As filed with the Securities and Exchange Commission on August 17, 2016

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AUTOLIV, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware

|

|

51-0378542

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

Vasagatan 11, 7

th

Floor, SE-111 20,

Box 70381,

SE-107 24 Stockholm, Sweden

+46 8 58 72 06 00

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

The Corporation Trust Company

Corporation Trust Center

1209 Orange Street

Wilmington, DE 19801

(302) 658-7581

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:

Dennis O. Garris

David A. Brown

Alston & Bird LLP

The Atlantic Building

950 F St. NW

Washington DC 20004

(202) 239-3300

Approximate

date of commencement of proposed sale to the public:

From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box.

¨

If any of the securities being registered on this Form are to be offered on

a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box.

x

If this Form is filed to register additional securities for an offering pursuant

to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier

effective registration statement for the same offering.

¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become

effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

x

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

x

|

|

Accelerated filer

|

|

¨

|

|

|

|

|

|

|

Non-accelerated

filer

|

|

¨

(do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

¨

|

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

Title of

each class of

securities to be registered

|

|

Amount to be

registered (1)

|

|

Proposed

maximum

offering price

per unit (1)

|

|

Proposed

maximum

aggregate

offering price (1)

|

|

Amount of

registration fee (1)

|

|

Common Stock, par value $1.00 per

share

|

|

|

|

|

|

|

|

|

|

Preferred Stock, par value $1.00 per

share

|

|

|

|

|

|

|

|

|

|

Depositary shares

|

|

|

|

|

|

|

|

|

|

Debt Securities

|

|

|

|

|

|

|

|

|

|

Warrants

|

|

|

|

|

|

|

|

|

|

Stock Purchase

Contracts

|

|

|

|

|

|

|

|

|

|

Units (2)

|

|

|

|

|

|

|

|

|

|

(l)

|

An unspecified aggregate initial offering price or number of the securities of each identified class is being registered as may from time to time be offered at

unspecified prices, along with an unspecified number of securities that may be issued on exercise, conversion or exchange of securities offered hereunder. Separate consideration may or may not be received for securities that are issuable on

exercise, conversion or exchange of other securities or that are issued in units with other securities registered hereunder or for depositary shares (including Swedish Depository Receipts described in the section of the prospectus entitled

“Swedish Depository Receipts”). In accordance with Rules 456(b) and 457(r) under the Securities Act of 1933, as amended, the registrant is deferring payment of the entire registration fee.

|

|

(2)

|

Any securities registered hereunder may be sold separately or as units with other securities registered hereunder.

|

PROSPECTUS

AUTOLIV, INC.

COMMON STOCK

PREFERRED STOCK

DEPOSITARY SHARES

DEBT SECURITIES

WARRANTS

STOCK PURCHASE CONTRACTS

UNITS

We or selling

securityholders may, from time to time, offer to sell common stock, preferred stock (which we may issue in one or more series), depositary shares (which may include Swedish Depository Receipts representing shares of common stock), debt securities

(which we may issue in one or more series), warrants, stock purchase contracts and units that include any of these securities. The preferred stock, depositary shares, debt securities, warrants and stock purchase contracts may be convertible into or

exercisable or exchangeable for or represent our common stock or preferred stock or other securities. Each time securities are sold pursuant to this prospectus, we will provide a supplement to this prospectus that contains specific information about

the offering and the specific terms of the securities offered. You should read this prospectus and the applicable prospectus supplement carefully before you invest in our securities. Neither we nor any selling securityholders may use this

prospectus to sell securities unless it includes a prospectus supplement.

Our common stock is listed on the New York Stock

Exchange and trades under the ticker symbol “ALV.” Swedish Depository Receipts representing shares of our common stock are listed on Nasdaq Stockholm and trade under the ticker symbol “ALIV SDB.”

We or any selling securityholders may offer and sell these securities to or through one or more underwriters, dealers and agents, or

directly to purchasers, on a continuous or delayed basis.

Investing in

our securities involves risks. See “

Risk Factors

” on page 4 of this prospectus, and any applicable prospectus supplement, and in the documents which are incorporated herein by reference.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of

this prospectus is August 17, 2016

TABLE OF CONTENTS

We are only offering the securities in places where sales of those securities are permitted. If you are in a

jurisdiction where offers to sell, or solicitations of offers to purchase, the securities offered by this document are unlawful, or if you are a person to whom it is unlawful to direct these types of activities, then the offer presented in this

document does not extend to you. The information appearing or incorporated by reference in this prospectus, any accompanying prospectus supplement and any related free writing prospectus, is accurate only as of the date thereof, regardless of the

time of delivery of this prospectus, any accompanying prospectus supplement or any related free writing prospectus, or of any sale of our securities, unless the information specifically indicates that another date applies. We are responsible for the

information contained and incorporated by reference in this prospectus, in any accompanying prospectus supplement, and in any related free writing prospectus we prepare or authorize. We have not authorized anyone to provide you with any other

information nor do we take any responsibility for any such other information that others may give you.

IMPORTANT INFORMATION ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or SEC, using a

“shelf” registration process. Under this shelf registration process, we and certain securityholders may, from time to time, sell any combination of the securities described in this prospectus in one or more offerings. The types of

securities that we or such securityholders may offer and sell, from time to time, pursuant to this prospectus are:

|

|

•

|

|

stock purchase contracts; and

|

|

|

•

|

|

units consisting of any of the securities listed above.

|

This prospectus provides you with a general description of those securities. Each time securities are offered under this prospectus, we will provide a prospectus supplement that will contain specific

information about the terms of that offering and the manner in which the securities will be offered, including:

|

|

•

|

|

the type and amount of securities that we propose to sell;

|

|

|

•

|

|

the initial public offering price of the securities;

|

|

|

•

|

|

the names of any underwriters, dealers or agents to or through which we will sell the securities;

|

|

|

•

|

|

any compensation of those underwriters, dealers or agents; and

|

|

|

•

|

|

information about any securities exchanges or automated quotation systems on which the securities will be listed or traded.

|

In addition, the prospectus supplement may also add, update or change the information contained in this

prospectus. We urge you to read this prospectus, any applicable prospectus supplement and any related free writing prospectus with additional information described under the heading “Incorporation of Certain Information by Reference.”

Wherever references are made in this prospectus to information that will be included in a prospectus supplement, to the

extent permitted by applicable law, rules or regulations, we may instead include such information or add, update or change the information contained in this prospectus by means of a post-effective amendment to the registration statement of which

this prospectus is a part, through filings we make with the SEC that are incorporated by reference into this prospectus or by any other method as may then be permitted under applicable law, rules or regulations. The registration statement, including

the exhibits to the registration statement and any post-effective amendment thereto, can be obtained from the SEC, as described under the heading “Where You Can Find Additional Information.”

In this prospectus, we refer to common stock, preferred stock, depositary shares, debt securities, warrants, stock purchase contracts and

units collectively as the “securities.” The terms “we,” “our,” “ours,” “us,” “Autoliv” and “the Company” refer to Autoliv, Inc. and our consolidated subsidiaries, except that

in the discussion of the capital stock and related matters, these terms refer solely to Autoliv, Inc. and not to any of its subsidiaries.

- 1 -

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC’s rules allow us to incorporate by reference certain information into this prospectus. This means that we

can disclose important information to you by referring you to another document. Any information referred to in this way is considered part of this prospectus from the date we file that document. Any reports filed by us with the SEC after the date of

this prospectus will automatically update and, where applicable, supersede any information contained in this prospectus or incorporated by reference into this prospectus. In other words, in the case of a conflict or inconsistency between information

set forth in this prospectus and information that we file later and incorporate by reference into this prospectus, you should rely on the information contained in the document that was filed later.

We incorporate by reference into this prospectus the following documents or information filed with the SEC (other than, in each case,

documents or information deemed to have been “furnished” and not “filed in accordance with SEC rules):

|

|

•

|

|

our Annual Report on Form 10-K for the fiscal year ended December 31, 2015, filed with the SEC on February 19, 2016;

|

|

|

•

|

|

our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2016 and June 30, 2016, filed with the SEC on April 29, 2016 and July 22, 2016,

respectively;

|

|

|

•

|

|

our Current Reports on Form 8-K filed with the SEC on February 16, 2016, April 1, 2016, May 3, 2016, May 10, 2016, June 29, 2016, July 15, 2016 and

August 15, 2016;

|

|

|

•

|

|

the description of our common stock contained in our Registration Statement on Form S-4 filed on March 24, 1997; and

|

|

|

•

|

|

all documents filed by us under Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

on or after the date of this prospectus and before the termination of the applicable offering.

|

We will

provide without charge to each person, including any beneficial owner, whom a copy of this prospectus is delivered, upon written or oral request of any such person, a copy of any or all of the information that has been or may be incorporated by

reference into this prospectus, other than exhibits to such documents, unless such exhibits have been specifically incorporated by reference into those documents. These documents are available on our Internet site at http://www.autoliv.com. You

can also request those documents from our Vice President of Corporate Communications at the following address:

Vasagatan 11, 7

th

Floor, SE-111 20,

SE-107 24, Stockholm, Sweden

Telephone: +46 8 587 20 600

Except as expressly provided above, no other information, including information on our Internet site, is incorporated by reference into this prospectus or any prospectus supplement.

- 2 -

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This prospectus and any prospectus supplement, including the documents incorporated by reference herein and therein,

contain statements that are not historical facts but rather forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include those that address activities, events or

developments that we or our management believes or anticipates may occur in the future. All forward-looking statements including without limitation, management’s examination of historical operating trends and data as well as estimates of future

sales, operating margin, cash flow, effective tax rate or other future operating performance or financial results are based upon our current expectations, various assumptions and data available from third parties. Our expectations and assumptions

are expressed in good faith and we believe there is a reasonable basis for them. However, there can be no assurance that such forward-looking statements will materialize or prove to be correct as forward-looking statements are inherently subject to

known and unknown risks, uncertainties and other factors which may cause actual future results, performance or achievements to differ materially from the future results, performance or achievements expressed in or implied by such forward-looking

statements.

In some cases, you can identify these statements by forward-looking words such as “estimates,”

“expects,” “anticipates,” “projects,” “plans,” “intends,” “believes,” “may,” “likely,” “might,” “would,” “should,” “could,” or

the negative of these terms and other comparable terminology, although not all forward-looking statements contain such words.

Because these forward-looking statements involve risks and uncertainties, the outcome could differ materially from those set out in the

forward-looking statements for a variety of reasons, including without limitation: changes in light vehicle production; fluctuation in vehicle production schedules for which the Company is a supplier; changes in and the successful execution of our

capacity alignment, restructuring and cost reduction initiatives and the market reaction thereto; changes in general industry and market conditions or regional growth or decline; loss of business from increased competition; higher raw material, fuel

and energy costs; changes in consumer and customer preferences for end products; customer losses; changes in regulatory conditions; customer bankruptcies; consolidations or restructuring or divestiture of customer brands; unfavorable fluctuations in

currencies or interest rates among the various jurisdictions in which we operate; component shortages; costs or difficulties related to the integration of any new or acquired businesses and technologies; continued uncertainty in pricing negotiations

with customers; successful integration of acquisitions and operations of joint ventures; our ability to be awarded new business; product liability, warranty and recall claims and investigations and other litigation and customer reactions thereto

(including the ultimate resolution of the Toyota recall); higher expenses for our pension and other postretirement benefits including higher funding requirements for our pension plans; work stoppages or other labor issues; possible adverse results

of pending or future litigation; our ability to protect our intellectual property rights or infringement claims; negative impacts of antitrust investigations or other governmental investigations and associated litigation relating to the conduct of

our business; tax assessments by governmental authorities and changes in our effective tax rate; dependence on key personnel; legislative or regulatory changes impacting or limiting our business; political conditions; dependence on and relationships

with customers and suppliers; and other risks and uncertainties identified in Item 1A “Risk Factors” in our annual report to stockholders for the year ended December 31, 2015 and Item 7 “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” in our annual report on Form 10-K for the year ended December 31, 2015. For any forward-looking statements contained in this prospectus, any accompanying prospectus supplement or any documents

incorporated by reference herein, or any other document, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and we assume no obligation to update publicly or

revise any forward-looking statements in light of new information or future events, except as required by law.

- 3 -

THE COMPANY

Autoliv is a Delaware corporation with principal executive offices in Stockholm, Sweden. It was created in 1997 from the merger of

Autoliv AB and the automotive safety products business of Morton International, Inc. The Company functions as a holding corporation and owns two principal subsidiaries, Autoliv AB, which we refer to as AAB, and Autoliv ASP, Inc., which we refer to

as ASP.

Autoliv, through AAB and ASP, is a leading developer, manufacturer and supplier of automotive safety systems to the

automotive industry with a broad range of product offerings, including passive safety systems and active safety systems. Passive safety systems are primarily meant to improve vehicle safety, and include modules and components for passenger and

driver-side airbags, side-impact airbag protection systems, seatbelts, steering wheels, passive safety electronics, whiplash protection systems and child seats, and components for such systems. Active safety products include automotive radars, night

vision systems, cameras with driver assist systems, positioning systems, active seatbelts and brake control systems.

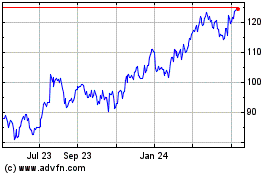

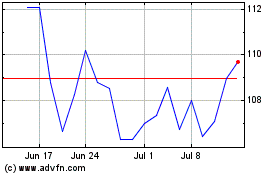

Shares

of Autoliv common stock trade on the New York Stock Exchange under the symbol “ALV.” Swedish Depository Receipts representing shares of Autoliv common stock, which we refer to as SDRs, trade on Nasdaq Stockholm under the symbol “ALIV

SDB,” and options in SDRs trade on the same exchange under the name “Autoliv SDB.” Options in Autoliv shares trade on NASDAQ OMX Philadelphia and NYSE Amex Options under the symbol “ALV.”

RISK FACTORS

Investing in our securities involves a high degree of risk. Before making a decision to invest in our securities, in addition to the other information contained in this prospectus, in any accompanying

prospectus supplement, or incorporated by reference herein or therein, you should carefully consider the risks described under “Risk Factors” contained in the applicable prospectus supplement and any related free writing prospectus, and

discussed under the headings Item 1A “Risk Factors” in our annual report to stockholders for the year ended December 31, 2015 and Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

in our most recent annual report on Form 10-K for the year ended December 31, 2015 and in each subsequently filed quarterly report on Form 10-Q, as well as any amendments thereto, which are incorporated by reference into this prospectus in their

entirety, together with other information in this prospectus, the documents incorporated by reference, and any related free writing prospectus.

USE OF PROCEEDS

Unless otherwise specified in a

prospectus supplement accompanying this prospectus, the net proceeds from the sale of the securities to which this prospectus relates will be used for general corporate purposes; however, we do not currently have any specific uses of the net

proceeds planned. General corporate purposes may include repayment of debt, acquisitions, additions to working capital, capital expenditures, acquisitions of or investments in businesses or assets and purchases of our common stock. Unless

otherwise specified in the applicable prospectus supplement, we will not receive any proceeds from the sale of our securities by selling securityholders.

- 4 -

RATIO OF EARNINGS TO FIXED CHARGES

Our consolidated ratio of earnings to fixed charges for each of the five fiscal years in the period ended December 31, 2015 and for the

six months ended June 30, 2016 is set forth below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended

June 30, 2016

|

|

Fiscal Year Ended December 31,

|

|

|

|

2015

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

2011

|

|

|

11x

|

|

10x

|

|

|

10x

|

|

|

|

16x

|

|

|

|

13x

|

|

|

|

11x

|

|

For the purpose of computing these ratios, (i) “earnings” consists of the sum of pre-tax income

from continuing operations before adjustment for non-controlling interests in our consolidated subsidiaries or income or loss from equity investees; fixed charges; amortization of capitalized interest; and distributed income of equity investees; and

(ii) “fixed charges” consists of the sum of interest expense (which includes amortization of premiums, discounts, and capitalized expenses related to debt issue costs and loss on extinguishment of debt, when applicable); capitalized

interest; and one-third of rental expense which we believe to be a reasonable estimate of an interest factor in our leases.

DESCRIPTION OF CAPITAL STOCK

The following summary of the terms of our capital stock, including our Restated Certificate of Incorporation, as amended, and Third Restated By-Laws, which we refer to as our Certificate of Incorporation

and By-laws, respectively, and relevant provisions of Delaware law may not be complete and is subject to, and qualified in its entirety by reference to, the terms and provisions of our Certificate of Incorporation and By-laws and Delaware law. You

should refer to, and read this summary together with, our Certificate of Incorporation and By-laws to review all of the terms of our capital stock that may be important to you.

Common Stock

Under our Certificate of Incorporation, our board of

directors is authorized to issue, without further stockholder approval, up to 325,000,000 shares of common stock, par value $1.00 per share. As of August 12, 2016, we had 88,218,525 issued and outstanding shares of our common stock held by

approximately 1,778 stockholders of record. All outstanding shares of our common stock are fully paid and nonassessable.

Our

common stock is listed on the New York Stock Exchange under the symbol “ALV.” Computershare Trust Company, N.A. is the transfer agent and registrar for our common stock.

Each share of our common stock entitles the holder to one vote on all matters submitted to a vote of our stockholders, including the

election of directors. In addition, the holders of shares of our common stock are entitled to participate in dividends ratably on a per share basis when our board of directors declares dividends on our common stock out of legally available

funds. In the event of our liquidation, dissolution or winding up, voluntarily or involuntarily, holders of our common stock will have the right to a ratable portion of the assets remaining after satisfaction in full of the prior rights of our

creditors and of all liabilities. No shares of our common stock have any preemptive, redemption or conversion rights, or the benefits of any sinking fund.

Preferred Stock

The following summary describes generally some of the

terms of preferred stock that we may offer from time to time in one or more series. The specific terms of any series of preferred stock will be described in the applicable prospectus supplement, any related free writing prospectus and other offering

material relating to that series of preferred stock along with any general provisions applicable to that series of preferred stock. The following description of our preferred stock, and any description of preferred stock in a prospectus supplement,

any related free writing prospectus and other offering material, may not be complete and is subject to, and

- 5 -

qualified in its entirety by reference to, the certificate of designations, preferences and rights relating to the particular series of preferred stock, which we will file with the SEC at or

prior to the time of the sale of the preferred stock. You should refer to, and read this summary together with, the applicable certificate of designations, preferences and rights and the applicable prospectus supplement, any related free writing

prospectus and other offering material to review the terms of a particular series of our preferred stock that may be important to you.

Under our Certificate of Incorporation, our board of directors is authorized to issue, without further stockholder approval, up to 25,000,000 shares of preferred stock, $1.00 par value per share, in one

or more series. For each series of preferred stock, our board of directors may determine whether such preferred stock will have voting powers. Our board of directors may also determine the designations, preferences and relative, participating,

optional or other special rights, and qualifications, limitations or restrictions of any preferred stock we issue. Our board of directors will determine these terms by resolution adopted before we issue any shares of a series of preferred stock. The

preferred stock will, when issued, be fully paid and nonassessable. As of the date of this prospectus, we have not designated or issued any series of preferred stock.

Anti-Takeover Effects of Certain Provisions of Delaware Law and Our Certificate of Incorporation and By-laws

The Delaware General Corporation Law

Our company is a Delaware corporation

subject to Section 203 of the Delaware General Corporation Law or DGCL. Section 203 provides that, subject to certain exceptions, a Delaware corporation may not engage in any “business combination” with any “interested

stockholder” for a three-year period following the time that such stockholder became an interested stockholder, unless:

|

|

•

|

|

the corporation has elected in its certificate of incorporation not to be governed by Section 203 (which we have not done);

|

|

|

•

|

|

prior to that time, the board of directors of the corporation approved either the business combination or the transaction which resulted in the

stockholder becoming an interested stockholder;

|

|

|

•

|

|

upon consummation of the transaction which resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least

85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding specified shares; or

|

|

|

•

|

|

at or subsequent to that time, the business combination is approved by the board of directors of the corporation and by the affirmative vote of at

least 66 and 2/3% of the outstanding voting stock which is not owned by the interested stockholder.

|

The

three-year prohibition also does not apply to business combinations proposed by an interested stockholder following the announcement or notification of extraordinary transactions involving the corporation and a person who had not been an interested

stockholder during the previous three years or who became an interested stockholder with the approval of a majority of the corporation’s directors.

The term “business combination” is defined generally to include mergers or consolidations between a Delaware corporation and an interested stockholder, transactions with an interested

stockholder involving the assets or stock of the corporation or its majority-owned subsidiaries and transactions which increase an interested stockholder’s percentage ownership of stock. The term “interested stockholder” is

defined to include any person, other than the corporation and any direct or indirect majority-owned subsidiary of the corporation, that (i) is the owner of 15% or more of the outstanding voting stock of the corporation or (ii) is an affiliate or

associate of the corporation and was the owner of 15% or more of the outstanding voting stock of the corporation at any time within the three-year period immediately prior to the relevant date, and the affiliates and associates of any such person.

- 6 -

Section 203 makes it more difficult for a person who would be an interested stockholder to

effect various business combinations with a corporation for a three-year period. The provisions of Section 203 may encourage companies interested in acquiring the Company to negotiate in advance with our board of directors, because the stockholder

approval requirement would be avoided if our board of directors approves either the business combination or the transaction which results in the stockholder becoming an interested stockholder. These provisions also may have the effect of preventing

changes in our board of directors and may make it more difficult to accomplish transactions which stockholders may otherwise deem to be in their best interests.

Classified Board

Our Certificate of Incorporation and By-laws previously

provided that our board of directors would be divided into three classes of directors, with each class elected for staggered three-year terms expiring in successive years. As a result, approximately one-third of our board of directors were

elected each year. However, in 2014, our Certificate of Incorporation and By-laws were amended to declassify our board of directors and provide for the annual election of directors. The amendments phase-in the declassification of our board of

directors and at the 2017 annual meeting of stockholders, all directors will be elected for one-year terms. Until our board of directors is fully declassified, the classification of directors will have the effect of making it more difficult for

stockholders to change the composition of our board of directors. Our Certificate of Incorporation and our By-laws provide that the number of directors will be fixed from time to time exclusively pursuant to a resolution adopted by our board of

directors. Our board of directors currently consists of eleven members.

Removal of Directors; Vacancies

Under the DGCL, unless otherwise provided in our Certificate of Incorporation, directors serving on a classified board may

be removed by the stockholders only for cause. Our Certificate of Incorporation and By-laws provide that (i) until the election of directors at the 2017 annual meeting of stockholders, directors may be removed only for cause and only upon the

affirmative vote of holders of at least 80% of the voting power of all the then outstanding shares of our capital stock entitled to vote generally in the election of directors, which we refer to as voting stock, voting together as a single class and

(ii) from and after election of the directors at the 2017 annual meeting of stockholders, directors may be removed from office at any time, with or without cause, only by the affirmative vote of the holders of at least 80% of the voting power of all

the then-outstanding shares of voting stock, voting together as a single class. In addition, our Certificate of Incorporation and By-laws also provide that any vacancies on our board of directors will be filled only by the affirmative vote of a

majority of the remaining directors, although less than a quorum.

No Cumulative Voting

The DGCL provides that stockholders are not entitled to the right to cumulate votes in the election of directors unless our Certificate of

Incorporation provides otherwise. Our Certificate of Incorporation does not provide for cumulative voting.

No

Stockholder Action by Written Consent; Calling of Special Meetings of Stockholders

Our Certificate of Incorporation and

By-laws prohibit stockholder action by written consent. They also provide that special meetings of our stockholders may be called only by our board of directors pursuant to a resolution adopted by a majority of our board of directors.

Advance Notice Requirements for Director Nominations and Stockholder Proposals

Our By-laws provide that stockholders seeking to nominate candidates for election as directors or to bring business before an annual

meeting of stockholders must provide timely notice of their proposal in writing to the corporate secretary. Generally, to be timely, a stockholder’s notice must be received at our principal executive

- 7 -

offices not less than 60 days nor more than 90 days prior to the first anniversary date of the previous year’s annual meeting. Our By-laws also specify requirements as to the form and

content of a stockholder’s notice. These provisions may impede stockholders’ ability to bring matters before an annual meeting of stockholders or to make nominations for directors at an annual meeting of stockholders.

Supermajority Provisions

The DGCL provides generally that the affirmative vote of a majority of the outstanding shares entitled to vote is required to amend a corporation’s certificate of incorporation or bylaws, unless the

certificate of incorporation requires a greater percentage. Our Certificate of Incorporation provides that the following provisions in our Certificate of Incorporation and our By-laws may be amended only by a vote of at least 80% of the voting power

of all of the outstanding shares of our stock entitled to vote:

|

|

•

|

|

classified board (the number, election and term of our directors);

|

|

|

•

|

|

the removal of directors;

|

|

|

•

|

|

the prohibition on stockholder action by written consent;

|

|

|

•

|

|

the ability to call a special meeting of stockholders being vested solely in our board of directors;

|

|

|

•

|

|

the ability of our board of directors to make, alter, amend or repeal our By-laws; and

|

|

|

•

|

|

the amendment provision requiring that the above provisions be amended only with an 80% supermajority vote.

|

Authorized but Unissued Capital Stock

The DGCL does not require stockholder approval for any issuance of authorized shares. However, the listing requirements of the New York Stock Exchange, which would apply so long as our common stock is

listed on the New York Stock Exchange, require stockholder approval of certain issuances equal to or exceeding 20% of the then-outstanding voting power or the then-outstanding number of shares of our common stock. Such approval is not required,

however, for any public offering for cash; any bona fide private financing, if the financing involves a sale of common stock, for cash, at a price at least as great as each of the book and market value of our common stock; and securities convertible

into or exercisable for common stock, for cash, if the conversion or exercise price is at least as great as each of the book and market value of our common stock. These additional shares may be used for a variety of corporate purposes,

including future public offerings, to raise additional capital or to facilitate acquisitions.

One of the effects of the

existence of unissued and unreserved common stock or preferred stock may be to enable our board of directors to issue shares to persons friendly to current management, which issuance could render more difficult or discourage an attempt to obtain

control of the Company by means of a merger, tender offer, proxy contest or otherwise, and thereby protect the continuity of our management and possibly deprive our stockholders of opportunities to sell their shares of common stock or preferred

stock at prices higher than prevailing market prices.

SWEDISH DEPOSITORY RECEIPTS

In connection with any offering of our common stock, at the request of the underwriter or other purchaser, we may deposit all or a

portion of such shares with Skandinaviska Enskilda Banken AB (publ), or the Depository, pursuant to a Custodian Agreement between us and the Depository. The Depository will then deliver Swedish Depository Receipts, or the SDRs, representing the

shares of our common stock. Any such SDRs will be issued and governed in accordance with the Custodian Agreement and the General Terms and Conditions for Swedish Depository Receipts in Autoliv, Inc., or the General Terms and

Conditions. Any prospectus supplement filed hereafter with respect to an offering of common stock may be deemed to include and refer to SDRs.

- 8 -

The SDRs are listed on Nasdaq Stockholm. Each SDR represents an ownership interest in

one Share of our common stock. The Depository’s office is located at Kungsträdgårdsgatan 8, SE-106 40 Stockholm, Sweden.

All SDRs relating to shares of our common stock held by the Depository, which are held on behalf of holders of SDRs or SDR Holders by a bank conducting business in the U.S. designated by the Depository,

or the U.S. Sub-Custodian, are issued and registered in the form of SDRs in the book-entry system administered by Euroclear Sweden AB, or Euroclear. No certificates representing the SDRs will be issued. An SDR Holder may hold the SDRs either

directly in a VPC account or indirectly through the SDR Holder’s broker or other financial institution. If the SDRs are held by an SDR Holder directly, then such SDR Holder, by having an SDR registered in its own name in a VPC account with

Euroclear, individually has the rights of an SDR Holder. If an SDR Holder holds the SDRs in a custody account with its broker or financial institution nominee, such Holder must rely on the procedures of such broker or financial institution to

assert the rights of an SDR Holder described in this section. An SDR Holder should consult with its broker or financial institution to find out what those procedures are.

We will not treat an SDR Holder as one of our stockholders and an SDR Holder will not have any stockholder rights, which are governed by U.S. federal law and Delaware law. Because the Depository will be

the stockholder of record for the shares of our common stock represented by all outstanding SDRs, stockholder rights rest with such record holder. An SDR Holder’s rights derive from the General Terms and Conditions.

The obligations of the Depository and its agents towards SDR Holders are set out in the General Terms and Conditions. The General Terms

and Conditions and the SDRs are governed by Swedish law. The following is a summary of the material terms of the General Terms and Conditions. Because it is a summary, it does not contain all of the information that may be important to you. For

more complete information, you should read the entire General Terms and Conditions which contains the terms of the SDRs.

Record and

Payment Date

The Depository will, in consultation with us, fix a date for the determination of the SDR Holders entitled to

dividends in cash, shares, rights, or any other property or the proceeds thereof (if the property is sold by the Depository in accordance with the General Terms and Conditions), receive applicable information to participate in and vote at a

stockholders’ meeting or otherwise exercise any rights whatsoever that may be exercised by our stockholders, which we refer to as the record date. The Depository will also, in consultation with us, fix the date for payment of each dividend

to SDR Holders, which we refer to as the payment date.

SDR Register

The shares of our common stock deposited with the Depository are held and are registered in the form of SDRs in the book-entry system

administered by Euroclear in accordance with the Swedish Financial Instruments Accounts Act (1998:1479) on the VPC accounts designated by the SDR Holders, which we refer to as the SDR Register.

Voting Rights

The

Depository will, as soon as possible after receipt of information of any general meeting of our stockholders, cause an SDR Holder of record in the SDR Register on the record date, to be furnished with information regarding such general meeting of

stockholders. The information shall include the following:

|

|

•

|

|

the time and location of the general meeting of stockholders and the matters intended to be considered by the meeting;

|

|

|

•

|

|

reference to instructions available through our website as to the actions that must be taken by each SDR Holder to be able to exercise its voting

rights at the general meeting; and

|

|

|

•

|

|

reference to materials for the general meeting available through our website.

|

- 9 -

Dividends and Other Distributions

An SDR Holder is entitled to participate in dividends ratably on a per SDR basis when our board of directors declare dividends on our

common stock in the same manner as a holder of a Share would be, although a cash dividend will be converted into Swedish Kronor (SEK). The conversion will be made in accordance with the exchange rates applied by the Depository from time to time and

will take place, not more than five nor less than three business days prior to the payment date by the Depository entering into futures contracts with delivery on the payment date. The final conversion rate will be an average of the rates achieved

in each such futures contract.

The person registered in the SDR Register on the record date as the SDR Holder or holder of

rights to dividends relating to the SDRs shall be considered to be authorized to receive dividends. Payments of dividends will be effected in SEK by Euroclear on the payment date. If the person receiving dividends is not an authorized recipient,

then the Company, the Depository and Euroclear will be considered to have fulfilled their respective obligations unless, in the case of the Depository or Euroclear, either was aware that the payment of dividends was made to an unauthorized person or

that, considering the specific circumstances, they have neglected what reasonably should have been regarded and the payment is not binding for the right recipient because such person was under age or had a legal guardian according to the Swedish

Code on Parents and Children and the right to receive dividends was in the authority of the legal guardian.

Euroclear will

pay dividends to the SDR Holders or holders of rights to dividends relating to the SDRs in accordance with the rules and regulations applied by Euroclear from time to time. Under the present rules and regulations of Euroclear, dividends normally are

paid to cash accounts linked to the VPC accounts on which the SDRs are registered. The dividend payments to the SDR Holders will be made without deduction of any costs, charges, or fees, neither from us, the Depository, the U.S. Sub-Custodian

nor Euroclear, except for the withholding tax, if any, levied in the U.S. and Sweden, on dividend payments or any other tax to be imposed by tax authorities in the U.S. or Sweden.

If we declare a dividend where we give stockholders an option to elect to receive such dividend in cash or some other form and if, in the

opinion of the Depository, it is not practically possible for the SDR Holders to have any option to choose between dividends in the form of cash or in any other form, the Depository shall on behalf of the SDR Holders be entitled to decide that such

dividends shall be paid in cash.

Taxation

In connection with any distribution to SDR Holders, we, the Depository, the U.S. Sub-Custodian, or Euroclear or any of their respective agents will remit to the appropriate governmental authority or

agency all amounts (if any) required to be withheld by us, the Depository, the U.S. Sub-Custodian, Euroclear or any of their respective agents and owing such authority or agency. In the event we, the Depository, the U.S. Sub-Custodian or Euroclear

or any of their respective agents determines that any distribution in cash, shares, rights or any other property is subject to any tax or governmental charges which it is obligated to withhold, it may use that cash, or sell all or a portion of such

property as is necessary and economically and practicably feasible to pay such taxes or governmental charges, and the Depository shall distribute the net proceeds of any sale or the balance of any such property or cash after deduction of such taxes

or governmental charges to the SDR Holders entitled thereto. The SDR Holders will remain liable for any deficiency.

The

Depository will use its best efforts to provide the SDR Holders with such information as it may possess and the SDR Holders may reasonably request to enable such SDR Holder or its agent to claim any benefit provided under the taxation treaty between

the U.S. and Sweden.

Exercise of Rights and Deposit or Sale of Securities Resulting from Dividends, Splits or Plans of Reorganization

The Depository, as promptly as possible, will accept delivery of shares of our common stock as a result of bonus issues

and the effect of split-ups or combinations of such shares. Registrations in the SDR Holders’

- 10 -

respective VPC accounts reflecting such bonus issue, split-up or combinations will be effected by Euroclear as soon as practically possible after the record date without any further information

being provided to the SDR Holders by the Depository. The person registered in the SDR Register on the record date as an SDR Holder or holder of rights relating to bonus issues will be considered to be authorized to receive any shares of our common

stock as a result of bonus issues or participate in any split-ups or combinations of SDRs. Should the person receiving bonus shares or participating in split-ups or combinations of SDRs not be authorized to receive SDRs or to participate in such

measures, the same principles shall apply as mentioned above under “Dividends and Other Distributions” regarding the right to receive dividends. If the SDR Holders are entitled to receive fractional shares as a result of “stock

dividends,” bonus issues or any other corporate action by us, such fractional shares will be sold by the Depository and the proceeds of such sale will be distributed to the SDR Holders. The Depository will not accept deposit of fractional

shares or an uneven number of fractional rights.

The Depository will provide the SDR Holders with information with regard to

new equity or debt issuances or other rights in which the SDR Holders have a right to subscribe for new shares and debentures, as well as other corporate action directed to stockholders by us in accordance with the provision governing delivery of

notice as outlined below. When it is not practically or economically feasible to distribute any such rights, the Depository will have the right to sell such rights on behalf of the SDR Holders and to distribute the proceeds of such sale to the SDR

Holders after deduction of any taxes levied in accordance with the General Terms and Conditions.

Restrictions on Deposit and Withdrawal

The Depository and the U.S. Sub-Custodian may refuse to accept shares of our common stock for deposit under the General

Terms and Conditions whenever notified that we have restricted transfer of such shares to comply with any ownership or transfer restrictions under Swedish, U.S. or any other applicable law.

Company Reports and Other Communications

The Depository will cause reports

and other information received by the Depository from us for distribution to the SDR Holders, to be delivered in accordance with the General Terms and Conditions to all SDR Holders or others holders being entitled to such information according to

the SDR Register. We will cause our annual report to be available through our website (www.autoliv.com). Additionally, we will, upon request from an SDR Holder, send our annual report to such SDR Holder.

The Depository shall arrange for notices or documentation to be distributed to SDR Holders in accordance with the General Terms and

Conditions to be delivered to the SDR Holders and other holders of rights registered in the SDR Register as entitled to receive notification pursuant to the Swedish Financial Instruments Accounts Act (1998:1479). Such notices or documents will be

sent by mail to the address listed in the SDR Register. We and the Depository may, instead of mailing notices, publish the corresponding information in at least one national Swedish daily newspaper and through our website.

Limitations on Obligation and Liability to SDR Holders

Under the terms of the General Terms and Conditions, we, the Depository, the U.S. Sub-Custodian and Euroclear will not be liable for (i) losses due to Swedish or foreign legal decrees or (ii) losses due

to Swedish or foreign action by public authorities, acts of war, strikes, blockades, boycotts, lockouts or other similar causes.

The reservations with respect to strikes, blockades, boycotts, and lockouts apply even if we, the Depository, the U.S. Sub-Custodian or Euroclear itself undertakes, or are the object of, such actions.

If the Depository, the U.S. Sub-Custodian, we or Euroclear are hindered from making payment or taking any other action by the

circumstances described above, such action may be deferred until the hindrance has ceased to exist.

- 11 -

Neither, we, the Depository, the U.S. Sub-Custodian nor Euroclear will be obligated to

provide compensation for losses arising in other situations if we, the Depository, the U.S. Sub-Custodian or Euroclear have exercised normal prudence, nor shall we, the Depository, the U.S. Sub-Custodian or Euroclear be liable for indirect damages.

Further, neither we, the Depository, the U.S. Sub-Custodian nor Euroclear is responsible for losses or damages incurred by an SDR Holder by reason that any dividend, right, delivery of notice or other that our stockholders are entitled to, for

technical, legal or other reasons beyond Euroclear’s control cannot be distributed or transferred to the SDR Holders registered in the SDR Register.

Amendment and Termination of the Custodian Agreement

The Depository, in

consultation with us, is be entitled to amend the General Terms and Conditions insofar as such amendments are required by Swedish law, U.S. law or any applicable legislation, court decisions or decisions by public authorities or changes in the rules

and regulations of Euroclear, or if, in the opinion of the Depository, such action is otherwise appropriate or necessary for practical reasons and the SDR Holders’ rights are in no material respect adversely affected.

The Depository may terminate deposits made under the General Terms and Conditions by delivery to the SDR Holders of a notice of

termination pursuant to the applicable provision in the General Terms and Conditions if: (i) a decision is taken to delist the SDRs from Nasdaq Stockholm; (ii) a decision is taken by us pursuant to our Certificate of Incorporation or our By-laws to

no longer maintain the SDR program under the General Terms and Conditions or (iii) Euroclear has decided to terminate the service agreement concerning registration of the SDRs.

For a period of twelve months from the date of the termination notice described above, the General Terms and Conditions will continue to

be valid in all respects; provided, however, that the SDRs, in accordance with an undertaking by us, will be listed on Nasdaq Stockholm for a period of six months from the date of such termination notice, if they have not been previously delisted on

the initiative of Nasdaq Stockholm.

For a period of two years after the expiration of twelve months from the date of the

termination notice, the Depository shall continue to hold the shares of our common stock in safe custody but shall discontinue registration of transfers of the SDRs (by closing the SDR Register), suspend distribution of dividends to the SDR Holders,

refuse to accept deposits of such shares or any other action required under the General Terms and Conditions. In addition, the Depository shall be entitled to compensation from an SDR Holder for all fees and costs incurred by the Depository in

connection with the SDRs from such date forward.

Three years after the date of the termination notice has been given, the

Depository is entitled to sell the shares of our common stock and deduct any fees and costs incurred in connection with any such sale of the Share. The proceeds of any such sale together with any dividends not paid to the SDR Holders, after the

deduction of fees and costs in accordance with the foregoing, will be held by the Depository without liability for interest thereon for the SDR Holders’ account.

DESCRIPTION OF OTHER SECURITIES

When we or any

selling securityholder decides to sell any depositary shares, debt securities, warrants, stock purchase contracts or units that may be offered under this prospectus, we will set forth in the applicable prospectus supplement or free writing

prospectus a description of such particular class of securities.

PLAN OF DISTRIBUTION

We or any selling securityholders may offer and sell the securities being offered hereby in one or more of the following

ways from time to time:

|

|

•

|

|

through underwriters or dealers;

|

- 12 -

|

|

•

|

|

directly to one or more purchasers; or

|

|

|

•

|

|

through a combination of any of these methods of sale.

|

We will identify the specific plan of distribution, including any underwriters, dealers, agents or other purchasers and any applicable compensation, in a prospectus supplement, in an amendment to the

registration statement of which this prospectus is a part, or in other filings we make with the SEC under the Exchange Act, which are incorporated by reference.

SELLING STOCKHOLDERS

Information about selling

securityholders, where applicable, will be set forth in a prospectus supplement, in an amendment to the registration statement of which this prospectus is a part, or in other filings we make with the SEC under the Exchange Act, which are

incorporated by reference.

LEGAL MATTERS

Unless otherwise indicated in the applicable prospectus supplement, Alston & Bird LLP, Washington, D.C. will pass upon the

validity of any securities (other than the SDRs) we offer by this prospectus and any applicable prospectus supplement, and Vinge, Stockholm will pass upon the validity of any SDRs we offer by this prospectus and any applicable prospectus

supplement. Any underwriters will be advised about issues related to any offering by their own legal counsel, which will be named in the applicable prospectus supplement.

EXPERTS

The consolidated financial statements

of Autoliv appearing in Autoliv’s Annual Report on Form 10-K for the year ended December 31, 2015, and the effectiveness of Autoliv’s internal control over financial reporting as of December 31, 2015, have been audited by Ernst & Young

AB, independent registered public accounting firm, as set forth in their reports thereon, included therein, and are incorporated herein by reference. Such consolidated financial statements are incorporated herein by reference in reliance upon

such reports given on the authority of such firm as experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with

the SEC. You may read and copy any documents filed by us with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the Public

Reference Room. Our filings with the SEC are also available to the public through the SEC’s Internet site at http://www.sec.gov. You may also review the information we file with the SEC at the NYSE’s office at 20 Broad Street, New

York, New York 10005. Information about us, including our SEC filings, is also available at our Internet site at http://www.autoliv.com. However, the information contained on our website, except for the SEC filings referred to below, is not a part

of, and shall not be deemed to be incorporated by reference into, this prospectus or any prospectus supplement.

We have filed

with the SEC a registration statement on Form S-3 relating to the securities covered by this prospectus and any applicable prospectus supplement. This prospectus and any applicable prospectus supplement are a part of the registration statement and

do not contain all the information in the registration statement. For further information with respect to us and the offerings made under this prospectus, reference is hereby made to

- 13 -

the registration statement. Any statement made herein or in any prospectus supplement concerning a contract or other document of ours is not necessarily complete, and you should read the

documents that are filed as exhibits to the registration statement or otherwise filed with the SEC for a more complete understanding of the document or matter. Each such statement is qualified in all respects by reference to the document to which it

refers. You may review a copy of the registration statement at the SEC’s Public Reference Room in Washington, D.C. or on the SEC’s Internet site.

- 14 -

PART II

Information Not Required in Prospectus

|

Item 14.

|

Other Expenses of Issuance and Distribution

|

The following table sets forth the fees and expenses (all of which are estimated) we expect to incur in connection with the offering of the securities registered under this registration statement, other

than underwriting discounts and commissions:

|

|

|

|

|

|

|

|

|

Amount

to be

paid

|

|

|

SEC registration fee

|

|

$

|

*

|

|

|

Federal and state taxes

|

|

|

**

|

|

|

Legal fees and expenses

|

|

|

**

|

|

|

Accounting fees and expenses

|

|

|

**

|

|

|

Trustee’s fees and expenses

|

|

|

**

|

|

|

Transfer agent’s fees and expenses

|

|

|

**

|

|

|

Printing fees

|

|

|

**

|

|

|

Miscellaneous

|

|

|

**

|

|

|

|

|

|

Total (without SEC registration fee)

|

|

$

|

**

|

|

|

*

|

In accordance with Rules 456(b) and 457(r) of the Securities Act of 1933, as amended, or the Securities Act, we are deferring payment of the registration fee for the

securities offered by this prospectus.

|

|

**

|

Estimates of these fees and expenses are not presently known. Estimates of the fees and expenses in connection with the sale and distribution of the securities

being offered will be included in any applicable prospectus supplement.

|

|

Item 15.

|

Indemnification of Directors and Officers

|

Section 145 of the Delaware General Corporation Law, or the DGCL, makes provision for the indemnification of officers and directors of corporations in terms sufficiently broad to indemnify our officers

and directors under certain circumstances from liabilities (including reimbursement of expenses incurred) arising under the Securities Act. Section 102(b)(7) of the DGCL permits a corporation to provide in its certificate of incorporation that a

director of the corporation shall not be personally liable to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director, except for liability (i) for any breach of the director’s duty of loyalty to the

corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) in respect of certain unlawful dividend payments or stock redemptions or repurchases, or (iv)

for any transaction from which the director derived an improper personal benefit.

As permitted by the DGCL, our Restated

Certificate of Incorporation, as amended, which we refer to as our Certificate of Incorporation, provides that, to the fullest extent permitted by the DGCL or decisional law, no director shall be personally liable to the Company or to its

stockholders for monetary damages for breach of his or her fiduciary duty as a director. The effect of this provision in our Certificate of Incorporation is to eliminate the rights of the Company and its stockholders (through stockholders’

derivative suits on behalf of the Company) to recover monetary damages against a director for breach of fiduciary duty as a director thereof (including breaches resulting from negligent or grossly negligent behavior) except in the situations

described in

clauses (i)-(iv),

inclusive, above.

Our Certificate of

Incorporation provides that the Company shall indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative

by reason of the fact that he is or was a director, officer,

II-1

employee or agent of the Company or is or was serving at the request of the Company as a director, officer, employee or agent of any other corporation or enterprise (including an employee benefit

plan), against all expenses, liability and loss (including attorneys’ fees, judgments, fines, ERISA excise taxes and penalties, and amounts paid or to be paid in settlement, and any interest, assessments, or other charges imposed thereof, and

any taxes imposed on such person as a result of such payments) actually and reasonably incurred by such person in connection with such action, suit or proceeding, to the fullest extent authorized by the DGCL if such person acted in good faith and in

a manner reasonably believed to be in or not opposed to the best interests of the Company, provided that the Company shall indemnify such person in connection with any such action, suit or proceeding initiated by such person only if authorized by

our board of directors or brought to enforce certain indemnification rights.

Our Certificate of Incorporation also provides

that expenses incurred by an officer or director of the Company (acting in his or her capacity as such) in defending any such action, suit or proceeding shall be paid by the Company, provided that if required by the DGCL such expenses shall be

advanced only upon delivery to the Company of an undertaking by or on behalf of such officer or director to repay such amount if it shall ultimately be determined that he or she is not entitled to be indemnified by the Company. Expenses incurred by

other agents of the Company may be advanced upon such terms and conditions as our board of directors deems appropriate.

Our

Certificate of Incorporation also provides that indemnification provided for in our Certificate of Incorporation or our Third Restated By-Laws, which we refer to as our By-laws, shall not be deemed exclusive of any other rights to which the

indemnified party may be entitled under any bylaw, agreement, vote of stockholders or disinterested directors or otherwise; and that the Company may purchase and maintain insurance to protect itself and any such person against any such expenses,

liability and loss, whether or not the Company would have the power to indemnify such person against such expenses, liability or loss under the DGCL, our Certificate of Incorporation or our By-laws.

In addition to the above, the Company has entered into indemnification agreements with each of its directors and certain of its officers.

The indemnification agreements provide directors and such officers with the same indemnification by the Company as described above and assure directors and such officers that indemnification will continue to be provided despite future changes in our

Certificate of Incorporation or our By-laws. The Company also provides indemnity insurance pursuant to which officers and directors are indemnified or insured against liability or loss under certain circumstances, which may include liability or

related loss under the Securities Act and the Securities Exchange Act of 1934, as amended, or the Exchange Act.

|

|

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

Incorporated by Reference to Filings

Indicated

|

|

|

|

|

|

1.1

|

|

Form of Underwriting Agreement.

|

|

*

|

|

|

|

|

|

3.1

|

|

Autoliv’s Restated Certificate of Incorporation, as amended.

|

|

Exhibit 3.1 to the Quarterly Report on

Form 10-Q (File No. 001-12933, filing date April 22, 2015).

|

|

|

|

|

|

3.2

|

|

Autoliv’s Third Restated By-Laws.

|

|

Exhibit 3.1 to Autoliv’s Current Report on Form 8-K (File No. 001-12933, filing date December 18, 2015).

|

|

|

|

|

|

4.1

|

|

Indenture for Senior Debt Securities, dated as of March 30, 2009, between Autoliv and U.S. Bank National Association, as Trustee

|

|

Exhibit 4.1 to Autoliv’s Registration Statement on Form 8-A (File No. 001-12933, filing date March 30,

2009).

|

II-2

|

|

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

Incorporated by Reference to Filings

Indicated

|

|

|

|

|

|

4.2

|

|

First Supplemental Indenture, dated as of

March 30, 2009, between Autoliv and U.S. Bank National Association, as Trustee.

|

|

Exhibit 4.2 to Autoliv’s Registration Statement on Form 8-A (File No. 001-12933, filing date

March 30, 2009).

|

|

|

|

|

|

4.3

|

|

Form of Indenture for Subordinated Debt Securities.

|

|

Exhibit 4.4 to Autoliv’s Registration Statement on Form S-3 (File No. 333-158139, filing date

March 23, 2009).

|

|

|

|

|

|

4.4

|

|

Specimen of Preferred Stock Certificate and Form of Designation of Preferred Stock.

|

|

*

|

|

|

|

|

|

4.5

|

|

Form of Note.

|

|

*

|

|

|

|

|

|

4.6

|

|

Form of Depositary Agreement.

|

|

*

|

|

|

|

|

|

4.7

|

|

Form of Depositary Receipt.

|

|

*

|

|

|

|

|

|

4.8

|

|

Form of Warrant.

|

|

*

|

|

|

|

|

|

4.9

|

|

Form of Stock Purchase Contract.

|

|

*

|

|

|

|

|

|

4.10

|

|

Form of Unit Agreement.

|

|

*

|

|

|

|

|

|

4.11

|

|

General Terms and Conditions for Swedish Depository Receipts in Autoliv, Inc. representing common shares in Autoliv, effective as

of

March 23, 2016, with Skandinaviska Enskilda Banken AB (publ) serving as custodian.

|

|

Exhibit 4.4 to the Quarterly Report on Form 10-Q (File No. 001-12933, filing date April 29, 2016).

|

|

|

|

|

|

5.1

|

|

Opinion of Alston & Bird LLP.

|

|

**

|

|

|

|

|

|

5.2

|

|

Opinion of Vinge.

|

|

**

|

|

|

|

|

|

12.1

|

|

Computation of Ratios of Earnings to Fixed Charges.

|

|

**

|

|

|

|

|

|

23.1

|

|

Consent of Ernst & Young AB.

|

|

**

|

|

|

|

|

|

23.2

|

|

Consent of Alston & Bird LLP (included in Exhibit 5.1).

|

|

**

|

|

|

|

|

|

23.3

|

|

Consent of Vinge (included in Exhibit 5.2).

|

|

**

|

|

|

|

|

|

24.1

|

|

Power of Attorney (included on Page II-6 as part of signature pages hereto).

|

|

**

|

|

|

|

|

|

25.1

|

|

Statement of Eligibility and Qualification of Trustee under the Trust Indenture Act of 1939, as amended, on Form T-1 of U.S. Bank National Association, as trustee for

Autoliv’s Senior Debt Securities under the Indenture for Senior Debt Securities.

|

|

**

|

|

|

|

|

|

25.2

|

|

Statement of Eligibility and Qualification of Trustee under the Trust Indenture Act of 1939, as amended, on Form T-1 of U.S. Bank National Association, as trustee for

Autoliv’s Subordinated Debt Securities under the Indenture for Subordinated Debt Securities.

|

|

**

|

|

*

|

To be filed by amendment to the registration statement or as an exhibit to a Current Report on Form 8-K and incorporated herein by reference.

|

II-3

(a) The undersigned registrant hereby undertakes:

(1) To file, during any period

in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To

include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the

prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth

in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or

high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum

aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration

statement;

provided, however,

that paragraphs (i), (ii) and (iii) do not apply if the information required to be included in

a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by

reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities

offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide

offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(i) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration

statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement

in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and