-line playback of the webcast will be available for at least 30

days following the call.

The Company produces Earnings Release Attachments (the

"Attachments") that provide detailed information regarding

operating, development, redevelopment, disposition and acquisition

activity. These Attachments are considered a part of this earnings

release and are available in full with this earnings release via

the Company's website at http://www.avalonbay.com/earnings. To receive

future press releases via e-mail, please submit a request through

http://www.avalonbay.com/email.

In addition to the Attachments, the Company provides a

management letter and teleconference presentation that will be

available on the Company's website at http://www.avalonbay.com/earnings before the

market opens on January 29, 2015. These supplemental materials will

be available on the Company's website for 30 days following the

earnings call.

About AvalonBay Communities, Inc.

As of December 31, 2014, the Company owned or held a direct

or indirect ownership interest in 277 apartment communities

containing 82,487 apartment homes in eleven states and the District

of Columbia, of which 26 communities were under construction and

eight communities were under reconstruction. The Company is an

equity REIT in the business of developing, redeveloping, acquiring

and managing apartment communities in the leading metropolitan

areas in New England, the New York/New Jersey Metro area, the

Mid-Atlantic, the Pacific Northwest, and the Northern and Southern

California regions of the United States. More information may be

found on the Company’s website at http://www.avalonbay.com. For

additional information, please contact Jason Reilley, Director of

Investor Relations at 703-317-4681.

Forward-Looking Statements

This release, including its Attachments, contains

forward-looking statements, within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. These forward-looking

statements, which you can identify by the Company’s use of words

such as “expects,” “plans,” “estimates,” “anticipates,” “projects,”

“intends,” “believes,” “outlook” and similar expressions that do

not relate to historical matters, are based on the Company’s

expectations, forecasts and assumptions at the time of this

release, which may not be realized and involve risks and

uncertainties that cannot be predicted accurately or that might not

be anticipated. These could cause actual results to differ

materially from those expressed or implied by the forward-looking

statements. Risks and uncertainties that might cause such

differences include the following, among others: the Company's

preliminary expectations and assumptions as of the date of this

release regarding insurance coverage, lender payoff and refinancing

requirements and potential uninsured loss amounts resulting from

the Avalon at Edgewater fire, as well as the ultimate cost and

timing of replacing the Edgewater building and achieving stabilized

occupancy, are subject to change and could materially affect the

Company's current expectations regarding the impact of the fire and

related loss on the Company's financial condition and results of

operations; we may abandon development or redevelopment

opportunities for which we have already incurred costs; adverse

capital and credit market conditions may affect our access to

various sources of capital and/or cost of capital, which may affect

our business activities, earnings and common stock price, among

other things; changes in local employment conditions, demand for

apartment homes, supply of competitive housing products, and other

economic conditions may result in lower than expected occupancy

and/or rental rates and adversely affect the profitability of our

communities; delays in completing development, redevelopment and/or

lease-up may result in increased financing and construction costs

and may delay and/or reduce the profitability of a community; debt

and/or equity financing for development, redevelopment or

acquisitions of communities may not be available or may not be

available on favorable terms; we may be unable to obtain, or

experience delays in obtaining, necessary governmental permits and

authorizations; expenses may result in communities that we develop

or redevelop failing to achieve expected profitability; our

assumptions concerning risks relating to our lack of control of

joint ventures and our abilities to successfully dispose of certain

assets may not be realized; our assumptions and expectations in our

financial outlook may prove to be too optimistic; the expected

proceeds from settlement of the Forward are subject to adjustment

for changes in the Fed Funds rate and the amount of dividends we

pay on our common stock, and our receipt of settlement proceeds

assumes that we will settle the Forward by physical delivery.

Additional discussions of risks and uncertainties that could cause

actual results to differ materially from those expressed or implied

by the forward-looking statements appear in the Company’s filings

with the Securities and Exchange Commission, including the

Company’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2013 under the heading “Risk Factors” and under the

heading “Management’s Discussion and Analysis of Financial

Condition and Results of Operations - Forward-Looking Statements”

and in subsequent quarterly reports on Form 10-Q.

The Company does not undertake a duty to update forward-looking

statements, including its expected 2015 operating results and other

financial data forecasts contained in this release. The Company

may, in its discretion, provide information in future public

announcements regarding its outlook that may be of interest to the

investment community. The format and extent of future outlooks may

be different from the format and extent of the information

contained in this release.

Definitions and Reconciliations

Non-GAAP financial measures and other capitalized terms, as used

in this earnings release, are defined and further explained on

Attachment 20, “Definitions and Reconciliations of Non-GAAP

Financial Measures and Other Terms.” Attachment 20 is included in

the full earnings release available at the Company’s website at

http://www.avalonbay.com/earnings.

This wire distribution includes only definitions and

reconciliations of the following non-GAAP financial measures:

Core FFO is the Company's FFO as

adjusted for the non-routine items outlined in the following table

(dollars in thousands, except per share data):

Q4 Q4 Full Year Full Year 2014 2013 2014 2013 (1)

FFO, actual $ 233,484 $ 195,344 $ 951,035 $ 642,814

Non-Routine Items Archstone and other acquisition costs (7,715 )

(1,198 ) (7,682 ) 44,052 Joint venture (gains) losses and costs (2)

(2,497 ) 475 (63,322 ) 35,554 Loss on interest rate protection

agreement — — — 51,000 Write-off of development rights and retail

assets (3) — 1,314 2,564 1,506 Compensation plan redesign and

severance related costs 155 (1,145 ) 815 3,580 Business

interruption insurance proceeds (1,907 ) (299 ) (2,494 ) (299 )

Early extinguishment of consolidated debt — 14,921 412 14,921 Gain

on sale of land (490 ) — (490 ) (240 ) Income taxes 9,243 — 9,243 —

Core FFO $

230,273 $ 209,412 $ 890,081 $ 792,888

Core FFO per share $ 1.74 $ 1.62 $ 6.78

$ 6.23 Average shares outstanding - diluted

132,677,639 129,611,467 131,237,502 127,265,903 (1) The

Company issued unsecured notes and common stock for purposes of

funding the Archstone acquisition in advance of closing the

purchase. This capital markets activity resulted in interest

expense of $834 associated with the unsecured notes, and

incremental weighted average shares of the Company’s common stock

outstanding of 2,741,096 during the year ended December 31, 2013.

The Company has not included the impact of this capital markets

activity as a non-routine adjustment for Core FFO. (2)

Amounts include the Company’s proportionate share of gains and

losses from joint ventures formed with Equity Residential as part

of the Archstone acquisition, joint venture dispositions including

the Company’s promoted interests, costs associated with the

extinguishment of debt, and acquisition costs including certain

costs incurred related to the Archstone acquisition. (3)

Represents write-offs expensed by the Company during the year to

date period for development rights and retail tenants individually

in excess of $1,000.

Debt-to-Total Market Capitalization

is a measure of leverage that is calculated by expressing, as a

percentage, debt divided by Total Market Capitalization, which is

defined as the aggregate of the market value of the Company’s

common stock, the market value of the Company’s operating

partnership units outstanding (based on the market value of the

Company’s common stock) and the outstanding principal balance of

debt. Management believes that this measure of leverage can be one

useful measure of a real estate operating company’s long-term

liquidity and balance sheet strength, because it shows an

approximate relationship between a company’s total debt and the

current total market value of its assets based on the current price

at which the Company’s common stock trades. Because this measure of

leverage changes with fluctuations in the Company’s stock price,

which occur regularly, this measure may change even when the

Company’s earnings, interest and debt levels remain stable.

Investors should also note that the net realizable value of the

Company’s assets in liquidation is not easily determinable and may

differ substantially from the Company’s Total Market

Capitalization.

Economic Gain (Loss) is calculated

by the Company as the gain (loss) on sale in accordance with GAAP,

less accumulated depreciation through the date of sale and any

other non-cash adjustments that may be required under GAAP

accounting. Management generally considers Economic Gain (Loss) to

be an appropriate supplemental measure to gain (loss) on sale in

accordance with GAAP because it helps investors to understand the

relationship between the cash proceeds from a sale and the cash

invested in the sold community. The Economic Gain (Loss) for each

of the communities presented is estimated based on their respective

final settlement statements. A reconciliation of Economic Gain

(Loss) to gain on sale in accordance with GAAP for the year ended

December 31, 2014 as well as prior years’ activities is

presented in the full earnings release.

Economic Occupancy (“Ec Occ”) is

defined as total possible revenue less vacancy loss as a percentage

of total possible revenue. Total possible revenue (also known as

“gross potential”) is determined by valuing occupied units at

contract rates and vacant units at market rents. Vacancy loss is

determined by valuing vacant units at current market rents. By

measuring vacant apartments at their market rents, Economic

Occupancy takes into account the fact that apartment homes of

different sizes and locations within a community have different

economic impacts on a community’s gross revenue.

Established Communities are

identified by the Company as communities where a comparison of

operating results from the prior year to the current year is

meaningful, as these communities were owned and had Stabilized

Operations, as defined below, as of the beginning of the respective

prior year period. Therefore, for full year 2014 operating results,

Established Communities are consolidated communities that have

Stabilized Operations as of January 1, 2013 and are not

conducting or planning to conduct substantial redevelopment

activities within the current year. Established Communities do not

include communities that are currently held for sale or planned for

disposition during the current year. Established Communities as of

January 1, 2014 do not include communities acquired as part of the

Archstone acquisition.

Established Communities Effective

April 1, 2014 includes communities that were owned and

had Stabilized Operations as of April 1, 2013, and therefore

includes communities acquired as part of the Archstone acquisition

that had Stabilized Operations as of April 1, 2013, as well as

certain other communities which the Company developed, redeveloped

or acquired that had Stabilized Operations as of April 1,

2013.

FFO is determined based on a

definition adopted by the Board of Governors of the National

Association of Real Estate Investment Trusts (“NAREIT”). FFO is

calculated by the Company as Net income or loss attributable to

common stockholders computed in accordance with GAAP, adjusted for

gains or losses on sales of previously depreciated operating

communities, extraordinary gains or losses (as defined by GAAP),

cumulative effect of a change in accounting principle, impairment

write-downs of depreciable real estate assets, write-downs of

investments in affiliates which are driven by a decrease in the

value of depreciable real estate assets held by the affiliate and

depreciation of real estate assets, including adjustments for

unconsolidated partnerships and joint ventures. Management

generally considers FFO to be an appropriate supplemental measure

of operating performance because, by excluding gains or losses

related to dispositions of previously depreciated operating

communities and excluding real estate depreciation (which can vary

among owners of identical assets in similar condition based on

historical cost accounting and useful life estimates), FFO can help

one compare the operating performance of a company’s real estate

between periods or as compared to different companies. A

reconciliation of FFO to Net income attributable to common

stockholders is as follows (dollars in thousands):

Q4 Q4 Full Year Full Year 2014 2013 2014 2013

Net income attributable to common stockholders $ 142,642 $ 252,212

$ 683,567 $ 353,141 Depreciation - real estate assets, including

discontinued operations and joint venture adjustments 115,592

106,123 449,769 582,325 Distributions to noncontrolling interests,

including discontinued operations 9 8 35 32 Gain on sale of

unconsolidated entities holding previously depreciated real estate

assets (779 ) (2,941 ) (73,674 ) (14,453 ) Gain on sale of

previously depreciated real estate assets (1) (23,980 ) (160,058 )

(108,662 ) (278,231 ) FFO attributable to common

stockholders $ 233,484 $ 195,344 $ 951,035 $

642,814 Average shares outstanding - diluted

132,677,639 129,611,467 131,237,502 127,265,903 Earnings per

share - diluted $ 1.08 $ 1.95 $ 5.21 $ 2.78

FFO per common share - diluted $ 1.76 $ 1.51

$ 7.25 $ 5.05 (1) Full year 2014

includes the impact of the non-controlling interest portion of the

gain on sale of community owned by Fund I that was consolidated for

financial reporting purposes.

Initial Year Market Cap Rate is

defined by the Company as Projected NOI of a single community for

the first 12 months of operations (assuming no repositioning), less

estimates for non-routine allowance of approximately $300 - $500

per apartment home, divided by the gross sales price for the

community. Projected NOI, as referred to above, represents

management’s estimate of projected rental revenue minus projected

operating expenses before interest, income taxes (if any),

depreciation, amortization and extraordinary items. For this

purpose, management’s projection of operating expenses for the

community includes a management fee of 2.5% - 3.5%. The

Initial Year Market Cap Rate, which may be determined in a

different manner by others, is a measure frequently used in the

real estate industry when determining the appropriate purchase

price for a property or estimating the value for a property. Buyers

may assign different Initial Year Market Cap Rates to different

communities when determining the appropriate value because they

(i) may project different rates of change in operating

expenses and capital expenditure estimates and (ii) may

project different rates of change in future rental revenue due to

different estimates for changes in rent and occupancy levels. The

weighted average Initial Year Market Cap Rate is weighted based on

the gross sales price of each community.

Interest Coverage is calculated by

the Company as EBITDA, as adjusted, divided by the sum of interest

expense, net, and preferred dividends, if applicable. Interest

Coverage is presented by the Company because it provides rating

agencies and investors an additional means of comparing our ability

to service debt obligations to that of other companies. EBITDA is

defined by the Company as net income or loss attributable to the

Company before interest income and expense, income taxes,

depreciation and amortization.

A reconciliation of EBITDA, as adjusted, and a calculation of

Interest Coverage for the fourth quarter of 2014 are as follows

(dollars in thousands):

Net income attributable to common stockholders

$ 142,642 Interest expense, net 47,987 Income tax expense 9,332

Depreciation expense 114,084 EBITDA $ 314,045

NOI from discontinued operations and real

estate assets sold or held for sale,not classified as discontinued

operations

2,257 Gain on sale of communities 23,980 EBITDA after

disposition activity $ 287,808 Joint venture income

(5,241 ) EBITDA, as adjusted $ 282,567 Interest

expense, net $ 47,987 Interest Coverage 5.9 times

Net Debt-to-Adjusted EBITDA is

calculated by the Company as total debt that is consolidated for

financial reporting purposes, less consolidated cash and cash in

escrow, divided by annualized fourth quarter 2014 EBITDA, as

adjusted.

Total debt principal (1) $ 6,448,138 Cash and

cash in escrow (605,085 ) Net debt $ 5,843,053 Net

income attributable to common stockholders $ 142,642 Interest

expense, net 47,987 Income tax expense 9,332 Depreciation expense

114,084 EBITDA $ 314,045 NOI from discontinued

operations and real estate assets sold or held for sale, not

classified as discontinued operations 2,257 Gain on sale of

communities 23,980 EBITDA after disposition activity $

287,808 Joint venture income (5,241 ) EBITDA, as

adjusted $ 282,567 EBITDA, as adjusted, annualized $

1,130,268 Net Debt-to-Adjusted EBITDA 5.2 times

(1) Balance at December 31, 2014 excludes $6,735 of debt

discount as reflected in unsecured notes, net, and $84,449 of debt

premium as reflected in notes payable, on the Condensed

Consolidated Balance Sheets. The debt premium is primarily related

to above market interest rates on debt assumed in connection with

the Archstone acquisition.

NOI is defined by the Company as

total property revenue less direct property operating expenses

(including property taxes), and excludes corporate-level income

(including management, development and other fees), corporate-level

property management and other indirect operating expenses,

investments and investment management expenses, expensed

development and other pursuit costs, net interest expense, gain

(loss) on extinguishment of debt, general and administrative

expense, joint venture income (loss), depreciation expense,

impairment loss on land holdings, gain on sale of real estate

assets, gain on sale of discontinued operations, income from

discontinued operations and NOI from real estate assets held for

sale or that have been sold. The Company considers NOI to be an

appropriate supplemental measure to Net Income of operating

performance of a community or communities because it helps both

investors and management to understand the core operations of a

community or communities prior to the allocation of corporate-level

property management overhead or general and administrative costs.

This is more reflective of the operating performance of a

community, and allows for an easier comparison of the operating

performance of single assets or groups of assets. In addition,

because prospective buyers of real estate have different overhead

structures, with varying marginal impact to overhead by acquiring

real estate, NOI is considered by many in the real estate industry

to be a useful measure for determining the value of a real estate

asset or groups of assets.

A reconciliation of NOI to Net Income, as well as a breakdown of

NOI by operating segment, is as follows (dollars in thousands):

Q4 Q4 Q3

Q2 Q1 Full Year Full Year 2014 (1) 2013

(1) 2014 (1) 2014 (1) 2014 (1) 2014 (2) 2013 (2) Net income (loss)

$ 142,530 $ 252,090 $ 241,001 $ 172,197 $ 141,599 $ 697,327 $

352,771 Indirect operating expenses, net of corporate income 12,721

10,881 13,173 12,343 10,818 49,055 41,554 Investments and

investment management expense 1,290 836 1,079 1,137 979 4,485 3,990

Expensed acquisition, development and other pursuit costs, net of

recoveries (6,855 ) (991 ) 406 2,017 715 (3,717 ) 45,050 Interest

expense, net 47,987 44,630 46,376 43,722 42,533 180,618 172,402

Loss on extinguishment of debt, net — 14,921 — 412 — 412 14,921

Loss on interest rate contract — — — — — — 51,000 General and

administrative expense 10,715 8,311 11,254 10,220 9,236 41,425

39,573 Joint venture (income) loss (5,241 ) (5,090 ) (130,592 )

(7,710 ) (5,223 ) (148,766 ) 11,154 Depreciation expense 114,084

104,806 111,836 110,395 106,367 442,682 560,215 Income tax expense

9,332 — 36 — — 9,368 — Gain on sale of real estate assets (24,470 )

— — (60,945 ) — (85,415 ) (240 ) Gain on sale of discontinued

operations — (160,058 ) — — (37,869 ) (37,869 ) (278,231 ) Income

from discontinued operations — (3,823 ) — — (310 ) (310 ) (16,713 )

NOI from real estate assets sold or held for sale, not classified

as discontinued operations (2,257 ) (5,185 ) (2,815 ) (4,998 )

(5,129 ) (15,199 ) (19,448 ) NOI $ 299,836 $ 261,328

$ 291,754 $ 278,790 $ 263,716 $ 1,134,096

$ 977,998 Established: New England $ 29,602 $

29,453 $ 30,259 $ 29,178 $ 28,026 $ 113,905 $ 113,043 Metro NY/NJ

68,357 65,466 67,255 66,054 63,989 223,591 216,928 Mid-Atlantic

32,991 33,515 32,284 32,531 32,800 69,498 71,282 Pacific NW 11,698

10,671 11,668 11,554 11,200 37,637 35,164 No. California 47,888

42,654 48,805 47,498 45,000 132,899 122,872 So. California 43,120

38,969 41,655 41,607 39,659

95,626 90,906 Total Established 233,656

220,728 231,926 228,422 220,674 673,156

650,195 Other Stabilized - AvalonBay 32,487 27,632

31,838 31,202 28,980 101,539 76,551 Other Stabilized - Archstone

N/A N/A N/A N/A N/A 241,522 192,203 Development/Redevelopment

33,693 12,968 27,990 19,166 14,062

117,879 59,049 NOI $ 299,836 $ 261,328

$ 291,754 $ 278,790 $ 263,716 $

1,134,096 $ 977,998 (1) Results based

upon reportable operating segments as determined as of April 1,

2014. (2) Results based upon reportable operating segments as

determined as of January 1, 2014.

NOI as reported by the Company does not include the operating

results from discontinued operations (i.e., assets sold during the

period January 1, 2013 through December 31, 2013 or classified as

held for sale at December 31, 2013) or assets sold or classified as

held for sale (i.e., assets sold or classified as held for sale at

December 31, 2014 that are not otherwise classified as

discontinued operations). A reconciliation of NOI from communities

sold, classified as discontinued operations or classified as held

for sale, to Net Income for these communities is as follows

(dollars in thousands):

Q4

Q4 Full Year Full Year 2014 2013 2014 2013

Income from discontinued operations $ — $ 3,823 $ 310 $

16,713 Depreciation expense — 345 — 13,500

NOI from discontinued operations $ — $ 4,168

$ 310 $ 30,213 Revenue from real estate

assets sold or held for sale, not classified as discontinued

operations $ 3,421 $ 8,248 $ 24,389 $ 30,867 Operating expenses

real estate assets sold or held for sale, not classified as

discontinued operations (1,164 ) (3,063 ) (9,190 ) (11,419 )

NOI from real estate assets sold or held for sale, not classified

as discontinued operations $ 2,257 $ 5,185 $ 15,199

$ 19,448

Other Stabilized Communities

(includes Other Stabilized Communities - AvalonBay and Other

Stabilized Communities - Archstone) as of January 1, 2014 are

completed consolidated communities that the Company owns, which did

not have stabilized operations as of January 1, 2013, but have

stabilized occupancy as of January 1, 2014. Other Stabilized

Communities as of January 1, 2014 do not include communities

that are planning to conduct substantial redevelopment activities

or that are under contract to be sold. Beginning in the quarter

ended March 31, 2013, Other Stabilized Communities includes

the stabilized operating communities acquired as part of the

Archstone acquisition. Beginning in the quarter ended June 30,

2014, most of the stabilized operating communities acquired as part

of the Archstone acquisition were included in the Established

Communities Effective April 1, 2014 portfolio.

Projected FFO, as provided within

this earnings release in the Company’s outlook, is calculated on a

basis consistent with historical FFO, and is therefore considered

to be an appropriate supplemental measure to projected Net Income

from projected operating performance. A reconciliation of the

ranges provided for Projected FFO per share (diluted) for the first

quarter and full year of 2015 to the ranges provided for projected

EPS (diluted) and corresponding reconciliation of the ranges for

Projected FFO per share to the ranges for Core FFO per share are as

follows:

Low

Range

High

Range

Projected EPS (diluted) - Q1 2015 $ 1.57 $ 1.61 Projected

depreciation (real estate related) 0.88 0.92 Projected gain on sale

of operating communities (0.59 ) (0.63 ) Projected FFO per share

(diluted) - Q1 2015 1.86 1.90 Non recurring

joint venture income and management fees (0.22 ) (0.24 ) Edgewater

operating and casualty losses 0.05 0.07 Other non-routine items

0.02 0.02 Projected Core FFO per share (diluted) - Q1

2015 $ 1.71 $ 1.75 Projected EPS

(diluted) - Full Year 2015 $ 4.65 $ 4.95 Projected depreciation

(real estate related) 3.50 3.70 Projected gain on asset sales (0.90

) (1.10 ) Projected FFO per share (diluted) - Full Year 2015 7.25

7.55 Non recurring joint venture income and

management fees (0.23 ) (0.25 ) Edgewater operating and casualty

losses 0.09 0.11 Income taxes 0.10 0.12 Write-off of unamortized

MTM premium (0.05 ) (0.07 ) Other non-routine items 0.04

0.04 Projected Core FFO per share (diluted) - Full Year 2015

$ 7.20 $ 7.50

Projected NOI, as used within this

release for certain development communities and in calculating the

Initial Year Market Cap Rate for dispositions, represents

management’s estimate, as of the date of this release (or as of the

date of the buyer’s valuation in the case of dispositions), of

projected stabilized rental revenue minus projected stabilized

operating expenses. For development communities, Projected NOI is

calculated based on the first twelve months of Stabilized

Operations, as defined below, following the completion of

construction. In calculating the Initial Year Market Cap Rate,

Projected NOI for dispositions is calculated for the first twelve

months following the date of the buyer’s valuation. Projected

stabilized rental revenue represents management’s estimate of

projected gross potential minus projected stabilized economic

vacancy and adjusted for projected stabilized concessions plus

projected stabilized other rental revenue. Projected stabilized

operating expenses do not include interest, income taxes (if any),

depreciation or amortization, or any allocation of corporate-level

property management overhead or general and administrative costs.

In addition, projected stabilized operating expenses for

development communities do not include property management fee

expense. Projected gross potential for development communities and

dispositions is based on leased rents for occupied homes and

management’s best estimate of rental levels for homes which are

currently unleased, as well as those homes which will become

available for lease during the twelve month forward period used to

develop Projected NOI. The weighted average Projected NOI as a

percentage of Total Capital Cost is weighted based on the Company’s

share of the Total Capital Cost of each community, based on its

percentage ownership.

Management believes that Projected NOI of the development

communities, on an aggregated weighted average basis, assists

investors in understanding management's estimate of the likely

impact on operations of the development communities when the assets

are complete and achieve stabilized occupancy (before allocation of

any corporate-level property management overhead, general and

administrative costs or interest expense). However, in this release

the Company has not given a projection of NOI on a company-wide

basis. Given the different dates and fiscal years for which NOI is

projected for these communities, the projected allocation of

corporate-level property management overhead, general and

administrative costs and interest expense to communities under

development is complex, impractical to develop, and may not be

meaningful. Projected NOI of these communities is not a projection

of the Company's overall financial performance or cash flow. There

can be no assurance that the communities under development or

redevelopment will achieve the Projected NOI as described in this

release.

Projected Stabilized Yield (also

expressed as “weighted average initial stabilized yield” or words

of similar meaning) means Projected NOI as a percentage of Total

Capital Cost.

Rental Revenue with Concessions on a Cash

Basis is considered by the Company to be a supplemental

measure to rental revenue in conformity with GAAP to help investors

evaluate the impact of both current and historical concessions on

GAAP-based rental revenue and to more readily enable comparisons to

revenue as reported by other companies. In addition, Rental Revenue

with Concessions on a Cash Basis allows an investor to understand

the historical trend in cash concessions.

A reconciliation of rental revenue from Established Communities

in conformity with GAAP to Rental Revenue with Concessions on a

Cash Basis is as follows (dollars in thousands):

Q4 Q4 Q2-Q4

Q2-Q4 Full Year Full Year 2014 (1) 2013 (1)

2014 (1) 2013 (1) 2014 (2) 2013 (2) Rental revenue (GAAP

basis) $ 334,880 $ 321,687 $ 995,854 $ 961,004 $ 963,917 $ 927,821

Concessions amortized 464 1,144 2,343 3,584 1,388 1,406 Concessions

granted (200 ) (1,422 ) (1,375 ) (3,870 ) (1,027 ) (979 )

Rental Revenue with Concessions on a Cash Basis $ 335,144 $

321,409 $ 996,822 $ 960,718 $ 964,278 $

928,248 % change -- GAAP revenue 4.1 % 3.6 % 3.9 %

% change -- cash revenue 4.3 % 3.8 % 3.9 % (1)

Results based upon reportable operating segments as determined as

of April 1, 2014. (2) Results based upon reportable operating

segments as determined as of January 1, 2014.

Stabilized/Restabilized Operations

is defined as the earlier of (i) attainment of 95% physical

occupancy or (ii) the one-year anniversary of completion of

development or redevelopment.

Total Capital Cost includes all

capitalized costs projected to be or actually incurred to develop

the respective development or redevelopment community, or

development right, including land acquisition costs, construction

costs, real estate taxes, capitalized interest and loan fees,

permits, professional fees, allocated development overhead and

other regulatory fees, offset by proceeds from the sale of any

associated land or improvements, all as determined in accordance

with GAAP. For redevelopment communities, Total Capital Cost

excludes costs incurred prior to the start of redevelopment when

indicated. With respect to communities where development or

redevelopment was completed in a prior or the current period, Total

Capital Cost reflects the actual cost incurred, plus any

contingency estimate made by management. Total Capital Cost for

communities identified as having joint venture ownership, either

during construction or upon construction completion, represents the

total projected joint venture contribution amount. For joint

ventures not in construction, Total Capital Cost is equal to gross

real estate cost.

Unencumbered NOI as calculated by

the Company represents NOI generated by real estate assets

unencumbered by either outstanding secured debt or land leases

(excluding land leases with purchase options that were put in place

for governmental incentives or tax abatements) as a percentage of

total NOI generated by real estate assets. The Company believes

that current and prospective unsecured creditors of the Company

view Unencumbered NOI as one indication of the borrowing capacity

of the Company. Therefore, when reviewed together with the

Company’s Interest Coverage, EBITDA and cash flow from operations,

the Company believes that investors and creditors view Unencumbered

NOI as a useful supplemental measure for determining the financial

flexibility of an entity. A calculation of Unencumbered NOI for the

year ended December 31, 2014 is as follows (dollars in

thousands):

Year To Date NOI (1) NOI for Established Communities

$ 673,156 NOI for Other Stabilized Communities - AvalonBay 101,539

NOI for Other Stabilized Communities - Archstone 241,522 NOI for

Development/Redevelopment Communities 117,879 NOI for discontinued

operations 310 NOI from real estate assets sold or held for sale,

not classified as discontinued operations 15,199

Total NOI generated by real

estate assets

1,149,605 NOI on encumbered assets 352,021

NOI on unencumbered assets

$ 797,584 Unencumbered NOI 69 % (1) Results

based upon reportable operating segments as determined as of

January 1, 2014.

Unleveraged IRR on sold communities

refers to the internal rate of return calculated by the Company

considering the timing and amounts of (i) total revenue during

the period owned by the Company and (ii) the gross sales price

net of selling costs, offset by (iii) the undepreciated

capital cost of the communities at the time of sale and

(iv) total direct operating expenses during the period owned

by the Company. Each of the items (i), (ii), (iii) and

(iv) are calculated in accordance with GAAP.

The calculation of Unleveraged IRR does not include an

adjustment for the Company’s general and administrative expense,

interest expense, or corporate-level property management and other

indirect operating expenses. Therefore, Unleveraged IRR is not a

substitute for Net Income as a measure of our performance.

Management believes that the Unleveraged IRR achieved during the

period a community is owned by the Company is useful because it is

one indication of the gross value created by the Company’s

acquisition, development or redevelopment, management and sale of a

community, before the impact of indirect expenses and Company

overhead. The Unleveraged IRR achieved on the communities as cited

in this release should not be viewed as an indication of the gross

value created with respect to other communities owned by the

Company, and the Company does not represent that it will achieve

similar Unleveraged IRRs upon the disposition of other communities.

The weighted average Unleveraged IRR for sold communities is

weighted based on all cash flows over the holding period for each

respective community, including net sales proceeds.

AvalonBay Communities, Inc.Jason ReilleyDirector of Investor

Relations703-317-4681

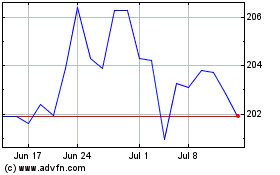

Avalonbay Communities (NYSE:AVB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Avalonbay Communities (NYSE:AVB)

Historical Stock Chart

From Apr 2023 to Apr 2024